INP-WealthPk

Ayesha Mudassar

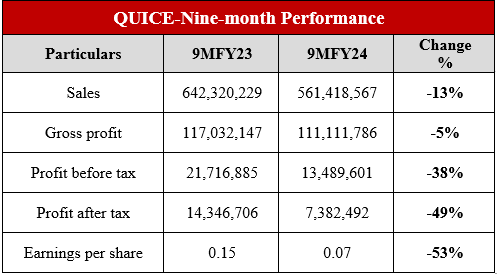

Quice Food Industries Limited (QUICE) witnessed a decline of 38% and 49% in before and after-tax profits, respectively, during the nine months of the fiscal year 2024, as compared to the corresponding period of the last fiscal, reports WealthPk. The company posted a pre-tax profit of Rs13.4 million and a post-tax profit of Rs7.3 million in 9MFY24. The decline in profitability was primarily attributed to challenging economic conditions, including higher raw material costs, increased depreciation expenses, and a rapid rise in interest rates.

In addition, the company’s topline declined by 13% YoY to Rs561.4 million compared to Rs642.3 million in 9MFY23. Driven by this sales reduction, the gross profit decreased by 5% YoY to Rs111.1 million in 9MFY24.

Pattern of Shareholding

As of June 30, 2023, QUICE has 98.4 million shares outstanding which were held by 4,550 shareholders. The general public, owing 66.2% of the shares, constitutes the largest shareholder category. Sponsors and their family members hold 31.8% of the shares, while Modaraba and mutual funds account for 1.3%. The remaining shares are distributed among other categories of shareholders, each holding less than 1% of the total shares.

Financial Performance (2018-23)

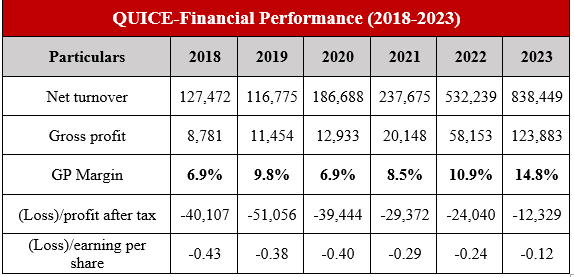

Except for a dip in 2019, the topline of QUICE has demonstrated remarkable growth over the years. However, its bottom line has failed to post a net profit in a single year since 2017. In 2019, the company’s topline registered an 8% reduction to an overall economic slowdown. Furthermore, the bottom line posted a net loss of Rs51.05 million, signifying a 23% decline. The loss per share for the year clocked in at Rs0.38 versus Rs0.43 in 2018. In 2020, the topline grew by 60% YoY, mainly driven by the company’s increased focus on export sales. However, a staggering rise in commodity prices and substantial rupee depreciation resulted in a drop in GP margin to 6.9%. Consequently, the bottom line posted a net loss of Rs39.4 million, with a loss per share of Rs0.40.

All numbers in thousands (000’s) except EPS

In 2021, QUICE’s topline grew by 27% YoY owing to historic growth in the syrup segment. The net loss stood at Rs29.3 million, reflecting a 26% YoY decrease. The loss per share was Rs0.29. The year 2022 witnessed a stunning 124% YoY growth in QUICE's topline. The net loss stood at Rs24.04 million, down 18% YoY, with a loss per share of Rs0.24. In 2023, the company’s topline witnessed a 58% YoY enhancement, reaching Rs838.4 million. The topline growth was mainly driven by export and local sales. Gross profit exhibited a tremendous YoY growth of 113% in 2023. Consequently, QUICE was able to trim its net loss by 49% to Rs12.3 million, with a loss per share of Rs0.12.

About the company

Quice Food Industries Limited was incorporated in Pakistan on March 12, 1990 as a Private Limited Company and was converted into a Public Limited Company on December 13, 1993. The company is principally engaged in the manufacturing and selling of jam, jelly, syrups, pickles, essences, custard powder, juices, and aerated drinks as well as other related products. Besides catering to the local market, the company has its export business in the USA, Canada, UAE, South Africa, East Africa, the UK, and Australia.

Credit: INP-WealthPk