INP-WealthPk

Shams ul Nisa

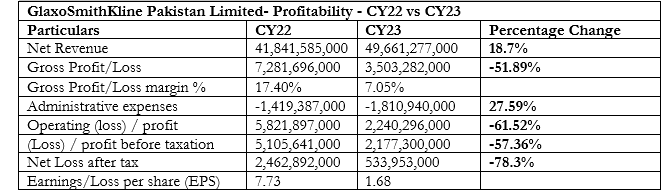

The GlaxoSmithKline Pakistan Limited (GSKPL) posted a massive decline of 78.3% in net profit to Rs533.9 million in CY23, compared to Rs2.46 billion in the calendar year 2022, reports WealthPK. The company attributed this decrease to the higher tax rate during the period. In CY23, the company earned a net revenue of Rs49.66 billion, 18.7% higher than Rs41.84 billion in CY22. The contributing factors for the increase include the sales of the products of Haleon Pakistan Limited whose marketing authorization rights are under GSKPL. In addition, the sales were boosted by the company's strong execution methods, efficient resource allocation, successful multichannel interaction with Healthcare Professionals (HCPs), and price rise over the previous year.

However, the gross profit contracted to Rs3.5 billion in CY24, representing a massive reduction of 51.89%. Thus, the gross profit margin dipped to 7.05% in CY23, mainly due to substantial currency devaluation, inflationary pressures, increased global commodity prices, and rising fuel costs. On the expenses front, the company’s administrative expenses grew by 27.59% to Rs1.81 billion during the review period. Its operating profit shrunk by 61.52% to Rs2.24 billion in CY23 from Rs5.82 billion in the same period last year. The profit before tax fell by 57.36% and earnings per share (EPS) reduced to Rs1.68 in CY23 from EPS of Rs7.73 in CY22.

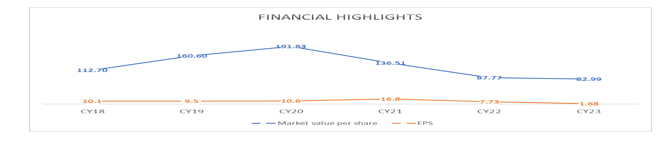

Financial Highlights

The market value per share is the current price of the company’s shares for which an investor is willing to pay for common stock. Starting from the Rs112.70 market value per share in 2018, the value per share kept on growing, reaching a peak of Rs191.83 in 2020. However, it continues to contract in succeeding years to stand at Rs82.99 in 2023. The EPS remained volatile over the year, ranging between the highest of Rs16.8 in 2021 and the lowest of Rs1.68 in 2023, representing a massive decline in the company’s profitability. The company registered an ESP of Rs10.1 in 2018.

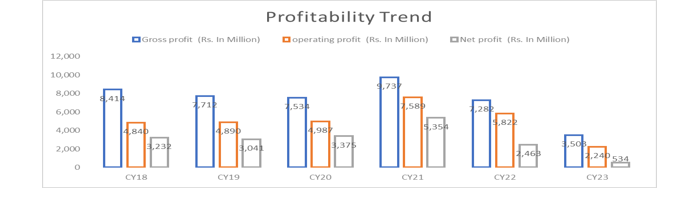

Profitability Trend

During the six years, the gross profit reduced significantly from Rs8.4 billion in 2018 to Rs3.5 billion in 2023. However, the company managed to earn a hefty amount of Rs9.73 billion gross profit in 2021. A similar pattern was followed by the operating profit and net profit of the pharmaceutical company. The company registered the highest operating profit and net profit of Rs7.58 billion and Rs5.35 in 2021. GSKPL's operating profit ratio peaked at 20.70% in 2021 due to an increase in net sales.

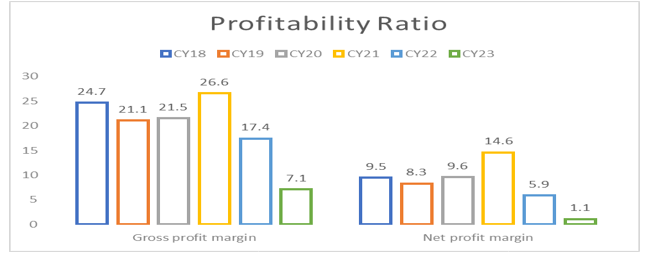

The gross profit margin stood at 24.7% in 2018 and declined in the subsequent years to 21.5% in 2020, indicating that the profit generated from sales declined marginally over time, without any change in the cost of production of the goods sold by the company. In 2021 the company experienced the highest gross profit ratio of 26.6%, which fell to 7.1% in 2023. The net profit ratio measures the company’s ability to generate net profit as a percentage of sales. The company registered a net profit ratio of 9.50% in 2018, which fell to 8.3% in 2019. The net profit ratio regained its momentum and peaked at 14.61% in 2021. However, the company’s net profit ratio continues to plunge, reaching its lowest at 1.1% in 2023.

Pharmaceuticals Sector

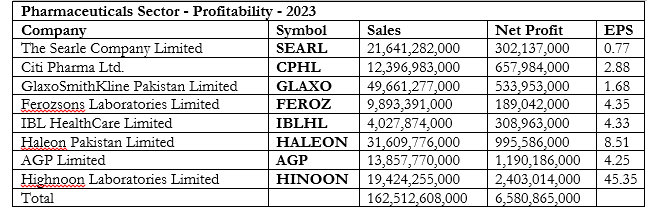

In 2023 the pharmaceutical sector generated a total sale of Rs162.51 billion. The GlaxoSmithKline Pakistan Limited was the top contributor with a total sale of Rs49.66 billion, followed by Haleon Pakistan Limited with a total sale of Rs31.6 billion and The Searle Company Limited Rs21.64 billion.

The net profit of the sector amounted to Rs6.58 billion in 2023, with the highest of Rs2.4 billion by Highnoon Laboratories Limited and Rs1.19 billion by AGP Limited. In terms of EPS, Highnoon Laboratories Limited led the sector with an ESP of Rs45.35 and the lowest of Rs0.77 by The Searle Company Limited in 2023.

Future Outlook

Despite the escalating costs, the company is committed to delivering medicines and vaccines to patients in Pakistan. The company desires for supportive regulatory environment by the government to ensure the availability of essential medicines.

Company Profile

GlaxoSmithKline Pakistan Limited is incorporated in Pakistan as a limited liability company. It is engaged in the manufacturing and marketing of research-based ethical specialties and pharmaceutical products.

Credit: INP-WealthPk