INP-WealthPk

Shams ul Nisa

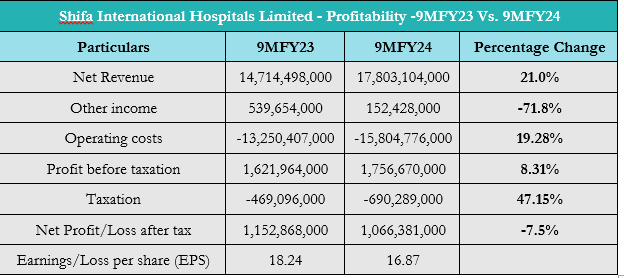

–Shifa International Hospitals Limited's net revenue surged by 21.0% while the net profit after tax dropped by 7.5% in nine months of the fiscal year 2024, reports WealthPK.

The company reported a net revenue of Rs17.8 billion and a net profit of Rs1.06 billion in 9MFY24. The increase in revenue indicates a substantial rise in the demand of hospital services as a result of high-quality treatments and facilities. However, other income experienced a considerable decline of 71.8% to Rs152.4 million in 9MFY24, due to improvement of rupee against US dollar compared to the same period last year. Furthermore, operating costs climbed to Rs15.8 billion during the review period, up by 19.28%. This is mainly due to inflationary pressures, increased labor costs, and higher cost of advanced equipment’s.

Additionally, the profit before taxation expanded by 8.31%, and the taxation surged significantly by 47.15% in 9MFY24. The company attributed the growth in taxation to the increase in super tax rate. The decline in net profit translated into contraction of earnings per share from Rs18.24 9MFY23 to Rs16.87 in 9MFY24.

Historical Trend

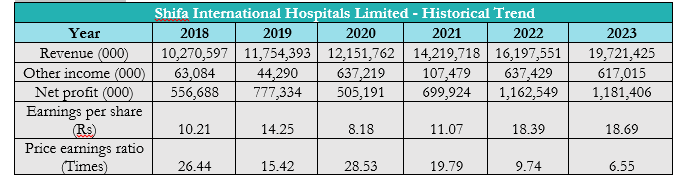

The revenue increased from Rs10.27 billion in 2018 to Rs19.7 billion in 2023, demonstrating the company has expansion in sales volume and customer satisfaction over the past six years. The company's other income dropped significantly to Rs44.29 in 2019 million from Rs63.08 million in 2018. However, in 2020 it increased to Rs637.2 million, due to a one-off gain from the sale of a land during the period. Furthermore, it increased steadily in the following years, but in 2023 it dropped to Rs617.7 million.

From Rs556.6 million in 2018 to a peak of Rs1.18 billion in 2023, the company's net profit increased over the six years. However, the net profit dropped to a record low of Rs505.19 million in 2020. The company's earnings per share had a similar pattern, increasing from Rs10.21 in 2018 to Rs18.69 in 2023, with just one decline of Rs8.18 in 2020. During the period of six years, the price-earnings ratio decreased overall, falling from 26.44 in 2018 to a low of 6.55 in 2023. In 2020, the company posted a record price-earnings ratio of 28.53 in 2020. This decline in price-earnings ratio, suggests that the company's stock is undervalued.

Profitability Ratios

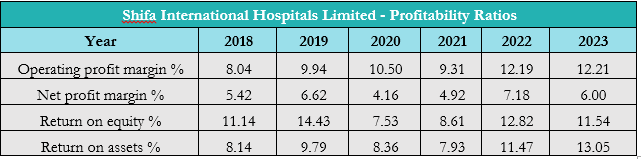

The operating profit margin shows steady growth over the six years, rising from 8.04% in 2018 to 12.21% in 2023, with just one decline to 9.31% in 2021.This suggests that the company's main activities have grown consistently, with effective cost control relative to sales revenue. However, significant swings were reported in net profit margin, which rises from 5.42% in 2018 to 6.62% in 2019 and then falls to 4.16% in 2020. It continued to get better in the next years, peaking at 7.18% in 2022 before dropping to 6.00% in 2023.

The return on equity increased slightly from 11.14% in 2018 to 11.54% in 2023. The company's return on equity peaked in 2019 at 14.43%. Overall return on assets increased from 8.14% in 2018 to 13.05% in 2023, indicating better asset utilization during the review period.

Liquidity and Capital Structure Ratios

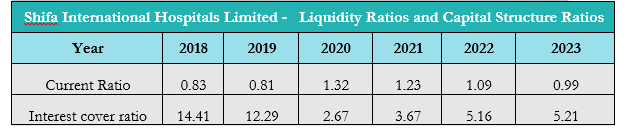

Shifa International Hospitals Limited's current ratio fluctuated, ranging from a minimum of 0.81 in 2019 to a maximum 1.32 in 2020. The company's current ratio of 0.99 in 2023 indicates a decline in current assets relative to current liabilities. Interest cover ratio witnessed a massive contraction from 14.41 in 2018 to 5.21 in 2023, lowering the ability to pay interest in its outstanding debts.

Future outlook

Despite the difficult macroeconomic environment and rising inflation, the Board of Directors is determined and hopeful in managing the company's profitability. The company is actively working on Shifa National Hospital Faisalabad. The company is committed to the two main objectives of the organization that is patient-centered care and continuous development.

Company profile

Shifa International Hospitals Limited was first established on September 29, 1987, as a private limited company, but in 1989, it changed its status to a public limited company. The Company's core activities are the establishment and management of hospitals and medical facilities across Pakistan. In addition, the company operates lab collection locations, pharmacies, and medical institutions throughout Pakistan's cities.

Credit: INP-WealthPk