INP-WealthPk

Ayesha Mudassar

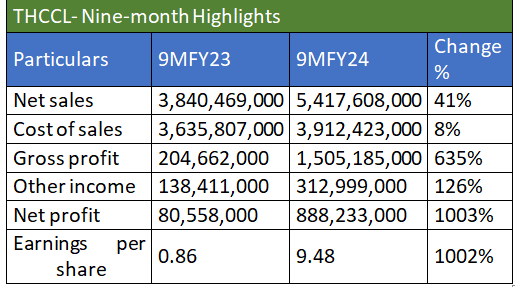

Thatta Cement Company Limited (THCCL) saw its gross and net profits shoot up by 635% and 1003%, respectively, during the nine months (July-March) of the last fiscal year 2023-24 compared to the corresponding period of the earlier fiscal, reports WealthPK. Net sales of the company also grew by a healthy 41% during the period. In 9MFY24, the company made net sales of Rs5.4 billion and gross profit of Rs1.5 billion. The net profit stood at Rs888.2 million compared to just Rs80.5 million over the same period in FY23, resulting in the earnings per share (EPS) of Rs9.48 versus Rs0.86 in 9MFY23. The company's profit was largely boosted by the massive increase in other income, which stood at Rs312.9 million in 9MFY24, compared to Rs138.4 million in 9MFY23.

In comparison to 9MFY23, the company increased net turnover by 41% from R3.8 billion to R5.4 billion in 9MFY24. The improved sales revenue was mainly due to an appreciation in local cement sales along with the substantial rise in the retention price. Furthermore, the cost of sales declined by 8%, mainly attributable to the company's transition towards utilisation of cheaper domestic coal.

Sectoral highlights- 9MFY23 vs 9MFY24

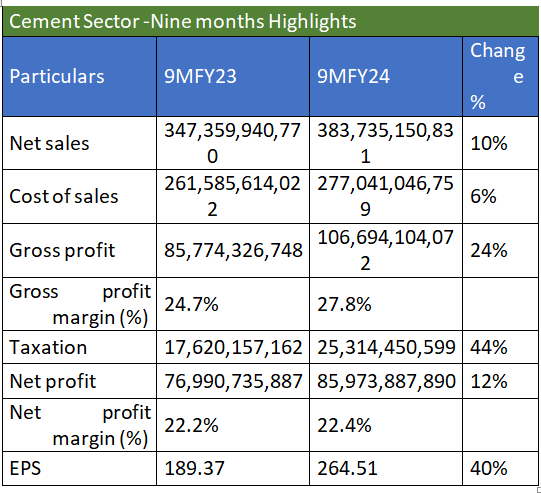

The cement sector recorded a 12% year-on-year (YoY) growth in net profits, which clocked in at Rs85.9 billion against Rs76.9 billion in the same period of the earlier fiscal. Likewise, the sector's gross profit grew by 24% during the nine months of FY24.

As per the results compiled by WealthPK from the income statements of the 11 Pakistan Stock Exchange-listed cement companies, the sector saw an increase of 10% in its net sales, worth Rs383.7 billion compared to Rs347.3 billion in 9MFY23. The cement sector includes Cherat Cement Company Limited (CHCC), DG Khan Cement Company Limited (DGKC), Dewan Cement Limited (DCL), Fauji Cement Company Limited (FCCL), Flying Cement Company Limited (FLYING), Kohat Cement Company Limited (KOHC), Lucky Cement Limited (LUCK), Maple Leaf Cement Factory Limited (MLCF), Pioneer Cement Limited (PIOC), Power Cement Limited (POWER), and Thatta Cement Company Limited (THCCL).

According to the monthly economic update and outlook for April 2024, the total cement dispatches (domestic and exports) stood at 34.5 million tonnes (MT), which is 2.6% higher than the 33.6MT dispatched during the corresponding period of last year. The improved dispatches were mainly due to the enhanced exports during the period under review. On the cost front, the cost of sales rose by 6% YoY, which stood at Rs277 billion in 9MFY24 compared to Rs261.5 billion in 9MFY23. Moreover, the sector paid a higher tax worth Rs25.3 billion against Rs17.6 billion in the corresponding period of FY23, depicting a rise of 44% YoY.

Challenges facing the cement sector

The cement industry faces two simultaneous but divergent challenges: Pakistan's per capita cement consumption stands at 182 kilogrammes, which is lower than its regional counterparts, indicating untapped market potential. Besides, the cement industry's heavy reliance on coal, which accounts for 66% of its energy consumption, exposes it to the fluctuations of global coal prices, and diverges from the global trend towards sustainable energy sources.

Company profile

Thatta Cement Company was incorporated in Pakistan as a public limited company in 1980. It is engaged in the manufacturing and marketing of cement, besides holding the ownership of Thatta Power (Private) Limited.

Credit: INP-WealthPk