INP-WealthPk

Shams ul Nisa

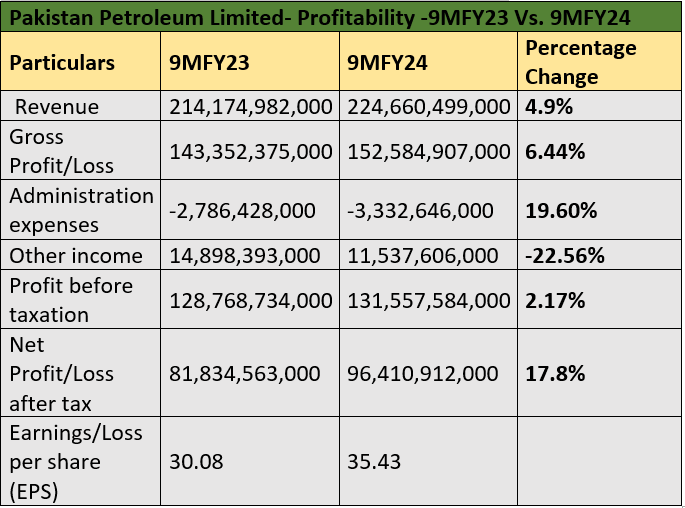

The profitability of Pakistan Petroleum Limited (PPL) witnessed a significant increase of 17.8% during the first nine months of the fiscal year 2023-24 compared to the corresponding period of FY23, reports WealthPK.

The key drivers were higher sales revenue and a much lower tax burden, which were somewhat offset by higher operating costs due to inflation and a small amount of associate losses. The company earned revenue of Rs224.66 billion in 9MFY24, up 4.9% from 9MFY23. This increase was due to positive price variance caused by significant devaluation and decline in average international crude oil prices. Furthermore, the company realised take-or-pay revenue totalled Rs3.183 billion. The gross profit grew by 6.44% to Rs152.58 billion in 9MFY24 from Rs143.3 billion in the same period of FY23. The higher administrative costs, inflationary pressures, and strategic investments in operations and management resulted in a 19.60% expansion in administrative expenses.

The other income contracted by 22.56% to Rs11.5 billion in 9MFY24, suggesting a decrease in non-operational revenue. However, the profit-before-tax inched up 2.17% to Rs131.55 billion from Rs128.7 billion in the same period of the earlier fiscal. Thus, the shareholders' earnings improved to Rs35.43 from Rs30.08 in 9MFY23.

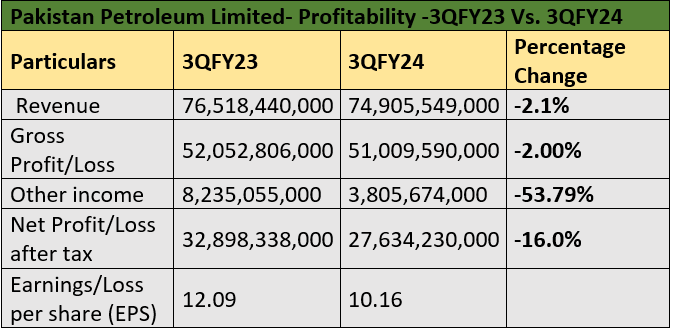

Quarterly analysis

The quarterly analysis of Pakistan Petroleum Limited shows a decrease in profitability. The company's revenue dipped by 2.1%, gross profit by 2.00%, other income by a significant 53.79%, and net profit by 16.0% during 3QFY24 compared to the corresponding period of FY23. The company reported a revenue of Rs74.9 billion, a gross profit of Rs51.0 billion, other income of Rs3.8 billion, and a net profit of Rs27.6 billion this quarter.

The earnings per share slipped to Rs10.16 in 3QFY24 from Rs12.09 in 3QFY23.

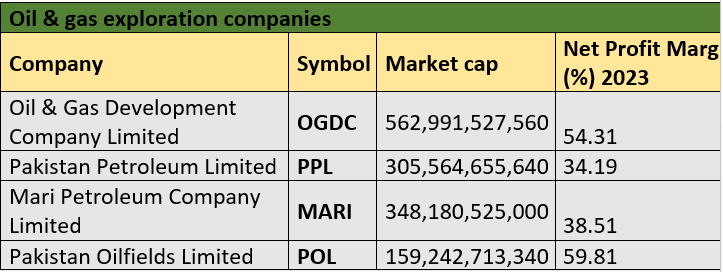

Market capitalisation, profit margins

Market capitalisation and net profit margins of Pakistan's leading oil and gas exploration companies varied significantly in 2023. Oil and Gas Development Company had the largest market capitalisation of Rs562.99 billion, with a strong net profit margin of 54.31%. The company had a significant presence in the market and effective cost control, enabling it to secure higher earnings. Mari Petroleum Company Limited was the second largest company, with a market capitalisation of Rs348.18 billion. However, it posted a relatively lower net margin of 38.51% in 2023 than its peers.

Though Pakistan Petroleum Limited came third with a market capitalisation of Rs305.5 billion, it registered the lowest net profit margin of 34.19% in 2023. Pakistan Oilfields Limited had the lowest market capitalisation, but the highest net profit margin of 59.81%.

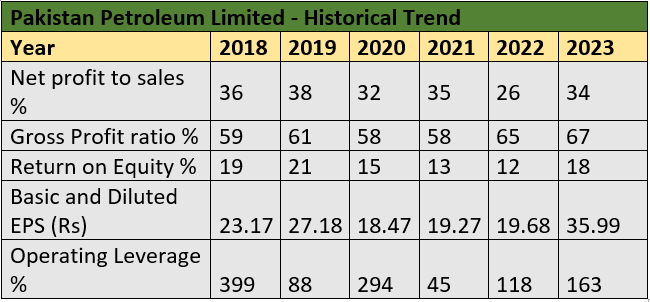

PPL's historical ratios

From 2018 to 2023, PPL's net profit-to-sales ratio fluctuated, with the highest of 38% in 2019 and the lowest of 26% in 2022. In 2023, the oil and gas exploration company had a net profit-to-sales ratio of 34%. Over the period under review, the company generated profits consistently, as evidenced by the gross profit ratio, which remained above 50%. The gross profit ratio grew from 59% in 2018 to 67% in 2023, with variations in between. The return on equity measures how well a company uses shareholder equity to generate profit. The company's return on equity decreased from 19% in 2018 to 18% in 2023.

Earnings per share decreased from Rs23.17 in 2018 to Rs18.47 in 2020. But in the following years, it increased, reaching a peak of Rs35.99 in 2023. Operating leverage measures how much a company generates operational income and increases sales. The company's operating leverage fell from 399% in 2018 to 163% in 2023.

Company profile

Pakistan Petroleum Limited was established in 1950 with the main objective of conducting exploration, prospecting, development and production of oil and natural gas resources in the country.

Credit: INP-WealthPk