INP-WealthPk

Hifsa Raja

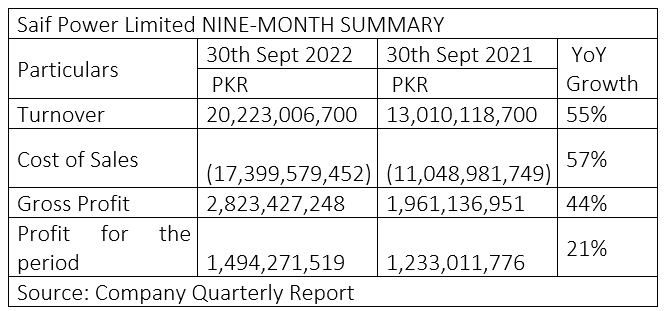

Total turnover of Saif Power Limited, an independent power producer, increased by 55% to Rs20 billion in the first nine months of the calendar year 2022 from Rs13 billion over the corresponding period of 2021. The company’s cost of sales also increased 57% to Rs17 billion in 9MCY22 from Rs11 billion over the same period of CY21. The gross profit in 9MCY22 increased to Rs2.8 billion from Rs1.9 billion during the same period of CY21, showing a growth of 44%. The net profit increased 21% to Rs1.4 billion in 9MCY22 from Rs1.2 billion in 9MCY21, reports WealthPK.

The company’s board of directors approved on October 27, 2022, a second interim cash dividend of Rs1.5 per share to its shareholders. The company has obtained short-term Islamic finance facilities from Islamic banks subject to a maximum limit of Rs5.3 billion. The facilities are secured on fuel stock and energy purchase price receivables of up to Rs7.03 billion. These facilities are secured against the ranking charge over all present and future fixed assets amounting to Rs6.18 billion.

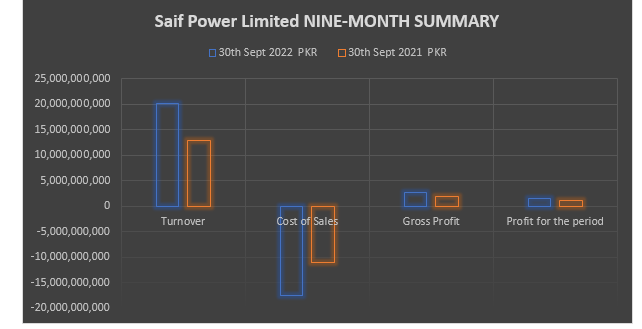

Earnings Growth Analysis

Earnings per share of the company have shown a mixed trend from 2018 to 2021. The EPS stood at Rs7.85 in 2018, Rs9.44 in 2019, Rs6.14 in 2020 and Rs4.52 in 2021. The earnings per share growth stood at 16.99% in 2018 and 20.25% in 2019, but it plunged to minus 34.96% in 2020, before slightly improving to minus 26.38% in 2021.

An extraordinary general meeting of shareholders in June 2021 approved the sale of Saif Cement Limited's (SCL) assets in order to invest in Saif Power Limited keeping in view the latter’s dwindling profits. Revenues from the sale of SCL assets will also be used to pay dividends to investors of Saif Power Limited.

Industry Comparison

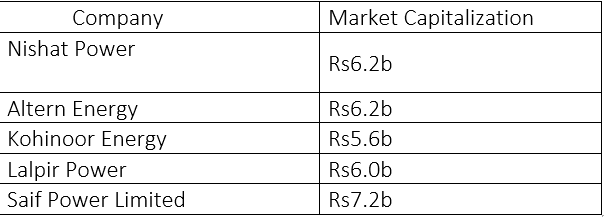

Nishat Power, Altern Energy, Kohinoor Energy, and Lalpir Power are considered rivals of Saif Power Limited, which has the highest market capitalisation of Rs7.2 billion among its competitors.

Profitability

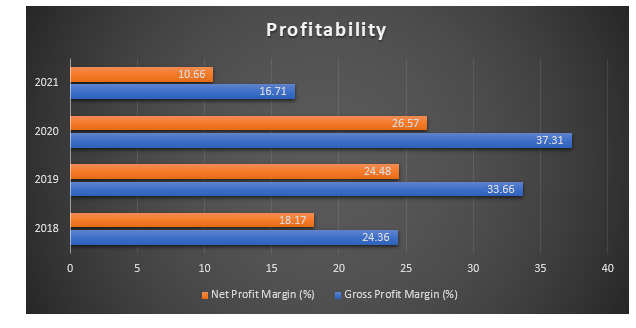

The net profit and gross profit margins of the company remained healthy in 2019 and 2020, but dipped in 2021 as is shown in the graph below. The profitability score is a useful metric for determining how desirable a stock is. Saif Power Ltd displays a profitability score of 8, which is much greater than that of its peer group.

Company Profile

Saif Power Limited was incorporated in Pakistan on November 11, 2004, as a public limited company under the now repealed Companies Ordinance, 1984. It commenced operations on April 30, 2010. The principal activities of the company are to own, operate and maintain a combined cycle power plant having a nameplate capacity of 225MW in Sahiwal district of Punjab, and sell the electricity to Central Power Purchasing Agency.

Credit: Independent News Pakistan-WealthPk