INP-WealthPk

Ayesha Mudassar

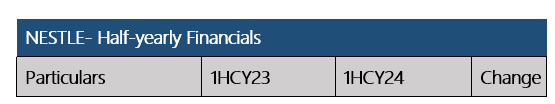

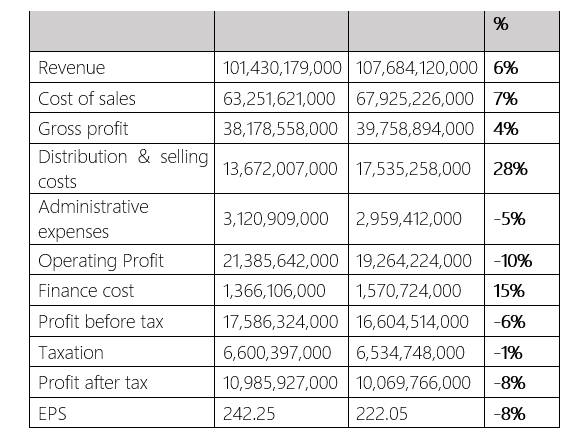

Nestle Pakistan Limited (NESTLE) experienced a 6% increase in sales

during the first half of the calendar year 2024, which reached Rs107.6 billion compared to Rs101.4 billion in the same period last year, reports WealthPK. The rise in revenue was driven by broad-based growth across segments and further complemented by demand-generating activities and a favourable portfolio mix. Additionally, sustained emphasis on product availability and renovation efforts played a significant role in driving higher revenue.

In the first half of the calendar year 2024, the net profit for Nestle Pakistan Limited was reported at Rs10.06 billion, a decline from Rs10.9 billion in the same period last year. This resulted in an earnings per share (EPS) of Rs222.05 compared to Rs242.25 in 1HCY23. The reduction in profit can be attributed to exchange losses and increased working capital requirements. Going by the income statement, the finance cost rose by 15% on account of new borrowings at normal rates and repayment of subsidized loans. On the taxation front, the company incurred a lower tax liability of Rs6.5 billion against Rs6.6 billion in 1HCY23, reflecting a year-on-year decline of 1%.

Pattern of Shareholding

As of December 31, 2023, NESTLE had a total of 45.3 million outstanding shares held by 1,097 shareholders. The largest shareholding category comprises associated companies, undertakings, and related parties, with 81.5% of the shares. This is followed by the local public, which accounts for 13.5% of the company's shares. Directors, CEO, their spouses, and minor children hold 3.2% of the shares, while institutions and public sector companies possess 1.14%. The insurance companies represent a minimal 0.01% of the outstanding shares. The remaining shares are distributed among various other shareholder categories including insurance and foreign companies, each holding less than 1% stake in the company.

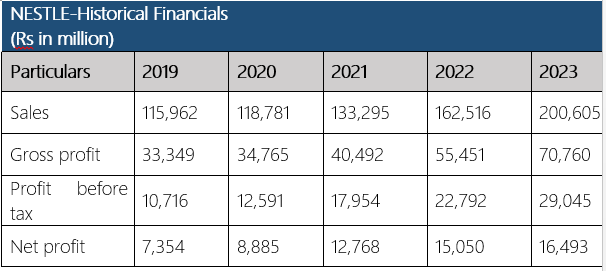

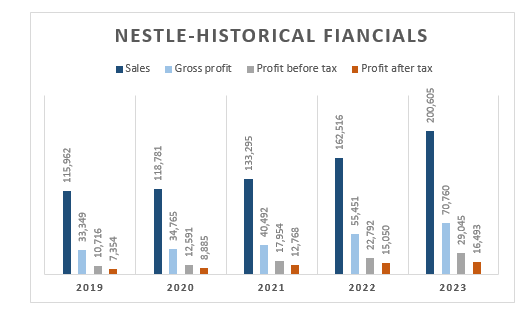

Historical Operational Performance (2019-2023)

Nestle Pakistan has demonstrated a consistent growth in both sales and net profit since 2019. Over the past six years, the company has observed a steady increase in gross and net profit. In 2020, the company’s sales achieved a moderate YoY growth of 2.4%, reaching Rs118.7 billion. This growth was driven by uninterrupted product supply and availability, innovation and renovation initiatives, and expansion of distribution networks. The improvement in gross and net profit resulted from various cost-saving initiatives, optimization projects, and prudent pricing management.

In the following years- 2021, 2022 and 2023-the company continued on its growth trajectory, registering increases in both revenue and profitability. This improvement was largely attributed to the localization of raw and packaging materials, a favourable product mix, stringent control on fixed costs, and increased exports.

Historical Ratios (2019-2023)

The ratio analysis offers valuable insights into the company’s financial performance over the years, highlighting key indicators such as gross profit margin, net profit margin, and earnings per share (EPS) growth ratio.

The gross profit margin, a crucial measure of a company’s efficiency in managing production costs, has demonstrated a consistent upward trend. In calendar year 2023, the gross profit margin reached 35.3%, a slight increase from 34.1% in 2022, 30.4% in 2021, 29.3% in 2020, and 28.8% in 2019. In contrast, the net profit margin has exhibited slight fluctuations during the period under review. For 2023, the net profit margin was recorded at 8.2%, a decrease from 9.3% in 2022 and 9.6% in 2021, although it remained higher than the 7.5% observed in 2020.

About the company

Nestle Pakistan Limited is a public limited company incorporated in Pakistan under the repealed Companies Ordinance 1984 (now Companies Act 2017). The company is a subsidiary of Nestle S.A – a Swiss-based public limited company. The firm is principally engaged in manufacturing, processing, and selling dairy, nutrition, beverages, and food products.

Credit: INP-WealthPk