INP-WealthPk

Shams ul Nisa

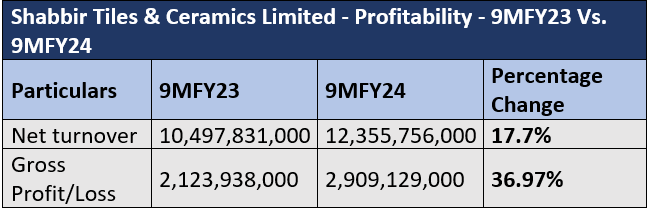

Shabbir Tiles & Ceramics Limited saw its net turnover rise by 17.7% to Rs12.36 billion in the first nine months (July-March) of the fiscal year 2023-24 (9MFY24) from Rs10.50 billion over the corresponding period of the earlier fiscal, reports WealthPK.

Despite the increasing energy costs, the gross profit of the company increased to Rs2.91 billion, up 36.97% from 9MFY23. Thus, the gross profit margin rose from 20.23% in 9MFY23 to 23.54% in 9MFY24. The company's efficient cost control and operations scaling resulted in a stunning 135.72% growth in operating profit during the period under review. The exceptional operational performance and strategic management were evident in the gigantic 717.42% increase in profit-before-taxation in 9MFY24.

The company posted a net profit of Rs316 million in 9MFY24, recovering from a net loss of Rs153.25 million in 9MFY23, yielding a net profit margin of 2.56% in 9MFY24 compared to a net loss margin of 1.46%. Strong financial results during the period resulted in earnings per share of Rs1.32 compared to loss per share of Rs0.22 in 9MFY23.

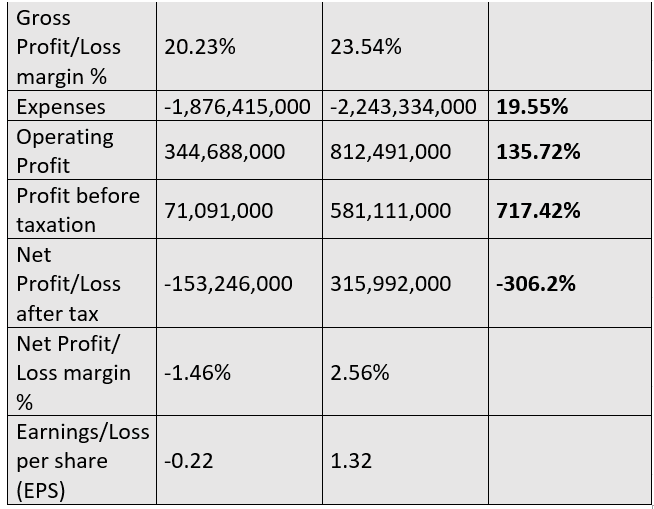

Historical trend

From Rs5.77 billion in 2018 to Rs14.18 billion in 2023, the company's turnover rose steadily over this period, demonstrating its successful expansion efforts and growing market demand. The gross profit exhibited some volatility, peaking at Rs3.06 billion in 2021 and then marginally declining to Rs2.99 billion in 2023, suggesting that expenses increased in tandem with sales.

Administrative costs increased from Rs157.76 million in 2018 to Rs386.69 million in 2023, indicating the company's investment in infrastructure and operations. The profit-after-tax was erratic, starting from Rs194.4 million in 2018 with the company suffering a loss of Rs325.7 million in 2020, and then rebounding and posting a formidable profit of Rs924.89 million in 2021. However, the strong recovery in 2021 was followed by a steep decline in 2023, suggesting the company's vulnerability to market conditions and operational difficulties. The current ratio has been stable over the years, indicating a sound liquidity position of the company to cover short-term obligations. The highest current ratio of 1.20 was recorded in 2021.

