INP-WealthPk

Shams ul Nisa

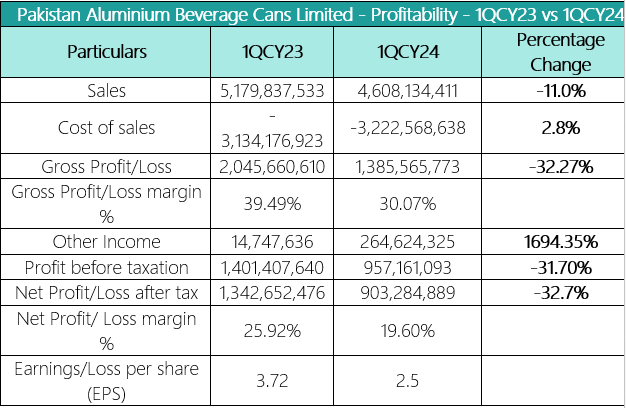

Pakistan Aluminum Beverage Cans Limited (PABC) registered an 11.0% drop in sales in the first quarter of 2024 to stand at Rs4.6 billion, primarily due to the domestic, regional, and international factors. Inflationary pressures, especially concerning fuel and energy prices, added to the decline in volumes, especially in local can sales.

During the review period, the company faced challenges in sustaining sales volume and containing production costs. Thus, the cost of sales increased by 2.8% to Rs3.22 billion in 1QCY24 from Rs3.13 billion in the same period last year. The gross profit dropped sharply from Rs2.04 billion in 1QCY23 to Rs1.38 billion in 1QCY24, a 32.27% decline. Thus, due to the ramp-up expenses, inflation, and the larger percentage of export sales, the gross profit margin slid to 30.07% in 1QFY24 from 39.49% in 1QFY23.

The company's other income jumped exponentially by 1694.35% in 1QCY24 – a noteworthy improvement to Rs264.6 million. However, the profit before tax collapsed to Rs957.16 million in 1QFY24, 31.70% lower than last year. From Rs1.34 billion in 1QCY23 to Rs903.28 million in 1QCY24, the net profit crashed by 32.7%. Moreover, the net profit margin dropped from 25.92% to 19.60%, indicating a decline in profitability. The earnings per share slipped to Rs2.5 in 1QCY24 from Rs3.72 in 1QCY23.

Assets, Equity, and Liabilities Analysis

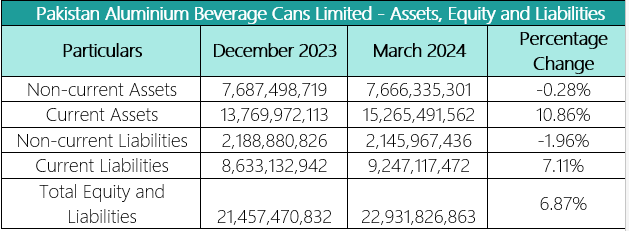

The financial position underwent notable shifts from December 2023 to March 2024. The non-current assets tumbled by 0.28% to Rs7.66 billion in March 2024, mainly due to the contraction in property, plant, and equipment. Whereas, the current assets increased by 10.86% to Rs15.26 billion in March 2024 from Rs13.76 billion in December 2023. This implies the company's better liquidity position because of increased cash and bank balances, accrued income, advances, deposits, prepayments, and other receivables.

During the period under review, the company paid off its long-term loans, leading to a contraction in non-current liabilities by 1.96% to Rs2.14 billion. However, short-term borrowings and accrued finance costs expanded, pushing the current liabilities to increase from Rs8.63 billion in December 2023 to Rs9.24 billion in March 2024, indicating an expansion of 7.11%. From Rs21.46 billion in December 2023 to Rs22.93 billion in March 2024, there was a 6.87% growth in the total equity and liabilities of the company.

Historical Trend

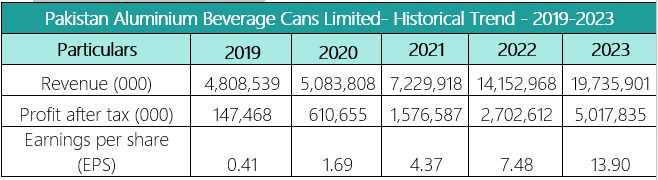

The revenue of Pakistan Aluminum Beverage Cans Limited consistently grew from Rs4.8 billion in 2019 to Rs19.7 billion in 2023. This implies that over the years, the company's manufacturing capacity has increased, resulting in higher demand for aluminum beverage cans and, thus, market expansion.

Similarly, the net profit steadily grew to the highest of Rs5.01 billion in 2023 from Rs147.4 million in 2019, showing boosted sales and successfully managing expenses, improved pricing, and operating efficiency to enhance profitability. The profitability per share has improved dramatically over the years due to increased revenue and net profit. The company noted a massive spike to an ESP of Rs13.90 in 2023 from an ESP of Rs0.41 in 2019. Overall, the historical trend indicates an increase in the company's growing product demand causing healthy financial results over the years.

Future Outlook

Pakistan's unstable economy is impacted by high inflation and erratic government policies, which affect the company's future, and domestic demand is decreasing due to instability in the Middle East. Despite this, the firm is concentrating on growing exports to fill gaps in the local demand. The company is dealing with higher worldwide commodity prices, local and regional political unrest, and growing fuel expenses. To overcome these obstacles, the company takes a proactive approach, adjusting to new situations and implementing policies to lessen problems at home and increase export markets.

Company profile

Pakistan Aluminum Beverage Cans Limited was established on December 4, 2014, and listed on the Pakistan Stock Exchange on July 16, 2021. The principal activity is the manufacturing and sale of aluminum cans.

Credit: INP-WealthPk