آئی این پی ویلتھ پی کے

Qudsia Bano

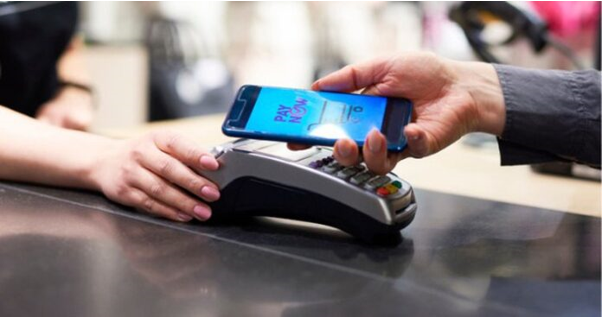

Pakistan’s digital payments ecosystem recorded robust growth during the first quarter of FY26, with total retail transactions reaching 2.8 billion and their aggregate value rising to Rs166 trillion, reflecting the continued shift toward electronic payment channels across the country, according to the State Bank of Pakistan’s Payment Systems Review.

The central bank reported that digital channels accounted for nearly 90 percent of all retail payment transactions during the quarter, underscoring the rapid decline in reliance on cash for routine financial activities. The dominance of digital payments highlights growing public confidence in electronic platforms and the expanding reach of formal financial services.

According to the review, the increase in retail payment volumes was primarily driven by the widespread use of digital banking channels, including mobile and internet-based platforms. These channels have become integral to everyday financial activity, enabling users to make payments, transfers and settlements quickly and securely. The report notes that improved accessibility and ease of use have played a central role in encouraging consumers to migrate to digital options.

In value terms, retail payments reached Rs166 trillion during the quarter, indicating the expanding scale of Pakistan’s digital economy. The State Bank observed that higher transaction values reflect increased adoption of electronic payments not only for low-value retail purchases but also for larger financial transactions conducted through formal banking channels.

The review highlights that the growth in digital payments has been supported by ongoing efforts to strengthen payment infrastructure and enhance interoperability among banks and payment service providers. These measures have allowed transactions to be processed more efficiently, reducing delays and improving the overall user experience.

The central bank noted that digital payment adoption continues to gain traction across different segments of society, driven by greater financial awareness and improved access to banking services. Financial institutions have expanded their digital offerings, while payment systems have been upgraded to handle rising transaction volumes and ensure system reliability.

According to the SBP document, the steady rise in digital retail payments reflects structural changes in consumer behaviour, with electronic transactions increasingly preferred for convenience, speed and security. The review further states that the growing share of digital payments is aligned with national objectives to promote financial inclusion and encourage formalisation of economic activity.

The State Bank emphasised that sustained growth in digital retail payments remains a key indicator of progress toward a more efficient and transparent payment ecosystem. Continued expansion of digital channels is expected to further strengthen Pakistan’s financial system and support broader economic digitalisation efforts.

Credit: INP-WealthPk