INP-WealthPk

Shams ul Nisa

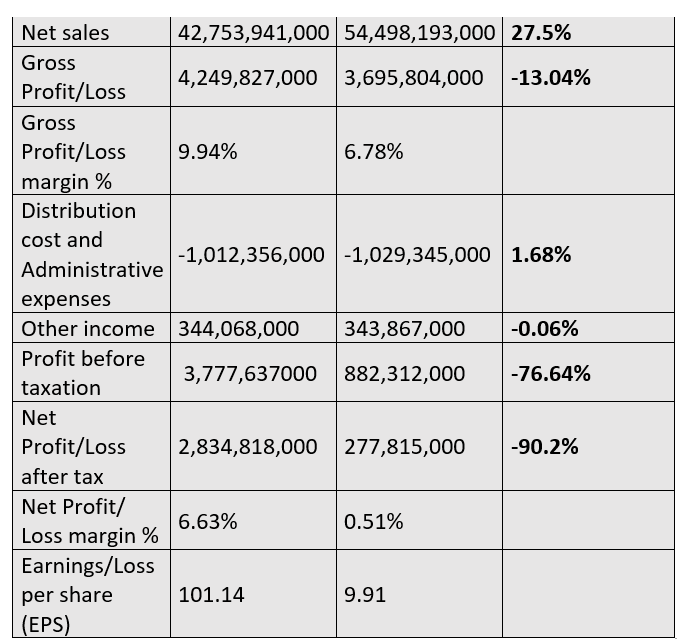

Gadoon Textile Mills Limited’s sales rose by 27.5%, but its net profit plummeted by 90.2% during the first nine months of the last fiscal year 2023-24 compared to the corresponding period of FY23, reports WealthPK.

During this period, higher sales volumes and prices for yarn and knitted bedding products led to the increase in net sales. However, the company’s gross profit declined by 13.04%, suggesting rising production costs or inefficiencies in operations. The gross margins decreased to 6.78% in 9MFY24 from 9.94% in 9MFY23 due to higher raw material prices, gas and electricity rates, and conversion costs. Despite sales growth, distribution costs decreased due to normalisation of shipping freight and increased free on-board export sales. However, inflationary pressure led to increased administrative expenses compared to 9MFY23, resulting a slight increase of 1.68% in distribution and administrative expenses. Other income showed slight decrease of 0.06% in 9MFY24.

![]()

The profit-before-taxation dropped sharply by 76.64%, from Rs3.78 billion in 9MFY23 to Rs882.31 million in 9MFY24, highlighting significant operational challenges and reduced profitability. The net profit margin dropped from 6.63% in 9MFY23 to 0.51% in 9MFY24. The earnings per share plunged to Rs9.91 in 9MFY24 from Rs101.14 in the same period last year.

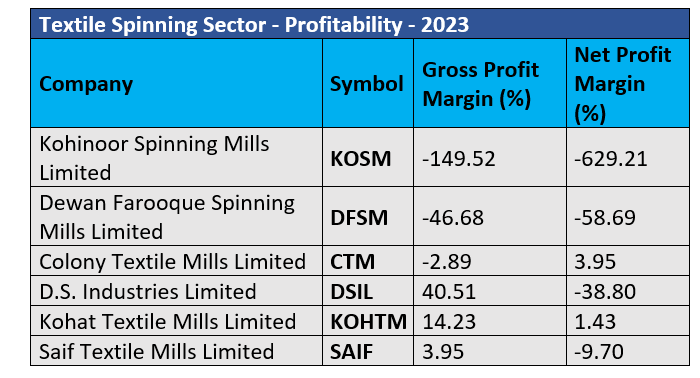

Textile spinning sector

In 2023, Pakistan's textile spinning sector grappled with significant challenges, as reflected in the profitability metrics of the companies. Kohinoor Spinning Mills Limited and Dewan Farooque Spinning Mills Limited reported negative gross loss margins of 149.52% and 46.68%, respectively, indicating substantial losses at the gross profit level. They also reported net loss margins of 629.21% and 58.69%, respectively. Colony Textile Mills Limited, despite having a net profit margin of 3.95%, showed a gross loss margin of 2.89%, pointing to challenges in generating adequate gross profit from sales.

DS Industries Limited had a strong gross profit margin of 40.51%, but struggled to convert this into net profit, as indicated by its net loss margin of 38.80%. Kohat Textile Mills Limited was the only company with positive gross and net margins of 14.23% and 1.43%, respectively. However, Saif Textile Mills Limited reported a gross margin of 3.95%, but net loss of 9.70% in 2023.

Liquidity ratios

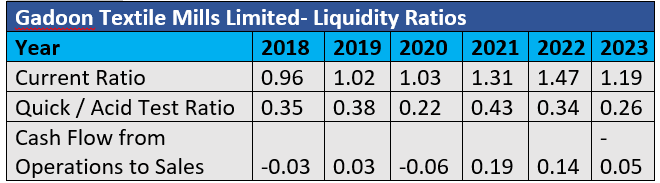

The company's current ratio, which assesses its ability to meet short-term liabilities with current assets, generally trended upward. It increased from 0.96 in 2018 to 1.47 in 2022, indicating that the company had sufficient current assets to cover its current liabilities. However, the ratio declined to 1.19 in 2023, suggesting a slight decrease in the company's liquidity. The quick ratio, which is a more stringent measure of liquidity, varied over the years, dropping from 0.35 in 2018 to 0.22 in 2020. A quick ratio below 1 indicates potential difficulties in meeting short-term obligations with the most liquid assets. Although the ratio improved in 2021, it declined again in 2022 and 2023.

Additionally, the cash flow from operations to sales ratio remained inconsistent, with negative values in 2018, 2020, and 2023, indicating that the company's operating activities have consumed more cash than what they generated during these years.Top of FormBottom of Form

Company profile

Gadoon Textile Mills was established as a public limited company in Pakistan on February 23, 1988. The company's main operations include the production and distribution of milk as well as the manufacturing and selling of yarn and knitted bedding products. The company's holding company is YB Holdings (Private) Limited.

Credit: INP-WealthPk