INP-WealthPk

Ayesha Mudassar

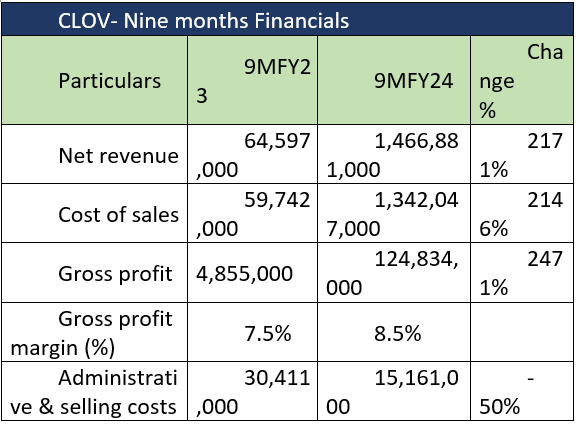

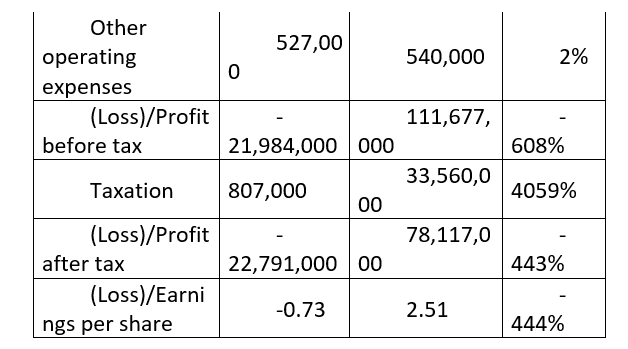

Clover Pakistan Limited (CLOV) reported a net profit of Rs78.1 million during the first nine months of the last fiscal year (9MFY24) compared to a net loss of Rs22.7 million over the corresponding period of FY23, reports WealthPK.

According to the results, the company’s top line massively increased by 2,171% year-on-year (YoY) to Rs1.4 billion compared to Rs64.5 million in 9MFY23.

The company’s gross profit rocketed to Rs124.8 million from Rs4.85 million in 9MFY23 as the increase in the cost of goods sold was less than the rise in sales. Accordingly, the gross margins of CLOV enhanced to 8.5% from 7.5% in 9MFY23. The expense section under the income statement shows that Clover observed a decrease in administrative and selling costs by 50% YoY during the period under review. On the tax front, the company paid a higher tax worth Rs33.5 million against the paltry Rs0.8 million spent in the corresponding period of FY23, depicting a substantial rise of 4,059% YoY.

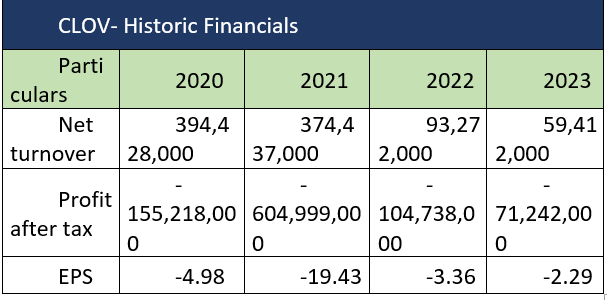

Performance over last four years (2020-23)

The CLOV’s top line has been consistently declining over the past four years till 2023. In addition, the bottom line has not recorded any positive figures since 2019, and posted the highest net losses in 2021 and 2022. In 2021, CLOV’s revenue decreased by 5% YoY as the company undertook a strategic streamlining of its operations. The closure of two marts, namely Nishat and Sahar Mart, with declining sales of lubricants, resulted in a gross loss of Rs24.07 million for the year. Furthermore, the net loss grew by 290% YoY in 2021 from the previous year, amounting to Rs604.9 million with a loss per share of Rs19.43.

In 2022, CLOV experienced its greatest YoY revenue decline of 75% due to reduced sales of industrial chemicals, equipment and lubricants. The significant slowdown was attributed to high inflation, currency depreciation as well as political uncertainty. Besides, a notable reduction in expenses trimmed down the net loss by 82% YoY in 2022 to clock in at Rs104.7 million, with loss per share declining to Rs3.52. The revenue downturn persisted in 2023, with CLOV’s top line contracting by an additional 21% YoY amid ongoing economic challenges. Operating expenses were reduced by 64% YoY due to rightsizing of resources. Conversely, other income grew considerably by over 11 times in 2023 on account of a high discount rate, which magnified the profit on deposit accounts.

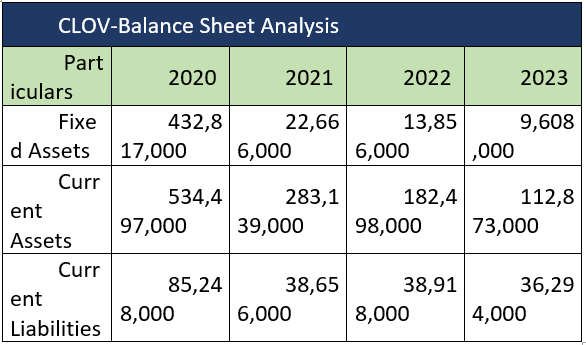

Balance sheet analysis

The analysis of the company’s financial position reveals a dramatic decline in both total assets and current liabilities over the years. Notably, the year 2022 witnessed the biggest contraction. During this year, the non-current and current assets saw a decline of 94% and 47%, respectively. Furthermore, the current liabilities diminished significantly, dropping from Rs85.2 million in 2020 to Rs36.2 million in 2023.

Overall, the trend reflects a significant decline in both fixed and current assets, which may raise concerns about the company’s financial stability and operational efficiency. However, the reduction in current liabilities signifies effective management of short-term obligations, potentially mitigating some of the risks associated with the declining asset base.

About the company

CLOV was incorporated in Pakistan as a publicly listed company in 1986. The company is engaged in the sale of consumer durables, food items, chemicals, and lubricants, as well as the trade of gantry equipment’s air/oil filters and other car care products. In addition, the company sells, distributes and provides after-sale support for digital screens, gasoline dispensers, vending machines, and office automation equipment. The company was initially owned by Lakson Group. However, in 2017 it was acquired by Fossil Energy (Private) Limited.

Future outlook

The ongoing economic slowdown, high inflation and discount rates, currency depreciation and political uncertainty are expected to continue posing challenges for CLOV’s business activities. The company needs to focus on cost optimisation strategies to minimise losses.

Credit: INP-WealthPk