INP-WealthPk

Ayesha Mudassar

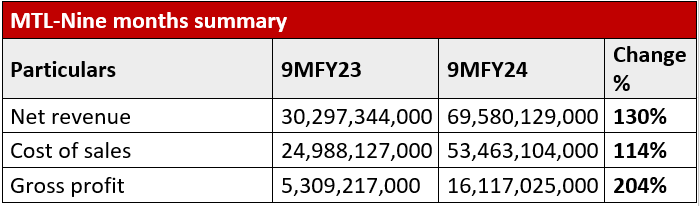

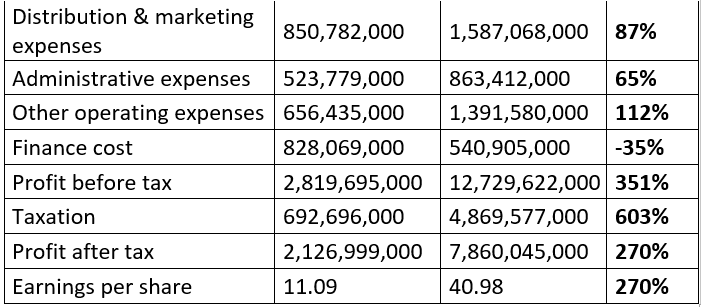

Millat Tractors Limited (MTL) profit increased by a significant 270% year-on-year (YoY) to Rs7.8 billion during the first nine months of the last fiscal year (9MFY24) compared to Rs2.1 billion profit reported over the same period in FY23, according to WealthPK.

The company's top line rose by 130% YoY to Rs69.5 billion as compared to Rs30.2 billion in 9MFY23. The cost of sales also grew by 114% YoY to Rs53.4 billion compared to Rs24.9 billion incurred in 9MFY23. Due to a greater proportionate rise in the company's sales compared to the cost of sales, the gross profit surged by 204% YoY to Rs16.1 billion in 9MFY24. On the expense side, the company observed an upsurge in distribution and marketing expenses by 87% YoY and administrative costs by 65% YoY to Rs1.5 billion and Rs863.4 million, respectively. Similarly, other operating expenses of MTL inflated by 112% YoY to Rs1.3 billion from Rs656.4 million in 9MFY23. However, the company's finance costs dipped by 35% YoY and stood at Rs540 million compared to Rs828 million in 9MFY23. On the tax front, the company paid a higher tax worth Rs4.8 billion against Rs692.6 million spent in the corresponding period of FY23, depicting a massive rise of 603% YoY.

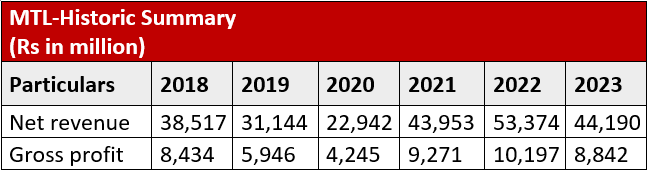

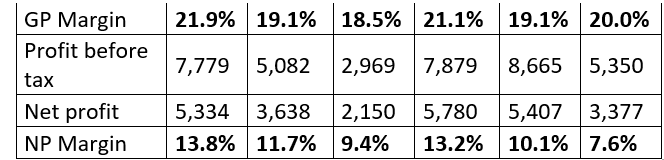

Historical performance (2018-23)

While MTL top line plunged in 2019 and 2020, it rebounded for the next two years and then nosedived again in 2023. The company's bottom line only posted growth in 2021 among all the years under review. The gross and net profit margins, which were declining until 2020, rebounded in 2021, but slipped again in 2022. In 2023, the gross profit inched up while the net margin continued its downward trajectory. In 2019, the company's net sales dropped by 19% YoY to Rs31,144 million. The retarded sales were led by diminished agricultural growth on account of water shortage as well as low demand for the sugarcane crop. Owing to low sales volume, MTL's gross profit margin dropped from 21.9% in 2018 to 19.1% in 2019. Furthermore, the bottom line took a 32% YoY dive and stood at Rs3,638 million with a net margin of 11.7%. The year 2020 was characterised by strict lockdowns and discontinuation of routine business activity due to the Covid-19 pandemic. The company's top line plummeted by 26% YoY, which squeezed the gross profit by 29%, with the margin falling to 18.5%. Furthermore, MTL's net profit narrowed down by 41% YoY to Rs2,150 million, with net margin standing at 9.4%.

After two rough years, MTL's top line posted an impressive 92% YoY growth in 2021. The gross profit grew by 118%, with gross margin jumping to 21.1%. Splendid growth in other income along with a drop in finance costs, helped the company attain a 169% growth in net profit. In 2022, the company's top line grew on account of an increase in tractor prices. However, the rise in the cost of raw materials, high interest rates, and sharp currency depreciation squeezed the company's profitability. The net profit dipped 6% to Rs5,407 million, with net margin clocking in at 10.1%. The 2023 was characterised by adverse economic conditions due to devastating floods, skyrocketing inflation, and massive currency depreciation. The company's top line slid by 17% YoY on the back of a 47% drop in volume. High operating expenses trimmed the net profit by 38%, with net margin slipping to 7.6%.

Company description

Millat Tractors is a public limited company and was incorporated in Pakistan in 1964 under the Companies Act, 1913 (now the Companies Act, 2017). The company is principally engaged in the assembling and manufacturing of agricultural tractors, implements, and multi-application products.

Credit: INP-WealthPk