INP-WealthPk

Arooj Zulfiqar

Pakistan's economy has shown significant positive developments going into the fiscal year 2024-25 as recent data reflects a favourable shift in several key economic indicators, providing optimism for the months ahead.

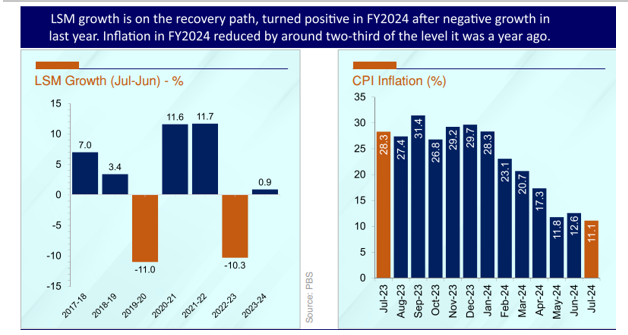

According to the data released by the Ministry of Finance in its monthly outlook for August, as of July 2024, Consumer Price Index (CPI) inflation has decreased to its lowest level in 32 months, recording 11.1% year-on-year (YoY) compared to 12.6% in the previous month and 28.3% in July 2023. This decline suggests a promising trend towards achieving single-digit inflation in the coming months. The fiscal sector also demonstrated resilience, with the government managing to reduce the fiscal deficit to 6.8% of GDP in FY24 from 7.8% the previous year. A surplus in the primary balance of 0.9% of GDP was reported, contrasting with a deficit of 1.0% in FY23. The total revenues saw a substantial increase of 38%, driven by a notable rise in both tax and non-tax collections in FY24. According to the Ministry of Finance’s data, the large-scale manufacturing (LSM) sector maintained a positive trajectory with a growth of 0.9% in FY24, reversing the previous year’s contraction of 10.3%. Despite a slight 0.03% YoY decrease in June 2024, driven by declines in textiles, non-metallic minerals, and

automobile production, the sector overall performed well. Notably, the auto industry witnessed a recovery in July 2024 with a 15.3% increase in vehicle production and a 16.9% rise in sales. Cement dispatches, however, saw a 6.8% YoY decline in July 2024, though exports grew by 21.6%. Meanwhile, CPI inflation for July 2024 showed a significant reduction, aligning with expectations of improved economic stability. The external account also exhibited improvement with a reduced current account deficit of $0.2 billion in July 2024, down from $0.7 billion the previous year. Goods exports increased by 12.9% to $2.4 billion, while imports rose to $4.8 billion, leading to a goods trade deficit of $2.4 billion. Significant growth was noted in the export of rice, fruits and plastic materials. Workers' remittances surged by 47.6% to $3.0 billion in July 2024, with Saudi Arabia contributing the largest share.

Foreign direct investment saw a notable increase of 63.7% to $136 million, with major contributions from China and the UK. The power sector received the largest share of FDI. In response to decreasing inflationary pressures, the Monetary Policy Committee (MPC) reduced the policy rate by 100 basis points to 19.5% effective July 30, 2024. This adjustment is expected to support sustainable economic recovery. Additionally, the Pakistan Stock Exchange (PSX) exhibited strong performance, with the KSE-100 index reaching 77,887 points by the end of July 2024, and the market capitalisation recording Rs10,368 billion. Overall, Pakistan's economic landscape has demonstrated promising growth and resilience, setting a positive tone for future developments.

Credit: INP-WealthPk