INP-WealthPk

Ayesha Mudassar

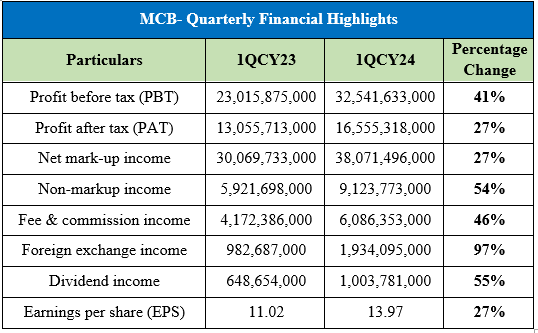

MCB Bank Limited (MCB), one of Pakistan’s largest private-sector banks, achieved substantial growth in core earnings. Its profit after tax (PAT) increased 27% year-on-year (YoY) to Rs 16.5 billion for the quarter that ended on March 31,

2024. As per the unconsolidated interim statement, the profit before tax (PBT) posted an impressive growth of 41%, reaching Rs 32.5 billion. As a result, the earnings per share (EPS) stood at Rs 13.97 compared to Rs 11.02 reported in the same period last year.

The net mark-up income increased by 27% on the back of strong volumetric growth in average current deposits and the timely repositioning of the asset book. The bank’s non-markup income surged to Rs 9.1 billion against Rs 5.9 billion in the last year with major contributions from fee commission income (Rs 6.08 billion), income from dealing in foreign currency (Rs 1.9 billion), and dividend income (Rs 1.0 billion). In addition, the total asset base of the bank grew by 14% and was recorded at Rs 2.4 trillion as of March 2024. The analysis of the asset mix highlights that net investments increased by 136% compared to the corresponding period of the last calendar year.

The year 2023

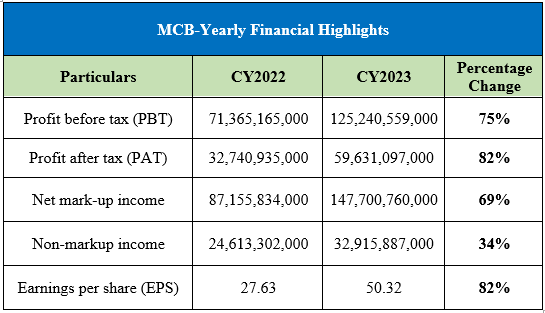

MCB demonstrated exceptional financial performance for the outgoing year, driven by an increase in the bank's total income. MCB’s net mark-up income increased to Rs 147.7 billion from Rs 87.1 a year earlier. In addition, the non-markup income rose to Rs 32.9 billion against Rs 24.6 billion in 2022.

The bank reported its highest-ever yearly profit of Rs 59.6 billion in 2023, with an 82% increase against Rs 32.7 billion recorded in 2022. The bank’s EPS in 2023 stood at Rs 50.32 compared to Rs 27.63 in 2022. The year 2023 was marked as a challenging year; the complexities stemmed from geopolitical tensions, economic uncertainties, and climate-related concerns. Despite these headwinds, MCB Bank maintained its commitment to financial stability, providing reliable banking services and support to valued customers. Amidst challenges, the year also presented exciting opportunities for innovation and growth. The rapid advancement of digital technologies including artificial intelligence (AI) has revolutionized the banking industry globally. Pakistan's banking sector is also actively engaged in the digital transformation process, providing immense opportunities to serve customers better.

About the bank

MCB is one of the pioneers of Pakistan’s banking sector. The bank was incorporated in the private sector in 1947; however, in 1974, it was nationalized. The bank was later privatized in 1991. MCB achieved a significant milestone by becoming the first Pakistani bank to list its global deposit receipts (GDRs) on the London Stock Exchange in 2006. Additionally, it holds the distinction of being the first bank in Pakistan to establish a wholly-owned Islamic subsidiary.

Future Outlook

MCB is committed to actively contributing to the development of the economy through strengthening financial inclusion and providing banking services across the country. Furthermore, the bank will target no-cost deposits to maximize the earnings potential and aggressively invest in the technological transformation to become a more agile and efficient organization.

Credit: INP-WealthPk