INP-WealthPk

Shams ul Nisa

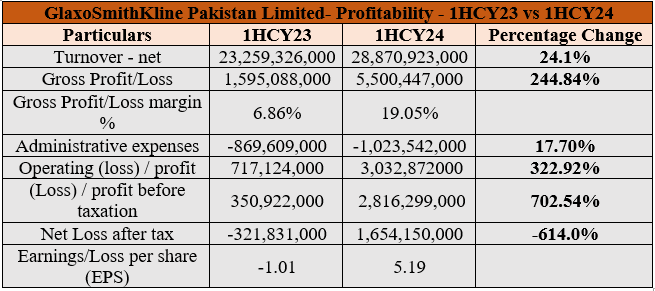

GlaxoSmithKline Pakistan Limited reported a substantial

surge in net profit to Rs1.65 billion in 1HCY24, compared to a sharp net loss of Rs321.83 million during the same period last year, indicating an increase of 614%, reports WealthPK.During this period, the company's net turnover rose by 24.1%, totaling Rs28.87 billion. The gross profit saw an

impressive rise of 244.84%, improving margins from 6.86% in 1HCY23 to 19.05% in 1HCY24. This improvement was largely attributed to price increases following the deregulation of non-essential products and approval of hardship cases. The administrative expenses rose by 17.70%, but this was relatively modest compared to the growth in the gross profit and revenue. The operating profit also experienced a significant boost, soaring by 322.92% to Rs3.03 billion in 1HCY24. The profit before taxation saw an extraordinary rise of 702.54%, from Rs350.92 million to Rs2.82 billion in 1HCY24. Thus, the earnings per share (EPS) reached Rs5.19, a notable improvement from the loss per share of Rs1.01 in the same period last year, demonstrating the company's ability to generate shareholder value after previous losses.

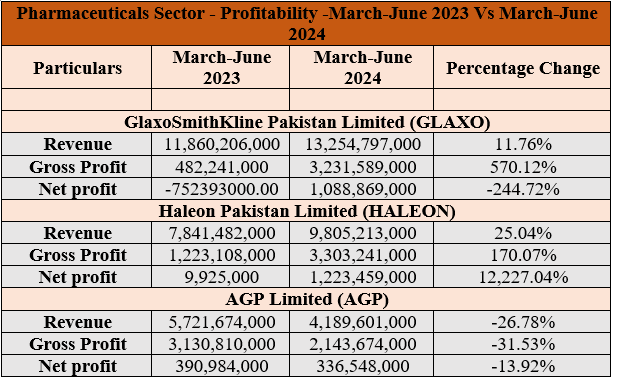

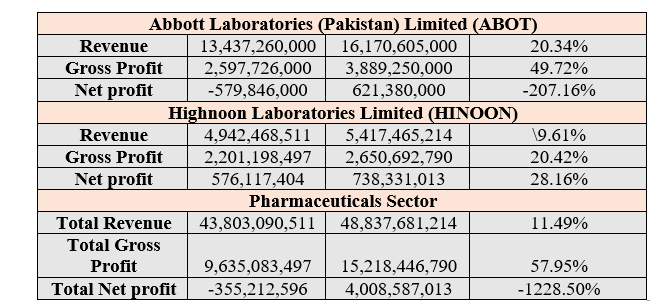

Pharmaceuticals Sector

The pharmaceuticals sector saw an increase of 11.49% in total revenue, growing from Rs43.80 billion between March and June 2023 to Rs48.84 billion during the same period in 2024, reflecting increased demand for pharmaceutical products and successful sales strategies. Haleon achieved the highest revenue growth in the sector, with a 25.04% increase. However, AGP Limited experienced a 26.78% drop in revenue, suggesting difficulties in revenue generation. The sector's gross profit surged by 57.95% during the period, reaching Rs15.22 billion, primarily driven by GlaxoSmithKline's remarkable growth of 570.12% in gross profit. Haleon followed with a 170.07% rise, reflecting successful cost control and improved pricing strategies. However, AGP Limited's gross profit dropped by 31.53%. The sector's total net profit saw a significant turnaround, shifting from a net loss of Rs355.21 million to Rs4.01 billion from March to June 2024, posting a massive spike of 1228.50%. Haleon led with a staggering 12,227.04% increase in net profit, showcasing strong revenue growth and effective cost management. GlaxoSmithKline also made a notable recovery from a net loss of Rs752.39 million to a net profit of Rs1.09 billion. On the other hand, AGP Limited and Abbott Laboratories reported declines in net profit, while Highnoon Laboratories posted a positive performance with a 28.16% increase in net profit.

Future Outlook

The economic situation in Pakistan remains concerning, with inadequate improvements in key indicators and challenges in managing high debt servicing costs and external repayments. The IMF has agreed on a $7 billion aid package with Pakistan, to be disbursed over more than three years, aimed at stabilizing the economy and promoting inclusive growth. The program seeks to support macroeconomic stability and foster a better business environment to encourage investment. The company is optimistic about working with the stakeholders to establish a regulatory framework that ensures the production and distribution of safe, high-quality medicines for the benefit of patients across the country.

Company Profile

GlaxoSmithKline Pakistan Limited is a limited liability company incorporated in Pakistan. It specializes in the manufacturing and marketing of research-based ethical pharmaceutical products. The company is a subsidiary of S.R. One International B.V., based in the Netherlands, and its ultimate parent company is GlaxoSmithKline plc (GSK plc) in the UK.

Credit: INP-WealthPk