INP-WealthPk

Shams ul Nisa

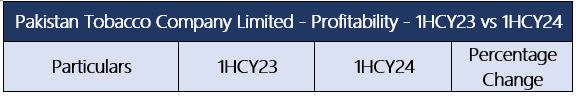

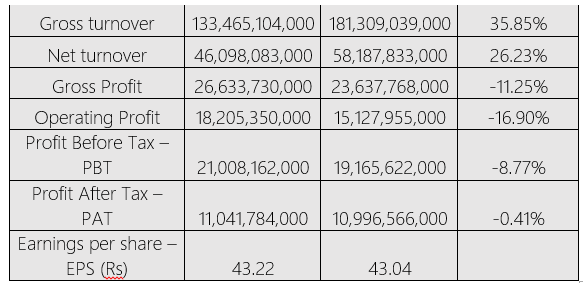

The Pakistan

Tobacco Company Limited’s (PTC) net and gross turnover climbed by 26.23% and 35.85%, respectively during the first half of the calendar year 2024, reports WealthPK. The gross profit, however, dropped 11.25% to Rs23.6 billion in 1HCY24 due to the rising costs. Moreover, the operating profit plunged 16.90%, from Rs18.2 billion in 1HCY23 to Rs15.1 billion in 1HCY24, indicating a weakened operational effectiveness.

Despite increased sales volumes, there were difficulties in sustaining profitability, as the profit before tax declined by 8.77% and profit after tax by 0.41%. The company witnessed an increase in its top line, but it is having trouble translating that growth into bottom-line profits, thus a slight decline in earnings per share from Rs43.22 in 1HCY23 to Rs43.04 1HCY24.

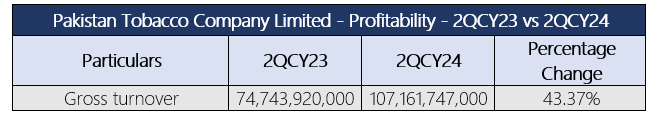

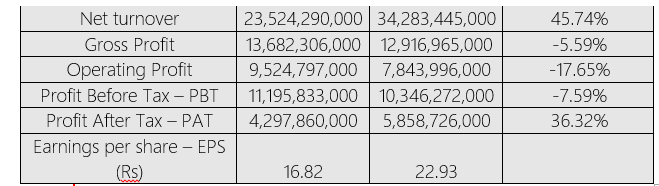

Quarterly Analysis

The company’s gross turnover increased by 43.37% and net turnover by 45.74% in 2QCY24. However, this growth did not translate into higher gross profit, which declined by 5.59%, indicating increased costs of goods sold. Likewise, the operating profit fell by 17.65%, indicating compromised operational efficiencies and

rising costs. The profit before tax decreased by 7.59%, but the profit after tax surged by 36.32%. Thus, the earnings per share increased substantially from Rs16.82 to Rs22.93, reflecting a positive outcome for the shareholders, despite challenges in the gross and operating profits.

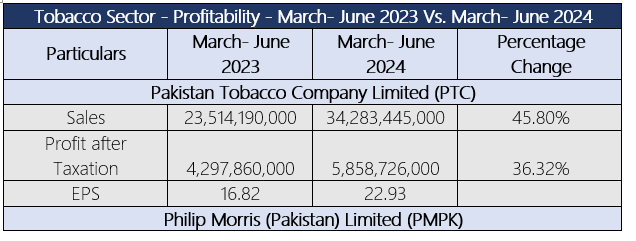

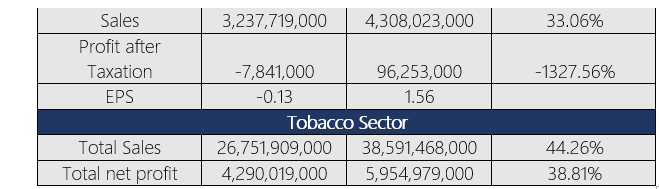

Tobacco Sector

Overall, the tobacco sector posted a healthy performance, with total sales jumping by 44.26% to Rs38.5 billion from March-June 2024. The total net profit grew by 38.81% to Rs5.95 billion compared to Rs4.2 billion in the same period last year. This growth indicates a favorable market environment for the tobacco industry in Pakistan, driven by increased consumer demand and possibly favorable regulatory conditions.

The PTC demonstrated impressive growth, with sales increasing by 45.80% to Rs34.3 billion and net profit by 36.32% to Rs5.86 billion. The earnings per share also improved notably to Rs22.93 in March-June 2024, indicating that the company expanded its market presence and effectively managed its profitability. Philip Morris (Pakistan) Limited sales increased by 33.06% to Rs4.3 billion during the review period. However, it reported a dramatic recovery from a net loss of Rs7.84 million in March-June 2023 to a profit of Rs96.25 million in March-June 2024. Thus, from a loss per share of Rs0.13 in March-June 2023, the company reported an earnings per share of Rs1.56 in March-June 2024.

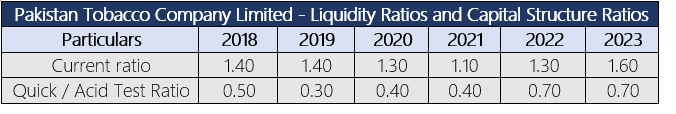

Liquidity ratios and capital structure ratios analysis

The company's current ratio has remained consistent from 2018 to 2023, indicating sufficient assets to meet its liabilities. Notably, the current ratio improved from 1.40 in 2018 to a peak of 1.60 in 2023. The quick ratio, which assesses the ability to pay short-term debts with current

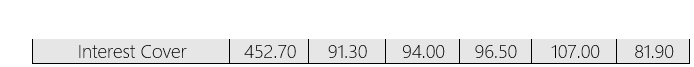

assets excluding inventory, has historically been below 1. However, it saw a significant increase in 2023, reaching 0.70, up from a low of 0.30 in 2019. The interest cover ratio is the earnings before interest and taxes (EBIT) to the interest rate on the company's outstanding debts. It has declined overall, dropping from a high of 452.70 in 2018 to a low of 81.90 in 2023.

Company profile

The Pakistan Tobacco Company Limited was established in Pakistan in 1947. The company’s core activities include the manufacturing and sales of cigarettes or tobacco.

Credit: INP-WealthPk