INP-WealthPk

Shams ul Nisa

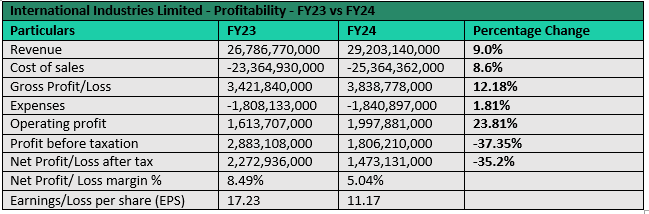

International Industries Limited (IIL) revenue grew by 9%, but net profit plunged by 35.2% during the fiscal year 2023-24 compared to the earlier fiscal, reports WealthPK.

During the period, the company earned a revenue of Rs29.2 billion and a net profit of Rs1.47 billion compared to Rs26.7 billion revenue and Rs2.2 billion profit in FY23. The cost of sales also increased by 8.6% in FY24 because of the increased conversion rates, and energy and freight costs despite the lower throughput. The gross profit improved by 12.18%, and expenses grew by 1.81% during the period.

Operating profit witnessed a significant expansion of 23.81%, indicating effective cost management. However, profit-before-taxation saw a significant decline of 37.35% in FY24. As a result of net profit decline, the net ratio also decreased to 5.04% in FY24 from 8.49% in FY23. The earnings per share dropped to Rs11.17 in FY24 from Rs17.23 in FY23, reflecting reduced profitability available to shareholders.

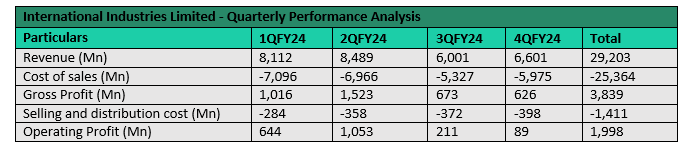

Quarterly performance analysis

IIL's revenue remained consistent over the four quarters of FY24, ranging between Rs8.4 billion in 2QFY24 and Rs6.6 billion in 4QFY24. The cost of sales was relatively stable, with the highest cost occurring in 1QFY24 at Rs7.10 billion, which decreased to Rs5.9 billion in 4QFY24. Furthermore, with quarterly fluctuations the gross profit for FY24 stood at Rs3.84 billion. The gross profit declined in 3QFY24 and 4QFY24. Moreover, selling and distribution costs totalled Rs1.41 billion, with incremental increases each quarter, peaking at Rs398 million in 4QFY24. Operating profit showed a strong performance in 2QFY24 and stood at Rs1.05 billion, but dropped significantly in 4QFY24 to Rs89 million. However, the company earned the other income of Rs1.35 billion in FY24.

The total finance cost amounted to Rs1.47 billion in FY24.

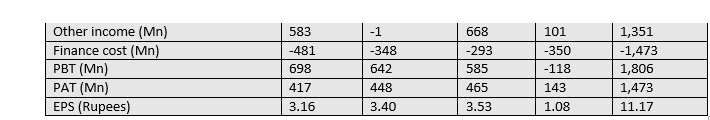

Profit-before-taxation showed strong performance in initial quarters but posted a loss of Rs118 million in 4QFY24. Net profit decreased from Rs417 million in 1QFY24 to Rs143 million in 4QFY24. The quarterly earnings ranged between a high of Rs3.53 in 3QFY24 and a low of Rs1.08 in 4QFY24.

Liquidity and capital structure ratios

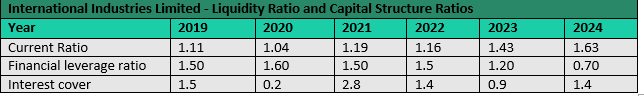

The company's current ratio remained above 1 from FY19 to FY24, signifying its capacity to timely discharge the debt. The current ratio rose from 1.11 in FY19 to 1.63 in FY24, indicating improved liquidity and operational stability.

The financial leverage ratio decreased from 1.50 in FY19 to 0.70 in FY24, indicating the firm's reduced reliance on debt to finance its operations. The interest cover ratio dropped from 1.5 in 2019 to 0.2 in 2020, but recovered to 1.4 in 2024, indicating improved earnings relative to interest obligations.

Future outlook

The government's efforts amid at ensuring macroeconomic stability have shown some positive results with declining inflation and currency stabilisation. Additionally, the agreement with the IMF for a long-term loan facility and initiatives to attract foreign investment in sectors like mining and agriculture are promising signs for the local economy. IIL remains focused on diversification, innovation, and strategic investments to navigate through the challenges and capitalise on emerging opportunities.

Company profile

IIL is a leading manufacturer of steel and polymer pipes, tubes, and fittings in Pakistan. Established in 1948, IIL has driven industrial growth globally. With a substantial equity of Rs18.4 billion and robust annual revenues, IIL has consistently ranked among Pakistan's top 25 firms for 16 years.

Credit: INP-WealthPk