INP-WealthPk

Ahmed Khan Malik

The Sindh government has started implementing the Revenue Mobiliation Plan (RMP) to generate enough money for meeting the increasing expenditures and to undertake the much-needed development initiatives.

Sindh receives a major chunk for its budget from the federal government through National Finance Commission, which is not sufficient to meet its growing expenditures. “The provincial government is mindful of its revenue needs, and has thus devised a plan for the purpose,” Saghir Chandio, Additional Director Revenue Department, Sindh, said.

In an interview with WealthPK, he said that the objective is to enhance provincial revenues through resource mobilisation by way of introducing few minimal taxes, rationalising the existing ones, and equalising the tax rates with other provinces and the Federal authorities. He noted that the Sindh government endeavours to implement the proposed administrative reforms envisaged in the plan for attaining financial self-reliance. “The government has also launched ‘E-Pay-Sindh’ facility that will ultimately digitise 34 of Sindh’s levies on a single aggregator platform,” he said, adding that the application of Alternate Delivery Channel (ADC) mechanism for collection of Sindh Sales Tax on Services (SST) and introduction of e-stamps are expected to yield encouraging results. Razzaq Sheikh, Director of the Revenue Wing in the Finance Department, said that the main objective of the plan was to improve revenue mobilisation and to enhance expenditure management.

“The twin objectives are aligned with the priorities of the provincial government with an emphasis on boosting the collection of sales tax and ensuring better financial management. This is to be achieved by improving budgetary processes, building robust systems such as e-procurement, a financial management information system, and a tax management information system,” he said. Sindh is the most industrialied province, but despite its apparent wealth, it faces challenges as the revenue growth is not up to the mark, which should have been on the higher side due to enormous potential. However, its recent growth and social development trends indicate that Sindh is not realising its full potential. A key constraint is the low levels of resource mobilisation. The province’s own revenue collection remains relatively static vis-a-vis provincial GDP, despite some success after it started collecting GST on services post-devolution.

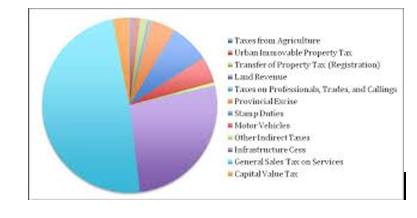

However, the formation of Sindh Revenue Board (SRB) to collect GST on services after devolution, and the recent wave of IT-based automation of tax related processes in other tax departments offer optimism. The provincial government has 15 taxes and other minor levies within its mandate, which are collected by three agencies: SRB, which is responsible for GST on services; Board of Revenue, which is responsible for collection of registration fee, stamp duty, capital value tax, agricultural income tax, and land revenue; and Excise, Taxation and Narcotics Department, which is responsible for property tax, professional tax, infrastructure development cess, motor vehicle tax, excise duty, cotton fee, and entertainment duty.

Credit: INP-WealthPk