INP-WealthPk

Shams ul Nisa

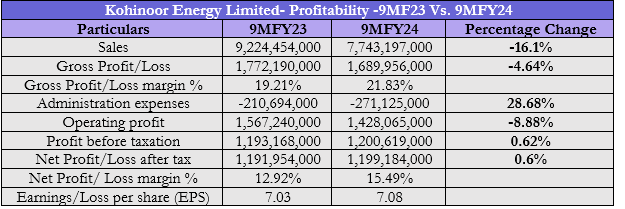

Kohinoor Energy Limited posted a considerable decline of around 16.1% in sales and a slight increase in net profit by 0.6% for the first nine months of the fiscal year 2024, reports WealthPk.

During 9MFY24, the sales stood at Rs7.74 billion compared to Rs9.22 billion in the same period last year. This was mainly because of the lower demand of the power purchaser. However, the impact of the reduction in dispatch was offset by the increase in capacity payment due to the rise in the US Dollar's exchange rate and US CPI moved net profit to Rs1.199 billion in 9MFY24 from Rs1.191 billion in 9MFY23.

Despite the significant decline in sales, the gross profit margin progressed to 21.83% in 9MFY24 from 19.21% in the same period last year. The administrative expenses grew to Rs271.1 million, 28.68% higher than Rs210.6 million in 9MFY23. However, the power company’s operating profit slipped to Rs1.42 billion from Rs1.56 billion in 9MFY23, indicating a decline of around 8.88%. At the end of the review period, the profit marginally strengthened by 0.62% to Rs1.2 billion before tax. Thus, the net profit margin widened to 15.49% in 9MFY24, and earnings per share witnessed a decimal increment to Rs7.8 in 9MFY23.

Production Analysis

The production performance of Kohinoor Energy Limited shows a fluctuating pattern in both dispatch levels and dispatch (MWH) from FY18 to FY23. The dispatch level, which shows the proportion of capacity used, began at 59.42% in FY18 but fell sharply to 35.67% in FY19. The downward trend continued to 31.04% in FY21, before climbing to 47.00% in FY22. However, in FY23 it slipped back to 30.30%.

![]()

The dispatch megawatt per hour (MWH), fell from 645,395 MWH in FY18 to 329,160 MWH in FY23. The decrease in production capacity utilization indicates a significant dip from FY18 to 337,122 MWH in FY21. There was a little recovery in FY22, with the dispatch level rising to 47.00% and the dispatch reaching 515,812 MWH. However, it declined in FY23, to 329,160 MWH, the lowest performance throughout the six years. This implies ineffective or lower operations, and unfavorable legal and commercial environments that made it difficult to sustain steady output levels. The company must tackle the problems to maintain and possibly boost production capacity utilization in the future.

Power generation and distribution Sector

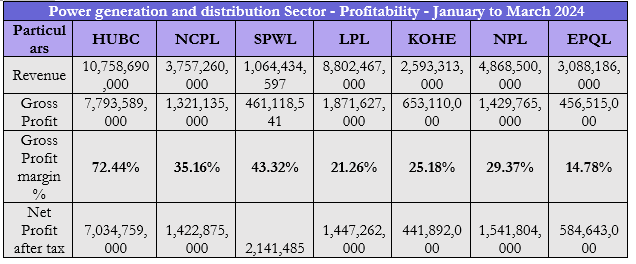

The profitability analysis of the power generation and distribution sector from January to March 2024 reveals significant variations among companies. The sector consists of The Hub Power Company Limited (HUBC), Nishat Chunian Power Limited (NCPL), Saif Power Limited (SPWL), Lalpir Power Limited (LPL), Kohinoor Energy Limited (KOHE), Nishat Power Limited (NPL), and Engro Powergen Qadirpur Limited (EPQL). HUBC leads in both revenue and profitability, with a net profit margin of 65.39% and a gross profit margin of 72.44%. NCPL also shows strong performance with a gross profit margin of 35.16% and a net profit margin of 37.87%, with a revenue of Rs3.75 billion and a net profit of Rs1.42 billion. SPWL, posted the smallest revenue of Rs1.06 billion, resulting in a gross profit margin of 43.32% and a net profit margin of 0.20%, indicating challenges in translating gross profit to net profit during the review period.

![]()

LPL has a moderate gross profit margin of 21.26% and a net profit margin of 16.44%, with a net profit of Rs1.44 billion. KOHE's revenue stood at Rs2.59 with a gross profit margin of 25.18% and a net profit margin of 17.04%. NPL and EPQL display moderate revenue and profitability growth with NPL having a gross profit margin of 29.37% and a net profit margin of 31.67%, and EPQL having a gross profit margin of 14.78% and a net profit margin of 18.93%.

Company Profile

Kohinoor Energy Limited was incorporated in Pakistan on April 26, 1994. The company's core operations include owning, running, and maintaining a power plant in Lahore and selling the electricity generated to the Pakistan Water and Power Development Authority (WAPDA).

Credit: INP-WealthPk