INP-WealthPk

Ayesha Mudassar

The United Bank Limited (UBL), one of the country's largest commercial banks, posted an unconsolidated profit after tax (PAT) of Rs 15.5 billion for the quarter that ended on March 31, 2024, with a growth of 12% over the corresponding period of the last year, reports WealthPK.

![]()

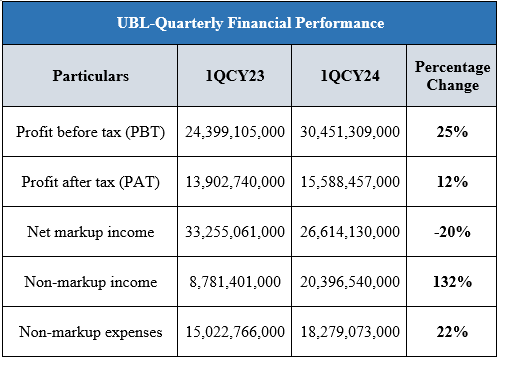

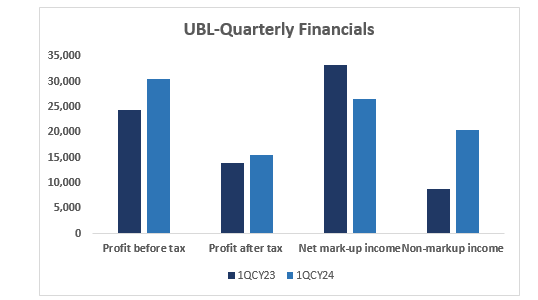

According to the quarterly report, the bank recorded a profit before tax (PBT) of Rs 30.4 billion for 1QCY24 versus a PBT of Rs 24.3 billion in 1QCY23. In addition, UBL announced an earnings per share (EPS) of Rs 12.73 for the quarter under review. The bank's net markup income for the quarter reached Rs 26.6 billion, representing a 20% year-on-year (YoY) decline. Although interest earnings surged by 166%, the interest expense spiked by an even greater proportion, resulting in a drop in net earnings. On the other hand, the non-markup income posted colossal growth, which stood at Rs 20.3 billion during 1QCY24, compared to Rs 8.7 billion in 1QCY23. Massive gains in the sales of securities and a rise in fee and commission income were the key contributors to this rise. On the expense side, the total non-markup expenses increased by 22% to Rs 18.2 billion in 1QCY24 compared to Rs 15.02 billion in 1QCY23. The increase was attributed to the rise in operating costs and charges toward the workers' Welfare Fund.

Performance over the last five years (2019-2023)

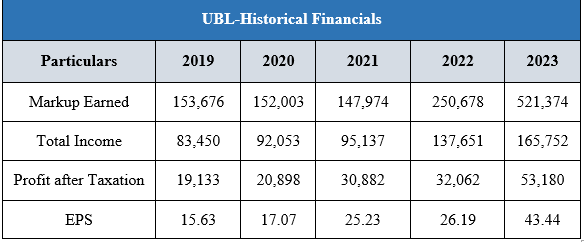

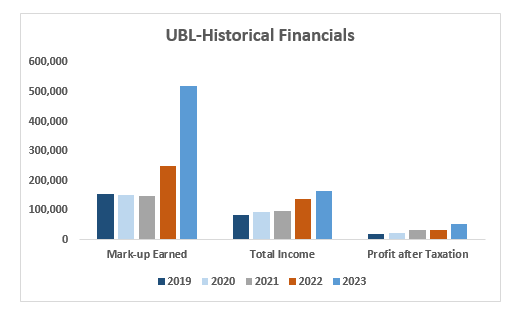

The historical analysis of UBL demonstrates a positive trend in key financial indicators, including markup earned, total income, profit after taxation, and EPS. These metrics suggest that UBL experienced growth and improved financial performance over the years. During the period under consideration, the bank earned the highest markup in 2023. High interest rates along with timely repositioning within the asset base, have improved margins. In addition,

(All numbers in millions except EPS)

Concerning total income, UBL earned a total income of Rs 83.4 billion in 2019, Rs 92.1 billion in 2020, Rs 95.1 billion in 2021, Rs 137.7 billion in 2022 and Rs 165.7 billion in 2023. The substantial increase in 2022 is mainly due to an enormous rise in foreign exchange income, interest earnings, and other income. In terms of PAT, the bank hit the highest five-year PAT in 2023, amounting to Rs 53.1 billion. The improved profitability was primarily fuelled by higher net interest income and provisioning reversals. In 2023, UBL recorded a net provisioning reversal of Rs 9.0 billion for 2023 against a net provision charge of Rs 15.7 billion in 2022. The bank posted a net profit of Rs 19.1 billion in 2020, Rs 20.9 billion in 2021, and Rs 30.8 billion in 2021. The trend of increasing EPS over the years, with the highest EPS in CY23, indicates that UBL's financial performance generally improved primarily due to income growth.

Future Outlook

UBL is committed to actively contributing to the development of the economy through strengthening financial inclusion and providing banking services across the country. Furthermore, the bank will target low-cost deposits to maximize the earnings potential and aggressively invest in technological transformation to become a more agile and efficient organization. Strengthening compliance and control standards in line with international best practices remains an ongoing strategic priority.

Credit: INP-WealthPk