INP-WealthPk

Shams ul Nisa

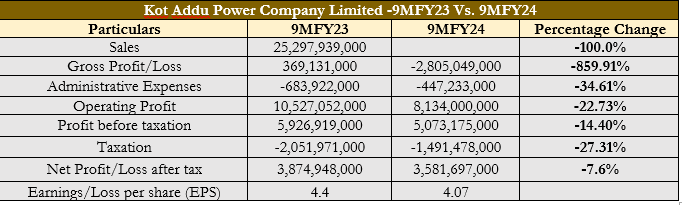

The net profit of Kot Addu Power Company Limited decreased by 7.6% to Rs3.58 billion in the nine months of the ongoing fiscal year 2024, reports WealthPK.

The company has still not signed an energy purchase agreement with a power purchaser, and thus it continues to halt sales during the review period. Furthermore, the company suffered a drastic decline to a gross loss of Rs2.80 billion in 9MFY24, 859.91% lower than a gross profit of Rs369.13 million in 9MFY23.

However, the company managed expenses efficiently despite no sales and possible restructuring efforts to lower overhead costs. The administrative expenses slipped to Rs447.2 million in 9MFY24 from Rs683.9 million in 9MFY23. The operating profit contracted by 22.73% to Rs8.13 billion in 9MFY24 and the profit before tax slipped to Rs5.07 billion in 9MFY34, 14.40% lower than Rs5.92 billion in the same period last year. During the review period, the company paid a total tax of Rs1.49 billion compared to a tax of Rs2.05 billion in 9MFY23, representing a 27.31% decline. Additionally, earnings per share witnessed a decimal reduction to Rs4.07 in 9MFY24 from an EPS of Rs4.4 in 9MFY23.

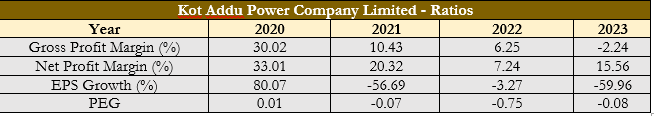

Ratios Analysis

Kot Addu Power Company Limited’s gross profit margin, a measure of operational efficiency, has declined significantly, with a sharp drop from 30.02% in 2020 to a loss margin of 2.24% in 2022, indicating rising costs and decreasing revenues. The net profit margin, which shows overall profitability after all expenses, also showed significant fluctuations. In 2020, KAPCO achieved a high net profit margin of 33.01%, but by 2021, it had decreased to 20.32%, indicating reduced profitability. This situation worsened in 2022, with the margin plummeting to 7.24%. Interestingly, in 2023, the net profit margin improved to 15.56%, suggesting that KAPCO managed to control other expenses or benefited from one-time gains, offsetting operational inefficiencies.

The company's registered earnings per share (EPS) growth of 80.70% in 2020. However, the power company posted a loss per share growth of 56.69% in 2021, 3.27% in 2022, and 59.96% in 2023. This trend indicates severe challenges in sustaining profitability and delivering consistent shareholder returns. A similar trend is followed by the price earnings-to-growth ratio, with a positive value of 0.01 in 2020 and negative values of 0.07% in 2021, 0.75% in 2022, and 0.08% in 2023. To restore investor trust and improve financial performance, KAPCO must strengthen income sources, manage its cost structure, and carry out strategic growth plans.

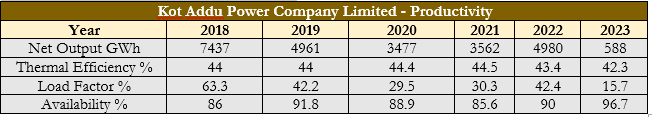

Productivity analysis

The productivity trend of Kot Addu Power Company Limited has shown noteworthy trends in terms of availability, load factor, thermal efficiency, and net production. The company's net output decreased over the years to 588 GWh in 2023, reflecting difficulties with operations, maintenance problems, and regulatory requirements. The efficiency of turning fuel into electricity is measured by thermal efficiency, which fluctuated little between 2018 and 2020, with a value of around 44%. However, it declined to 43.4% in 2022 and 42.3% in 2023.

The load factor is the installed capacity's usage rate, which decreased to 15.7% in 2023 from 63.3% in 2018. This implies that the installed capacity is not fully utilized, due to declining demand, operational limitations, and regulatory concerns. The availability percentage is the amount of time the power plant is operational and able to produce energy. It was generally high and steady, but there were minor variations. The availability was 86% in 2018, 91.8% in 2019, 88.5% in 2020, and 85.6% in 2021. However, it grew to 96.7% in 2023.

Company Profile

Kot Addu Power Company Limited was established in Pakistan on April 25, 1996, by the Pakistan Water and Power Development Authority (WAPDA). The company’s core activities include the ownership, operation, and maintenance of the Power Plant. The company's power plant is the largest in Pakistan with 10 multi-fuel gas turbines and 5 steam turbines. The company sells its electricity to Central Power Purchasing Agency (Guarantee) Limited (CPPA-G).

Credit: INP-WealthPk