INP-WealthPk

Muhammad Asad Tahir Bhawana

Pakistan’s total publicly guaranteed debt stood at Rs55.8 trillion as of December 2022, up 7% from what it was at the end of June 2022, said the Ministry of Finance in its debt sustainability report.According to the report available with WealthPK, the high-interest rate environment and the Pakistani rupee’s continuous depreciation against the US dollar in the first half of FY23, contributed to an increase in the interest rate burden.

In total, 62.8% of the debt was domestic. There are three types of domestic debt: permanent (medium-and long-term), floating (short-term), and unfunded (primarily made up of various instruments available under the National Savings Schemes). Meanwhile, 37.2% of total public debt is external debt, owned by multilateral development partners, bilateral creditors, and commercial lenders.

The government is making efforts to secure funds from various sources to meet external repayment needs. It is to be noted here that Pakistan successfully secured the rollover of a Chinese SAFE deposit worth $10 billion and a Saudi time-deposit worth $300 million during the first half of FY23. Furthermore, multilateral agencies have provided $3.298 billion to the government.

Meanwhile, the government has repaid $2.722 billion and $1 billion, respectively, on international commercial loan obligations and international Sukuk maturity. In order to finance the fiscal deficit, the government has utilised medium-and long-term instruments, specifically floating-rate Pakistan Investment Bonds. Additionally, the government reduced the stock of Treasury bills by approximately Rs661 billion during this period.

Furthermore, the government intends to finance the federal fiscal deficit from medium-to-long-term domestic and external sources during the second half of FY23. Aside from this, the government has introduced multiple tenor Shariah-compliant debt securities to diversify the borrowing basket and to broaden investment avenues during the current high-interest rate environment.

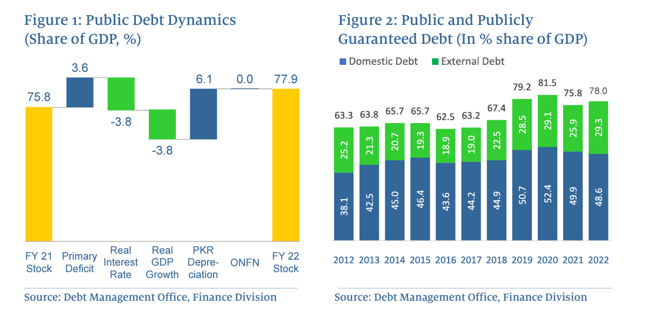

Meanwhile, the total public and publicly-guaranteed debt-to-GDP ratio increased from 75.8% to 78% in the first half of FY23. The depreciation of the Pakistani rupee and a primary deficit contributed to this increase, with domestic debt financing the fiscal deficit primarily. Combined negative real interest rates and GDP growth partially compensated for the increase. The domestic debt-to-GDP ratio stood at 46.4% in the first half of FY23, down from 47.1% over the same period of last year. Because of the rupee depreciation, the external debt-to-GDP ratio increased from 34.1% to 36.9%.

As part of its commitment, the government is looking to diversify the borrowing basket for financing the federal fiscal deficit through the introduction of new instruments on the domestic market and by taking advantage of the maximum amount of concessional external financing available.

Credit: Independent News Pakistan-WealthPk