INP-WealthPk

Ayesha Mudassar

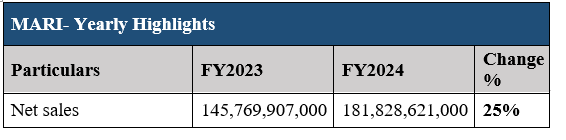

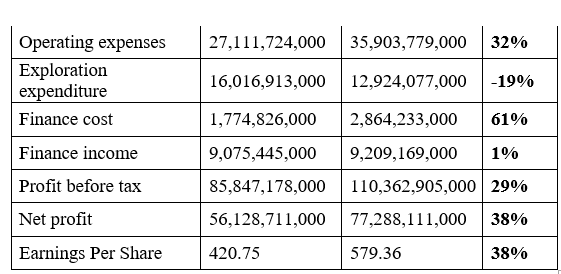

Mari Petroleum Company Limited (MARI) announced its

financial results for the Fiscal Year 2024, showcasing a record-breaking performance with significant growth in profitability, according to WealthPK. The company posted a net profit of Rs77.2 billion in FY24, reflecting an increase of nearly 38% year-on-year (YoY) compared to Rs56.1 billion in FY23. This profit growth was primarily driven by higher revenue, effective cost management strategies, stable financial income, and favorable taxation. In comparison to the corresponding period of FY23, the oil exploration company witnessed a 25% increase in revenues, rising from Rs145.7 billion to Rs181.8 billion. This growth was mainly attributed to increased hydrocarbon sales volume, higher wellhead prices, and currency depreciation.

On the expense front, MARI’s operating expenses for FY24 reflected a 32% YoY increase. However, the exploration expenses decreased by 19% due to the absence of dry wells and reduced costs associated with the exploration activities. The company’s finance cost for FY24 surged by 61%

YoY, demonstrating the effects of rising interest rates. In contrast, the finance income remained relatively stable, bolstered by elevated short-term investments and higher prevailing interest rates.

Quarterly Review

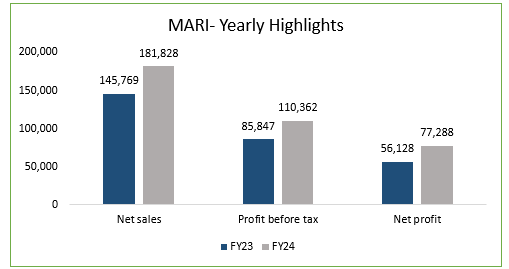

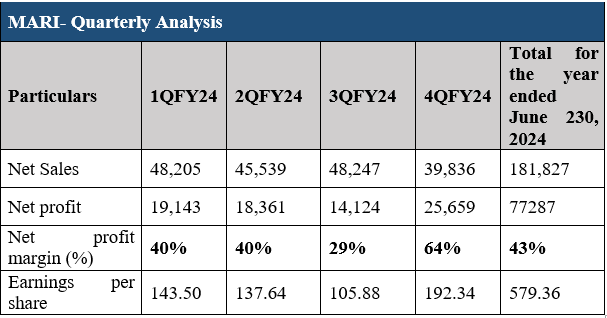

Quarterly analysis reveals that Mari Petroleum Company Limited achieved profitability in all four quarters of FY24. In the first quarter (July-September) of FY24, the company posted a net revenue of Rs48.2 billion and a net profit of Rs19.1 billion, resulting in earnings per share of Rs143.50.

All values are in millions except EPS

In the second quarter (October-December), the company’s net revenue decreased to Rs45.5 billion with a net profit of Rs18.3 billion. Therefore, the net profit ratio was reported to be 40% respectively. In the third quarter (January-March), the company hit the net sales of Rs48.2 billion, yielding a net profit of Rs 14.1 billion and a net profit margin of 29%. The EPS for 3QFY24 was Rs105.88. The sales distribution remained consistent across the quarters, with a slight dip observed in the final quarter. This decrease was attributable to external factors such as emergency shutdowns, plant turnarounds in the fertilizer sector, and forced curtailment by the gas distribution companies.

Historical Performance (2018-2023)

The company has demonstrated consistent growth in both sales and net profit over the years. In the fiscal year 2023, the company achieved remarkable results with a 53% YoY increase in net sales and a 70% rise in net profit. This revenue growth was primarily fuelled by higher prices and enormous local currency depreciation. Additionally, the bottom line benefitted from substantial growth in finance income and colossal exchange gains.

All values are in millions except EPS

FY20 was marked by the Covid-19 pandemic and declining oil prices for exploration and production companies. Despite these challenges, Mari Petroleum reported a 21% increase in net sales due to higher gas wellhead prices and currency depreciation. Moreover, the company achieved a 25% YoY growth in net profit. In FY21, the company recorded a modest 1% increase in its sales and a 4% rise in net profit. This was supported by improved hydrocarbon production and reduced exploration and production expenses. In FY22, Mari Petroleum experienced significant revenue growth of 30% YoY, propelled by rising oil prices and increased hydrocarbon production. However, the bottom line rose only 5% YoY due to the implementation of a super tax on companies in the latest budget.

About the Company

Mari Petroleum Company Limited is the second largest producer of natural gas. It is an integrated oil and gas exploration and production company with a success rate of approximately 70%. The company operates the largest gas reservoir at Mari Gas Field in Daharki, Sindh. Mari’s key customers include fertilizer manufacturers, power generation companies, gas distribution companies, and refineries.

Looking Ahead

The financial performance highlights that MARI has made significant strides in boosting domestic hydrocarbon production. By maintaining a strategic focus, embracing innovative technologies, and adopting calculated risk-taking, the company can tap into the vast untapped hydrocarbon potential within the country. Furthermore, streamlining the regulatory framework and implementing progressive policies will be instrumental in leading Pakistan toward achieving energy and food security.

Credit: INP-WealthPk