INP-WealthPk

Ayesha Mudassar

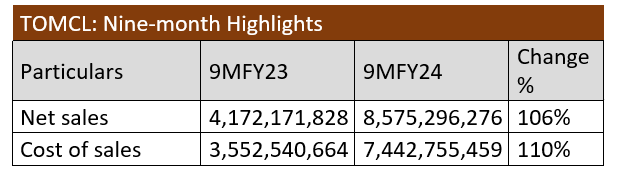

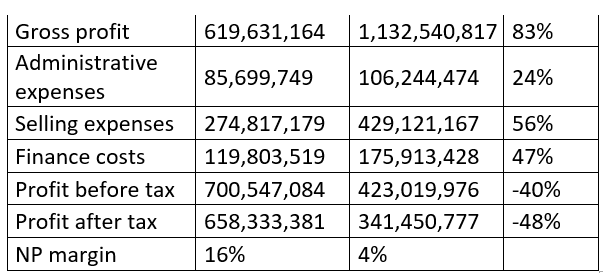

The Organic Meat Company Limited (TOMCL) witnessed a decline of 40% and 48% in before-and-after-tax profits, respectively, during the first nine months of the fiscal year 2023-24 as compared to the corresponding period of the earlier fiscal, reports WealthPK. The company posted a pre-tax profit of Rs423 million and a post-tax profit of Rs341.4 million in 9MFY24. The lower profit was mainly due to challenging economic conditions caused by higher raw material costs, increased depreciation expenses, and a rapid rise in freight rates.

TOMCL posted a 106% year-on-year (YoY) rise in its top line in 9MFY24. This was because of the enormous increase in the volumetric sales of frozen offal and meat during the period.

Pattern of shareholding

As of June 30, 2023, TOMCL had a total of 134.9 million shares outstanding held by diverse categories of shareholders. Directors, the chief executive officer, their spouses, and minor children had the majority stake of 55.4% in the company followed by the general public holding 28.09% of the shares. Modarabas and Mutual Funds accounted for 8.8%, while other local companies held 4.3%. Around 2.3% of TOMCL shares were held by insurance companies, and the remaining 0.8% by banks, DFIs and NBFCs.

Financial performance (2019-23)

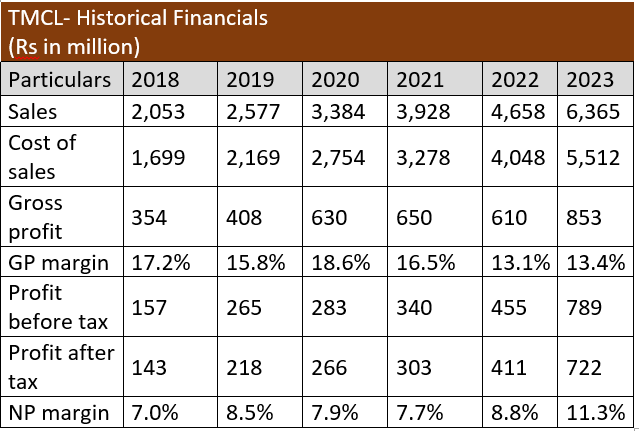

TOMCL’s top and bottom lines have been growing steadily over the years. In 2019, TOMCL’s top line grew by 26% YoY on the back of a considerable improvement in both export and local sales. Cost of sales increased by 28% YoY, which culminated in a gross profit (GP) margin of 15.8% in 2019 versus 17.2% the previous year. Furthermore, the stunning growth in other income resulted in a 52% increase in the net profit, pushing it to Rs218 million.

TOMCL registered a top line growth of 31% YoY in 2020. High sales volume coupled with better pricing and cost management resulted in GP margin rising to 18.6%. In addition, the net profit grew by 22% YoY and stood at Rs266 million in 2020. Due to favourable pricing and currency dynamics as well as impressive offal sales, the company was able to post a 16% YoY top-line growth in 2021. Net profit increased by 14% YoY in 2021 to clock in at Rs303 million with an NP margin of 7.7%. In 2022, the company's sales grew by 19% YoY.

However, the high cost of sales resulted in a shrunken GP margin of 13.1% with gross profit pushing down by 6%. The company's bottom line grew by 36% YoY on the back of tremendous exchange gains as well as gains on biological assets. The year 2023 saw a 37% YoY growth in top-line. The cost of sales climbed to Rs5,512 million due to higher procurement and depreciation charges. The gigantic rise in other incomes gave vigorous impetus to TOMCL's net profit, which posted a stupendous 76% YoY growth to clock in at Rs722 million in 2023 with an NP margin of 11.3%.

About the company

TOMCL was incorporated as a private limited company in 2010. The company is engaged in the processing and sale of halal meat and allied products. It is also one of the leading exporters of red meat and meat by-products. Middle eastern countries are the major export markets of TOMCL.

Future outlook

The company is dedicated to increasing sales and leveraging its expanded capacities. The recent acquisition of a $4 million contract from the UAE will bolster the company’s revenue streams. Moreover, the company is diversifying its product lines to align with market demands and capitalise on emerging opportunities in newly-entered geographical markets.

Credit: INP-WealthPk