INP-WealthPk

Shams ul Nisa

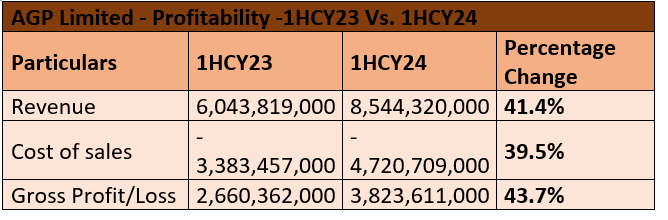

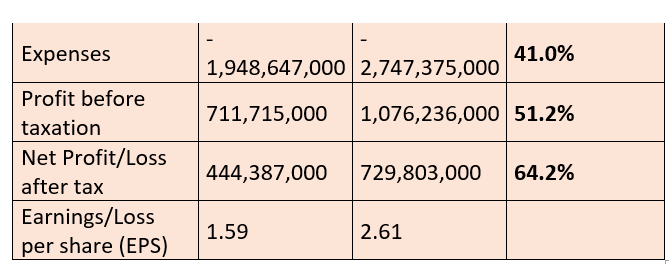

AGP’s top line grew 41.4%to Rs8.5 billion in the first half of the ongoing calendar year 2024 from Rs6.04 billion in 1HCY23. This growth was fueled by the continued sales success of its leading brands in the domestic market, which saw a 39% rise, while export sales grew an impressive 44%, reports WealthPK.

The cost of sales also rose by 39.5%, and gross profit increased by 43.7% year-on-year, reflecting effective management of production costs. The company’s expenses surged by 41.0%, largely due to increased sales and ongoing inflationary pressures. The finance costs significantly rose primarily due to long-term financing and a rise in short-term borrowings.

The profit-before-taxation surged 51.2% from Rs711.72 million in 1HCY23 to Rs1.08 billion in 1HCY24. The net profit also saw a remarkable 64.2% growth. Consequently, the earnings per share rose significantly to Rs2.61 in 1HCY24 from Rs1.59 in 1HCY23, reflecting increased shareholder value and confidence.

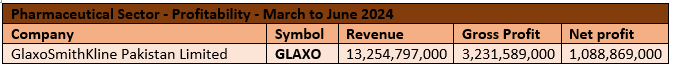

Pharmaceutical sector performance (March-June24)

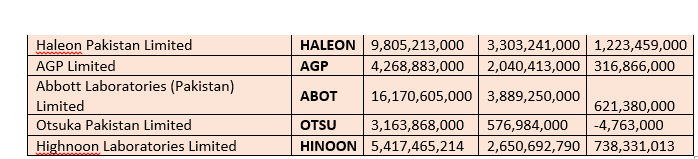

Abbott Laboratories (ABOT) topped the pharmaceutical sector with the highest revenue of Rs16.17 billion, followed by GlaxoSmithKline Pakistan Limited (Glaxo) at Rs13.25 billion and Haleon Pakistan Limited at Rs9.81 billion during March to June 2024. These results highlight the strong market presence and effective sales strategies. Highnoon Laboratories Limited and AGP reported revenues of Rs5.42 billion and Rs4.27 billion, respectively. Otsuka Pakistan Limited (OTSU) recorded the lowest revenue of Rs3.1 billion.

In terms of gross profit, ABOT also led the sector with Rs3.89 billion, followed by HALEON with Rs3.30 billion. GLAXO had a gross profit of Rs3.23 billion, while HIGHNOON reported Rs2.65 billion gross profit. AGP achieved a gross profit of Rs2.04 billion, which is notable considering its lower revenue compared to larger competitors. OTSU’s gross profit was comparatively low at Rs576 million, indicating potential challenges in cost management or pricing strategies. HALEON showed strong performance with a net profit of Rs1.22 billion during the March-June24 period, indicating effective management of revenues and expenses. GLAXO followed with a net profit of Rs1.09 billion, indicating solid profitability. AGP registered a net profit of Rs316 million, demonstrating its ability to maintain profitability despite lower revenue compared to its competitors. HIGHNOON reported a net profit of Rs738 million, showcasing its effective operational strategies in a competitive market.

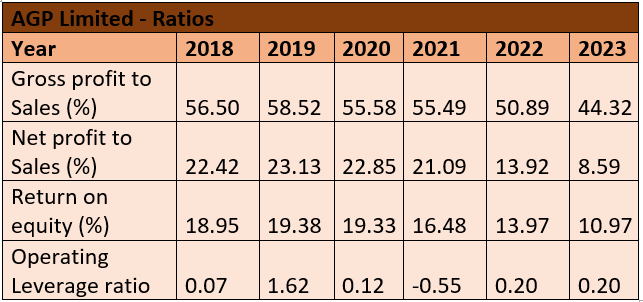

Ratios analysis (2018-23)

AGP Limited's gross profit margin fell from 56.50% in 2018 to 44.32% in 2023, highlighting difficulties in maintaining profit margins amid rising production costs. Additionally, the net profit margin decreased from 22.42% in 2018 to 8.59% in 2023, suggesting a reduction in operational efficiency and cost management.

The return on equity decreased from 18.95% in 2018 to 10.97% in 2023, signalling reduced returns for investors. Additionally, the operating leverage ratio varied significantly over the years, with a negative value in 2021, suggesting considerable losses due to revenues not covering the fixed costs.

Future outlook

Pakistan's economy is expected to grow positively in FY25 with inflation and policy rate expected to further decrease as the government takes measures to boost growth. The exchange rate is also expected to remain stable due to IMF disbursements. Amid these positive macroeconomic indicators, AGP is committed to sustainable growth and market expansion, leveraging its existing product portfolio and group synergies. The company is diversifying suppliers, strengthening export capabilities, optimising inventory, and planning strategic investments to expand manufacturing capacity.

Awards and achievements

AGP was awarded excellence in six categories at the 2024 Global Diversity, Equity & Inclusion Benchmarks Awards, showcasing its commitment to fostering a diverse and inclusive workplace.

Company profile

AGP was incorporated in 2014 as a public limited company. It was listed on the Pakistan Stock Exchange in 2018. Its main activities include pharmaceutical products import, marketing, export, dealership, distribution, wholesale, and manufacturing.

Credit: INP-WealthPk