INP-WealthPk

Ayesha Mudassar

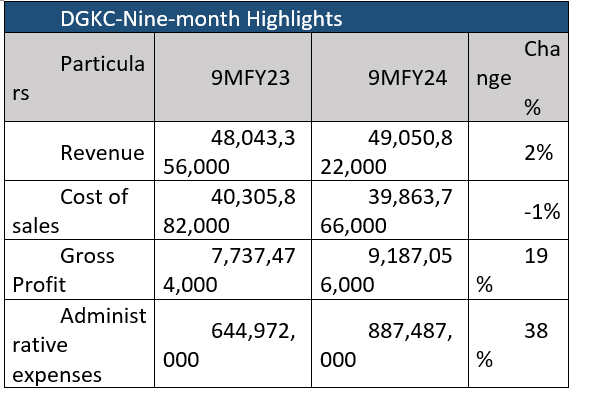

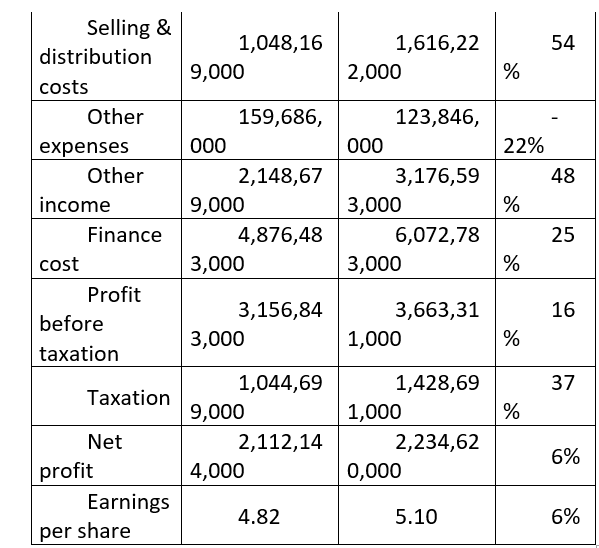

DG Khan Cement Company Limited (DGKC) reported an improvement in its financial performance during the first nine months of the last fiscal year 2023-24 as it posted a net profit of Rs2.2 billion against the profit of Rs2.1 billion over the same period of FY23, according to WealthPK.

The company earned a gross profit of Rs9.1 billion, up from Rs7.7 billion in 9MFY23. Additionally, the DGKC recorded a 16% increase in profit-before-tax during the period under review.

The company witnessed a smaller increase of 2% in revenue. However, the cost of sales declined by 1% during 9MFY24. Furthermore, the cement company posted earnings per share (EPS) of Rs5.10 in 9MFY24 compared to EPS of Rs4.82 in 9MFY23.

Sectoral analysis- 9MFY24

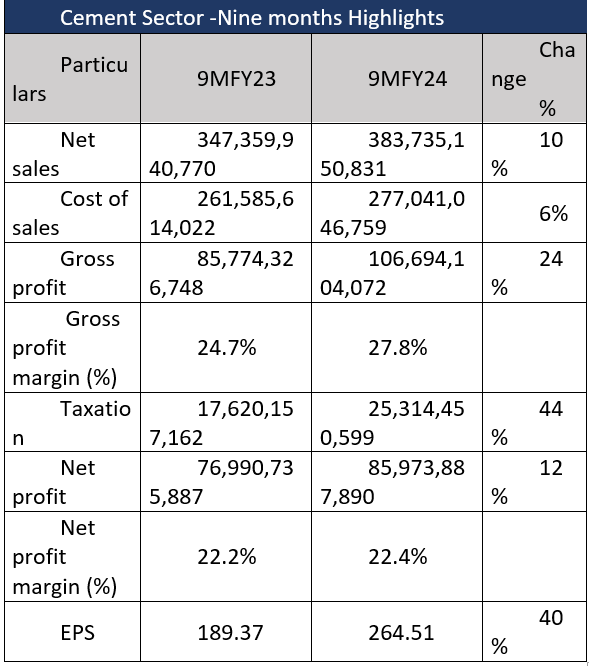

The cement sector showed modest performance in 9MFY24, as it recorded a 12% year-on-year (YoY) growth in net profits, which clocked in at Rs85.9 billion against Rs76.9 billion in the same period of the earlier fiscal.

As per results compiled by WealthPK of the income statements of the 11 Pakistan Stock Exchange-listed cement companies, the sector’s sales increased 10% to Rs383.7 billion from Rs347.3 billion in 9MFY23. The cement sector includes Cherat Cement Company Limited (CHCC), DG Khan Cement Company Limited (DGKC), Dewan Cement Limited (DCL), Fauji Cement Company Limited (FCCL), Flying Cement Company Limited (FLYING), Kohat Cement Company Limited (KOHC), Lucky Cement Limited (LUCK), Maple Leaf Cement Factory Limited (MLCF), Pioneer Cement Limited (PIOC), Power Cement Limited (POWER), and Thatta Cement Company Limited (THCCL). According to the Monthly Economic Update and Outlook for April 2024, the total cement dispatches (domestic and exports) were 34.5 million tonnes (MT), which is 2.6% higher than the 33.6MT dispatched during the corresponding period of FY23. The improved dispatches were mainly due to the ’increased exports during the period under review. On the cost front, the cost of sales rose by 6% YoY, which stood at Rs277 billion in 9MFY24 compared to Rs261.5 billion in 9MFY23. In addition, the sector paid a higher tax worth Rs25.3 billion against Rs17.6 billion in the corresponding period of FY23, up 44% YoY.

About the company

DG Khan Cement is a public limited company incorporated in Pakistan on September 27, 1978. The company is primarily engaged in the production and sale of clinker and cement, and has over 1,900 employees. As of March 31, 2024, its market capitalisation was approximately Rs35 billion.

Future outlook

The likely long-term bailout deal with the International Monetary Fund and the initiation of stringent measures against smuggling and illegal currency outflows have contributed to improved confidence within the business community. However, high inflation and elevated interest rates are expected to continue posing challenges to domestic cement demand in the short-term.

Credit: INP-WealthPk