INP-WealthPk

Ayesha Mudassar

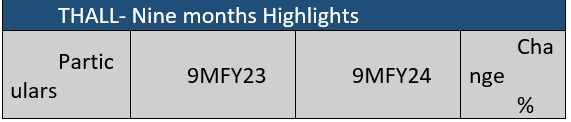

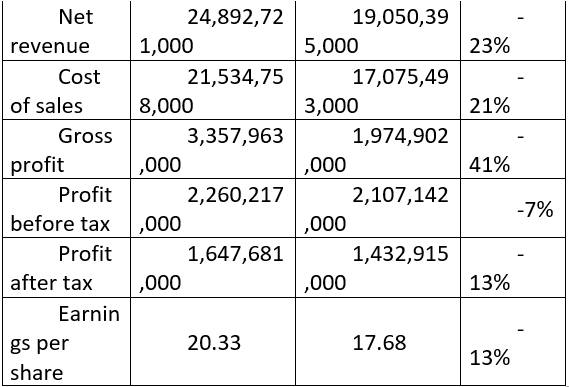

The net revenue of Thal Limited (THALL), the auto parts maker, declined by 23%, the gross profit by 41%, and the net profit by 13% during the first nine months of the fiscal year 2023-24 (9MFY24) compared to the corresponding period of FY23, reports WealthPK. According to the unconsolidated interim statement, the company posted a net revenue of Rs19.05 billion and a gross profit of Rs1.9 billion in 9MFY24. The net profit stood at Rs1.4 billion compared to Rs1.6 billion in the same period of FY23, resulting in an earnings per share (EPS) of Rs17.68 versus Rs20.33 in the earlier fiscal.

The sharp decline in sales was largely driven by a substantial rise in input costs and tightened auto financing conditions owing to the high-interest rate environment. In addition, the reduction in profits was primarily attributed to a 23% decline in net revenue during the period under review.

Pattern of shareholding

As of June 30, 2023, THALL had 81.02 million outstanding shares held by 4,403 shareholders. Foreign investors held the largest share, with 40% of the company’s stock, followed by local individuals with a 29.6% stake. Banks, DFIs, NBFIs, insurance companies, pension funds, and other financial institutions collectively owned 11.2% of THALL’s shares, while directors, the CEO, their spouses, and minor children accounted for 5.3% of the company’s shares. Public sector companies and mutual funds each held 4.2% of the shares, while joint-stock companies owned approximately 3.1% stock. The remaining shares were distributed among other categories of shareholders.

Six years at a glance (2018-23)

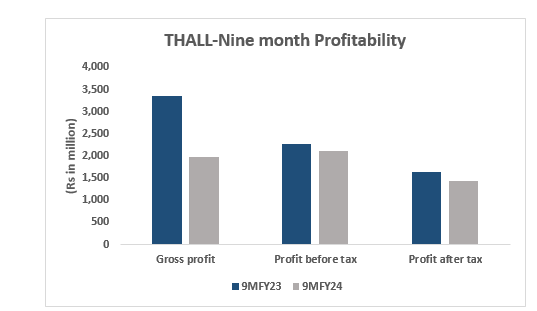

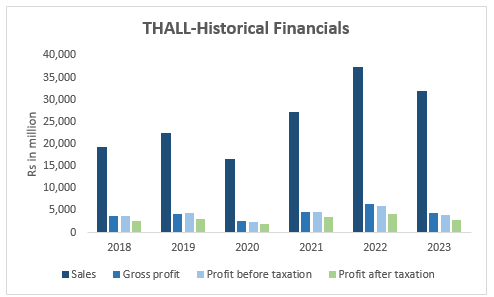

During the period under review, THALL's top and bottom lines plunged twice, in 2020 and 2023. These downturns were mainly due to the rupee depreciation and the imposition of additional duties and taxes, which led to inflated auto prices. The historical analysis of THALL’s sales reveals that the company earned the highest revenues in FY22 on account of a 42% increase in revenue from the engineering segment due to higher automobile sales. Additionally, the company’s other segment saw a 29% rise in revenue on the back of increased demand for Pakistani grain sacks in the export market.

![]()

The company's historical gross profit performance showed considerable fluctuations over the years. The company posted a gross profit of Rs3.7 billion in 2018, Rs4.2 billion in 2019, Rs2.5 billion in 2020, Rs4.6 billion in 2021, Rs6.5 billion in 2022, and Rs4.4 billion in 2023. The increase in gross profit during FY22 was primarily attributed to a significant rise in net sales. In the span of the last six years, the auto parts maker achieved its highest net profit of Rs4.2 billion in FY22. However, in 2023, the net profit experienced a significant decline of 35%, falling to Rs2.7 billion.

Company profile

THALL was incorporated in Pakistan as a public limited company in 1966. The principal activity of the company is the manufacturing of jute goods, engineering goods, laminate sheets and paper sacks.

Future outlook

The upcoming quarters are expected to remain challenging due to political uncertainty, exchange rate volatility and projected increases in energy costs. However, the management remains committed to implementing cost-effective initiatives and refining product mix strategies to boost profitability and expand market share.

Credit: INP-WealthPk