INP-WealthPk

Ayesha Mudassar

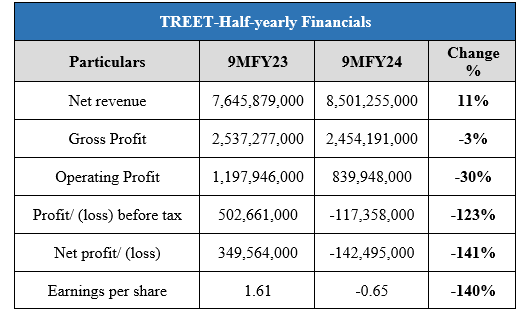

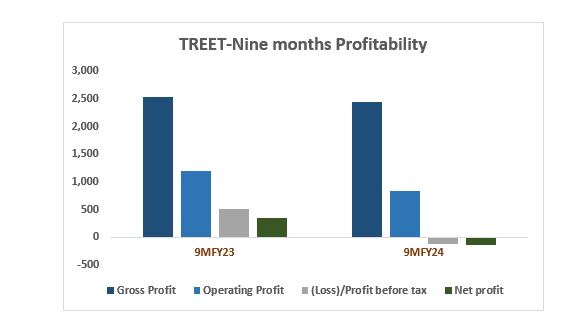

Treet Corporation Limited (TREET)’s financial performance took a notable hit as the company posted a net loss of Rs142.4 million during the nine months (July-March) of the ongoing fiscal year, compared to Rs349.5 million in net profit recorded over the corresponding period of the earlier fiscal, reports WealthPk. The reversal from profit to loss highlights the combined impact of the increased administrative and distribution expenses, as well as the considerable rise in financing costs.

As per the unconsolidated income statement, TREET posted a loss before tax of Rs117.3 million for 9MFY24 versus a profit of Rs502.6 million during the same period last year. Moreover, TREET announced a loss per share of Rs0.65 for the period under review. The operating profit also indicates a significant decline of 30% compared to the corresponding period of the previous year. Despite the prevailing economic challenges, the company achieved a notable 15% increase in revenue which illustrates the company’s effective implementation of strategic sales approaches, both domestically and in export markets.

Pattern of Shareholding

As of June 30, 2023, TREET has 178.7 million shares outstanding, owned by 9,592 shareholders. TREET’s directors, having a stake of over 42% in the company, form the biggest shareholding category followed by the general public with a 40.4% share. NIT and ICP hold 6.5%, while Banks, DFIs and Insurance companies account for 3.6%. Joint stock companies hold 3.3% of the company’s shares. Loads Limited, an associate company of TREET, has a stake of 2.7%. The remaining shares are held by other categories of shareholders including Modarba, the Federal Board of Revenue (FBR), and foreign companies.

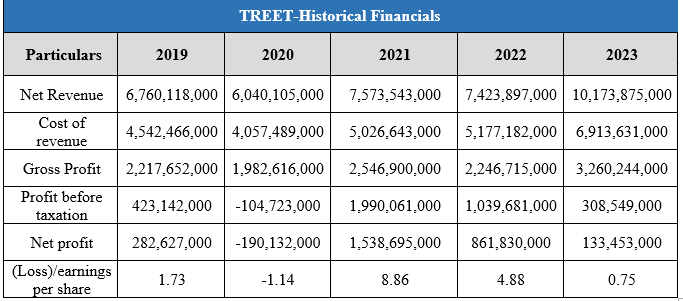

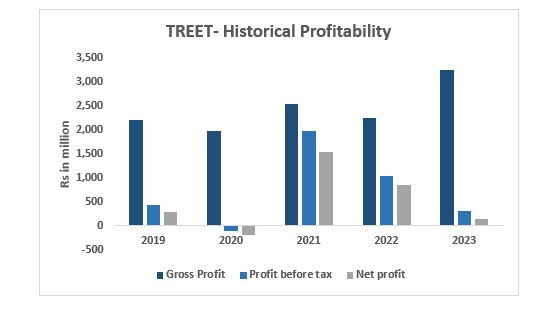

Historical Performance (2019-2023)

The top line of Treet Corporation has been growing except for 2020 and 2023. However, the profit margins have been fluctuating in all the years under consideration. In the year 2020, the company's net revenue dropped by 10.7% on account of lower domestic and export sales. Owing to the outbreak of Covid-19, TREET experienced a reduction in its gross profit. In addition, the discontinued operations played their due role in suppressing the bottom line which clocked in at negative 190.1 million in 2020.

Following a dip in 2020, the top line of TREET regained momentum in 2021 and grew substantially by 25.4% Year-on-Year (YoY). The top-line growth was backed by higher sales volume coupled with improved pricing and product mix. Consequently, the gross profit amplified by 28.5% The company recorded a net profit of Rs1,538 million in 2021 against a loss of Rs190.1 million in the previous year. The net revenue of TREET witnessed a 2% reduction in 2022. With high costs and lower sales volume, gross profit declined by 11.8% during the year. Moreover, TREET posted a net profit of Rs861.8 million with earnings per share of Rs4.88 in 2022. The year 2023 witnessed an outstanding 37% YoY growth in its top line. The robust sales growth was the result of improved sales volume across segments as well as price optimization strategies. As a result, the gross profit jumped by 45%. However, higher salary expenses, elevated advertisement costs as well as soaring finance costs have resulted in 44% lower net profit compared to the year 2022.

About the Company

Treet Corporation was incorporated in Pakistan on January 22, 1977, as a public limited company under the Companies Act 1913 (now Companies Act, 2017). The principal activity of the company is to manufacture and sell razors and razor blades along with other trading activities. Besides having a major share in the local market, the company sells its products to over 40 countries across the globe.

Credit: INP-WealthPk