INP-WealthPk

Shams ul Nisa

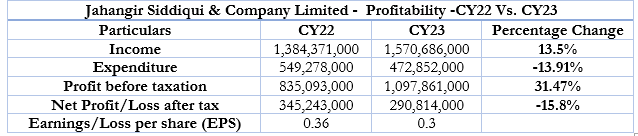

The Jahangir Siddiqui & Company Limited’s income surged 13.5% to Rs1.57 billion for the calendar year 2023, compared to Rs1.38 billion in the corresponding period of the previous year, reports WealthPK. The company attributed this rise in income to the higher return on investments, which was primarily due to the increase in interest rates and dividend income. On the expenditure front, the company’s operating and administrative expenses, provision for Sindh workers’ welfare fund, and reversal of provision for impairment grew significantly during the period.

However, the finance cost reduced to Rs117.5 million in CY23 compared to Rs246.2 million in CY22. The company successfully paid the principal and accumulated interest to Term finance certificate holders on maturity. Thus, this decrease in finance cost offset the growth in other expenses and resulted in an overall reduction in expenditure by 13.91%.

The company’s profit before tax reached Rs1.09 billion in CY23, 31.47% higher than Rs835.09 million in the same period last year. However, the company’s net profitability declined 15.8% to Rs290.81 million in CY23, due to increased net tax. Consequently, the earnings per share (EPS) slipped marginally to Rs0.30 in CY23 from EPS of Rs0.36 in CY22.

Financials analysis

Starting from CY18, the total income slid to Rs956.5 million in CY20 but grew substantially to Rs1.5 billion in CY21. However, in CY22 there was another dip to Rs1.38 billion before reaching the highest of Rs1.57 in CY23. The overall income growth was mainly due to higher Return on Investments.

![]()

The investment company observed the highest profit after tax of Rs1.2 billion in 2020 and the lowest of Rs206.8 million in year CY18. Similarly, the company’s EPS showed fluctuating trends. The company recorded the highest ESP of Rs1.32 in 2020 and lowest of Rs0.23 in CY18.

Ratios analysis

![]()

The company’s net profit margin rose from 16.61% in CY18 to 125.97% in CY20, but kept on declining in the subsequent years, reaching 18.52% in CY23. Over the period under review, the operating profit margin remained volatile. Yearly, the operating profit margin increased from 35.42% in CY18 to the highest 140.12% in CY20, mainly due to a significant reversal in provision for impairment. The company's operating profit margin contracted to 60.32% in CY22 but expanded to 69.90% in CY23. Its return on assets followed a similar pattern, reaching a peak of 3.44% in CY20.

Liquidity Ratio

The current ratio remained above 1.2 over CY2018-23, implying a strong liquidity position for the company. Likewise, the acid ratio stayed over 1, indicating higher current assets than current liabilities. The company witnessed a peak cash-to-current liabilities of 7.02 in CY20 and lowest at 2.13 in CY18.

![]()

Investment banks, securities trading, and consultancy sector

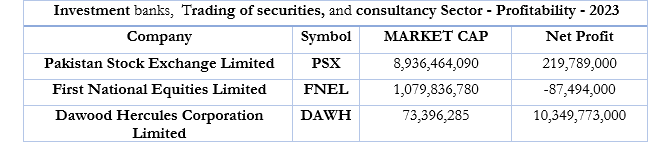

In the “investment banks, securities trading, and consultancy” sector, the Dawood Hercules Corporation Limited was highly profitable in 2023 as it registered a net profit of Rs10.34 billion. OLP Financial Services Pakistan Limited secured a net profit of Rs1.2 billion, making it the second most profitable company in the sector. However, First National Equities Limited bore a net loss of Rs87.49 million during the review period.

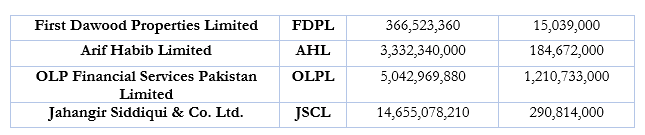

In terms of market capitalization, Jahangir Siddiqui & Company Limited had the highest outstanding share worth Rs14.65 billion, constituting 44% of total sector shares. 27% of the total outstanding shares were held by Pakistan Stock Exchange Limited and 15% by OLP Financial Services Pakistan Limited.

Future Outlook

The company stressed the need for fiscal and structural reforms to tackle socioeconomic challenges such as high inflation, and exchange rate volatility to ensure a positive contribution of the company to Pakistan’s economy and Shareholders’ value.

Credit: INP-WealthPk