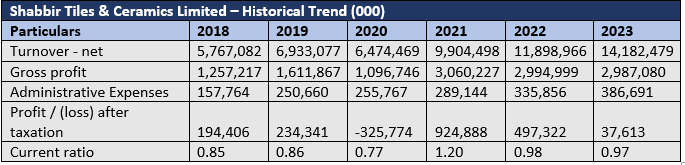

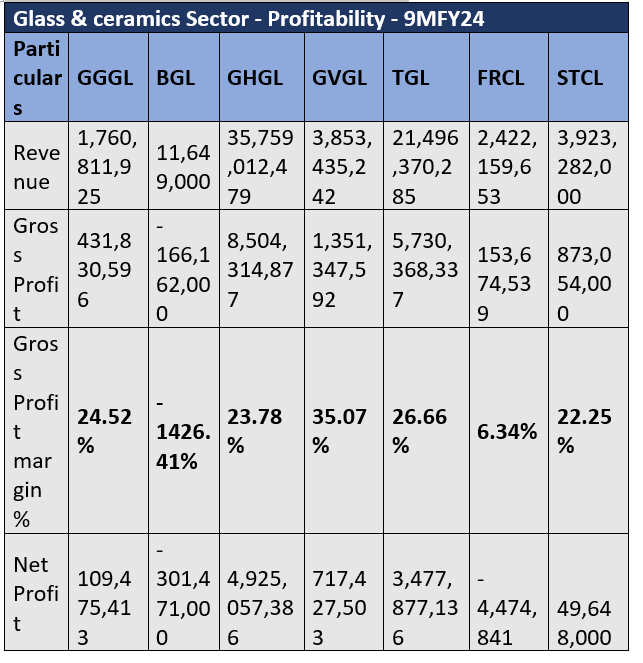

Glass and ceramics sector

Profitability in the glass and ceramics sector for 9MFY24 shows considerable differences across companies. Major players in the sector are Ghani Global Glass Limited (GGGL), Balochistan Glass Limited (BGL), Ghani Glass Limited (GHGL), Ghani Value Glass Limited (GVGL), Tariq Glass Industries Limited (TGL), Frontier Ceramics Limited (FRCL) and Shabbir Tiles & Ceramics Limited (STCL).

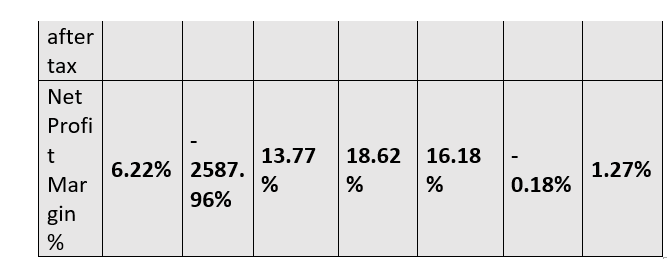

GHGL and TGL stood out with significant revenues of Rs35.7 billion and Rs21.49 billion, respectively, while BGL reported minimal revenue of Rs11.6 million. GVGL had the highest gross profit margin at 35.07%, reflecting strong cost management and operational efficiency. In contrast, BGL reported a massive gross loss of -1426.41%, indicating major operational challenges. GHGL achieved a net profit margin of 13.77%, whereas BGL and FRCL suffered net losses of Rs301.47 million and Rs4.47 million, respectively. STCL recorded a modest net profit margin of 1.27%. The varying net profit margins underscore the sector's disparities, with GHGL's strong results sharply contrasting BGL's negative margin of -2587.96%. Meanwhile, TGL and GVGL maintained solid net profit margins of 16.18% and 18.62%, respectively.

Future outlook

The company is optimistic that a relatively better economic outlook will positively impact the real estate and the construction sector and infuse investor confidence. Industry experts highlight numerous strategic investment opportunities in Pakistan's real estate sector as the government recognises the crucial role of the construction sector in the overall economy.

Company profile

Shabbir Tiles and Ceramics Limited was established in Pakistan in 1978. The company is primarily engaged in the manufacture and sale of tiles and trading of allied building products

Credit: INP-WealthPk