INP-WealthPk

Shams ul Nisa

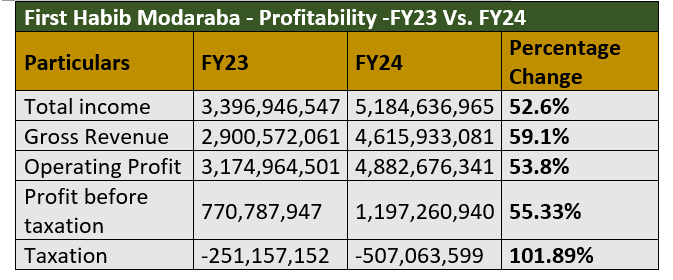

First Habib Modaraba’s total income jumped by 52.6% from Rs3.40 billion in FY23 to Rs5.18 billion in FY24, reports WealthPK.

The company’s gross revenue surged by 59.1%, indicating strong demand for the company's services. Its operating profit also increased 53.8% from Rs3.17 billion to Rs4.88 billion over the comparable period. This indicates effective management of operational costs and improved operational efficiency during the period. Furthermore, the profit-before-taxation rose by 55.33%, from Rs770.79 million in FY23 to Rs1.20 billion in FY24.

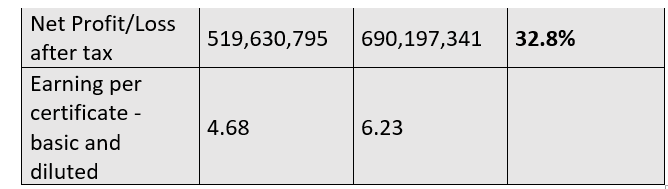

However, the taxation amount more than doubled in FY24, increasing by 101.89%. The net profit increased by 32.8%, from Rs519.63 million in FY23 to Rs690.20 million in FY24. The earnings per certificate rose from Rs4.68 to Rs6.23 in FY24.

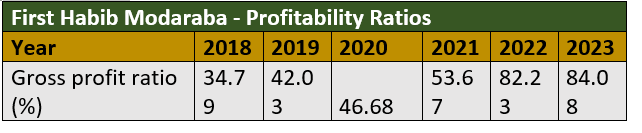

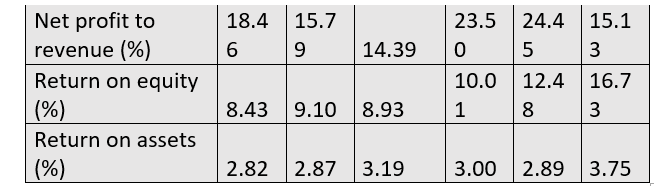

Profitability ratios

The gross profit ratio of First Habib Modaraba has consistently increased from 34.79% in 2018 to 84.08% in 2023, indicating higher gross profits generation relative to revenue. This improvement is attributed to effective cost management and pricing strategies. Starting from 18.46% in 2018, the net profit to revenue ratio fluctuated over the years, reaching a peak of 24.45% in 2022 before declining to 15.13% in 2023. The decrease in 2023 may be due to increased operating expenses or a higher tax burden, but overall, the company has been able to generate consistent net profits.

The company’s return on equity also showed an upward trend, increasing from 8.43% in 2018 to 16.73% in 2023, indicating efficient resource allocation and consistent profit generation. Its return on assets remained relatively stable, fluctuating between 2.82% and 3.75% over the period. The slight increase in 2023 may indicate optimisation of asset utilisation and higher profits relative to total assets.

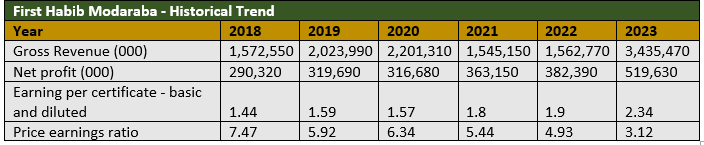

Historical trend

The company's gross revenue has increased significantly from Rs1.57 billion in 2018 to Rs3.44 billion in 2023, indicating its ability to expand its operations and capture a larger market share. The net profit has also grown steadily, from Rs290.32 million in 2018 to Rs519.63 million in 2023. This growth suggests effective management but also the need for continued focus on cost control.

The earnings per certificate have improved from Rs1.44 in 2018 to Rs2.34 in 2023, indicating the company's ability to generate more profit per certificate and effectively translate that growth into shareholder value. However, the price-earnings ratio declined significantly from 7.47 in 2018 to 3.12 in 2023, suggesting a less optimistic market outlook or undervaluation of the stock relative to earnings.

Company profile

First Habib Modaraba is a multipurpose modaraba working under the management of Habib Metropolitan Modaraba Management Company (Private) Limited. The modaraba’s core operations are the leasing and financing of Murabaha and Musharaka industries among other related businesses.

Credit: INP-WealthPk