INP-WealthPk

Shams ul Nisa

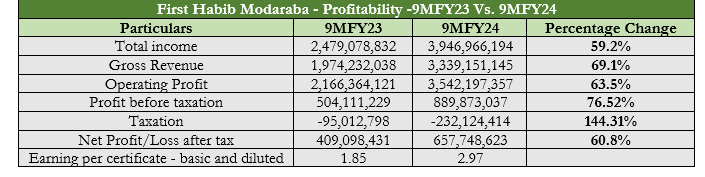

First Habib Modaraba posted a notable total income gain of 59.2%, from Rs2.47 billion in 9MFY23 to Rs3.94 billion in 9MFY24, reports WealthPK.

The company attributed better performance during the period to the successful disbursement of about Rs10.445 billion in nine months as compared to Rs7.449 billion during the same period last year. Likewise, a 69.1% increase in gross revenue to Rs3.33 billion in 9MFY24 suggests increased revenue streams and more operational efficiency. Due to better control over operational expenditures in relation to income, the company’s operating profit increased 63.5% from Rs2.16 billion in 9MFY23 to Rs3.54 billion during the review period. Its profit before taxes increased to Rs889.9 million, indicating a 76.52% growth. On the taxation side, the company bore a total tax of Rs232.1 million in 9MFY24, 144.31% more than Rs95.01 million in the same period last year.

The company’s net profit grew by 60.8% from Rs409.1 million in 9MFY23 to Rs657.7 million in 9MFY24. The financial results showed that the company is more appealing to stakeholders and investors due to its improved overall financial health, as a result of rise in net profit and total income. Thus, the basic and diluted earnings per share climbed to Rs2.97 in 9MFY24 from Rs1.85 in the same period last year, indicating higher profitability and value for shareholders.

Profitability Ratios Analysis

An analysis of profitability ratios provides important information about profitability of a company from its core activities. The First Habib modaraba registered a gross profit ratio increase nearly more than twice from 34.79% in 2018 to 84.08% in 2023. However, the net profit to revenue continued to fluctuate, between 14.39% in 2020 and 24.45% in 2022. The company's net profit dropped from 18.46% in 2018 to 2020, then increased in 2021 and 2022 before falling to 15.13% in 2023.

![]()

The return on equity increased twofold from 8.43% in 2018 to 16.73% in 2023. In 2020, the company saw one decline in the indicator to 8.93%. The return on assets varied from 2.82% in 2018 to 3.75% in 2023, showing little change over the past six years.

Liquidity Ratios Analysis

A thorough understanding of the company's capacity to repay debt is analyzed by the liquidity ratio. Over the past six years, the current ratio stayed below 1, ranging between and 0.64 in 2020 and 0.52 in 2023. This showed that the company's current ratio is below 1.2, which denotes a higher risk due to the inability of current assets to meet all of the short-term liabilities of the business.

![]()

Historical Trend

The earnings per share of First Habib Modaraba increased steadily between 2018 and 2023, suggesting a strong trajectory for profitability growth. The EPS increased from Rs1.44 in 2018 to Rs2.34 in 2023. However, the price earnings ratio dropped from 7.47 in 2018 to 5.92 in 2019, but increased to 6.34 in 2020. However, the steady decline implies that the company has been undervaluing shares over the past six years. ![]()

Future Outlook

With the establishment of a new administration and political stability, economic activity is predicted to improve in the current year. External obstacles like the need for foreign funding and debt rollover from domestic lenders, especially the IMF, still exist, nonetheless. Although foreign currency problems have been lessened by stabilization measures and reforms implemented under IMF programs, the government's current account position will continue to be threatened by growing debt payment costs and rising living expenses, notably energy prices. The company is optimistic about meeting its goals and delivering acceptable outcomes for FY23–FY24 in spite of these obstacles.

Company profile

First Habib Modaraba is a multipurpose modaraba working under the management of Habib Metropolitan Modaraba Management Company (Private) Limited. The company’s core operations include leasing, financing of murabaha, and musharaka industries, among other related businesses.

Credit: INP-WealthPk