INP-WealthPk

Ayesha Mudassar

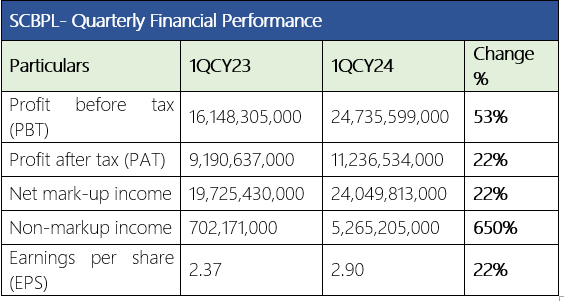

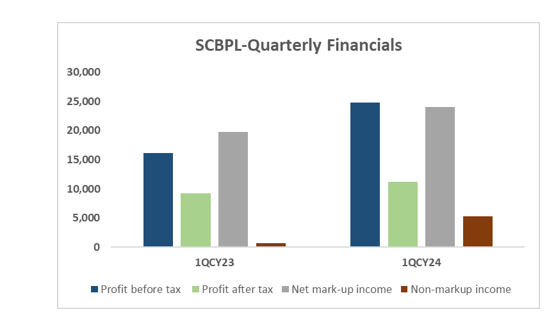

Standard Chartered Bank (Pak) Limited posted a profit after tax (PAT) of Rs11.2 billion for the quarter ending March 31, 2023, with a growth of 22% over the same period of last calendar year, reports WealthPK. As per its quarterly report, the bank registered a profit before tax (PBT) of Rs24.7 billion for 1QCY24 against Rs16.1 billion in 1QCY23. The primary driver of improved profitability was the extraordinary spike in the bank’s non-markup income. To reward the shareholders for this remarkable performance, the Board of Directors recommended an interim cash dividend of Rs1.5 per share i.e. 15%.

Going by the income statement, the bank’s net markup income increased by 22% to Rs24.04 billion, reflecting proactive balance sheet management, higher interest rates, and pricing discipline. In addition, the non-markup income for the 1QCY24 reached Rs5.2 billion, representing a 650% year-on-year increase. This is primarily due to a massive increase in foreign exchange income and a greater gain in securities during the quarter. The profit and loss statement further shows that the total non-markup interest expense stood at Rs5.05 billion, up by 24% YoY.

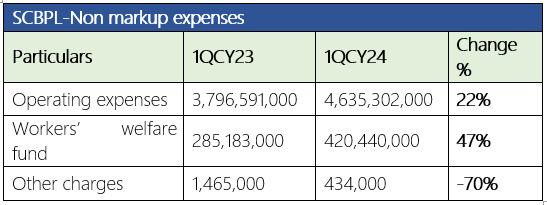

Under the non-markup expenses, worker's welfare fund and operating expenses ticked up while other charges declined during the period under review. The bank is continuously investing in its digital capabilities and infrastructure to enhance the clients' banking experience through the introduction of innovative solutions. The management is also fully committed to achieving sustained growth through bringing the best services to the customers.

Balance Sheet Analysis

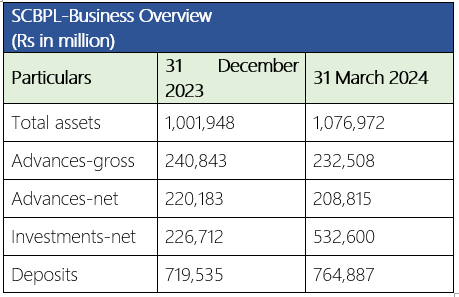

The bank's total asset base reached Rs1.076 trillion and deposits crossed Rs764 billion as of March 31, 2023.

The analysis of the asset mix highlights that net investment increased massively by 135% during the quarter. In addition, the net advances declined 5% to Rs208 billion as of March 31st, 2023.

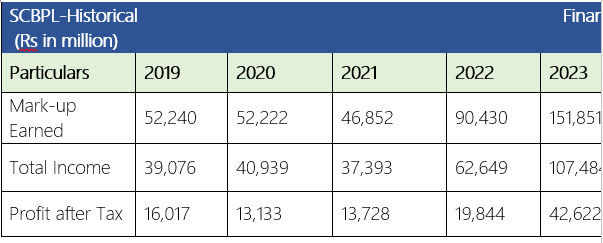

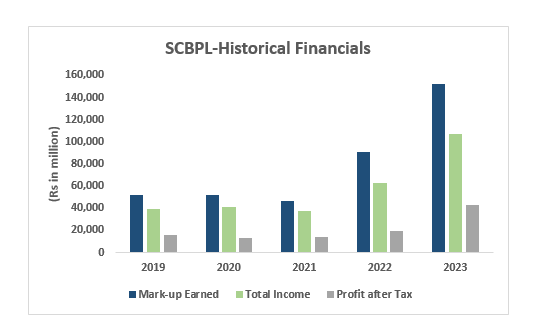

Performance over the last five years (2019-2023)

Historical analysis shows that the SCBPL's performance witnessed fluctuations in the early years, followed by substantial growth in markup earned, total income, profit after tax, and EPS in the latter years. This improvement could be attributed to various factors, including effective management strategies, changes in market conditions, and shifts in the banking industry landscape. In the years under consideration, the bank earned the highest mark-up in 2023. This indicates that the bank had a strong performance in terms of interest income, which was a significant revenue source.

However, the bank witnessed two dips regarding earned markup in 2020 and 2021. Concerning total income, the bank earned a total income of Rs39.1 billion in 2019, Rs40.9 billion in 2020, Rs37.3 billion in 2021, Rs62.6 billion in 2022, and Rs107.4 billion in 2023. In terms of PAT, the bank hit the highest four-year PAT of Rs42.6 billion in 2023. The bank earned a net profit of Rs16.1 billion in 2019, Rs13.1 billion in 2020, Rs13.7 billion in 2021, and Rs19.8 billion in 2022.

![]()

The bank posted the highest five-year EPS of Rs11.01 in CY23. However, a decline in EPS was experienced in 2020.

Future Outlook

Despite a challenging domestic and external environment, the bank is committed to playing its vital role in creating sustainable value for stakeholders and supporting a robust economic momentum in the country.

Credit: INP-WealthPk