INP-WealthPk

Shams ul Nisa

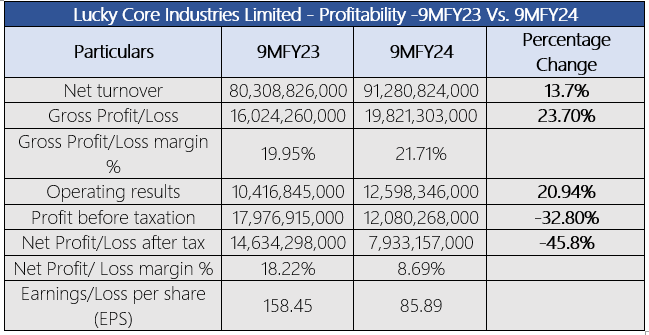

Lucky Core Industries Limited ended the nine months of the current Fiscal Year 2023 with an increase of 13.7% in its net turnover, reports WealthPK. The pharmaceuticals, chemical and agri sciences, soda ash, and polyester segments’ net turnover climbed by 32%, 25%, 20%, and 3% during the period, pushing the overall net turnover to Rs91.28 billion. This rise was attributable to the higher exports in the soda ash business, increased demand for chemicals and agri sciences, and effective management with a focus on manufacturing and commercial excellence of the pharmaceutical segment.

The gross profit rose 23.70% to Rs19.8 billion in 9MFY24. This resulted in the expansion of gross margin to 21.71% in 9MFY24 from 19.95% in 9MFY23. The favorable operating results of the pharmaceuticals, chemicals & agri sciences, soda ash, and animal health segments stimulated the rise in the operating results by around 20.94%, whereas the polyester business contracted by 40% during the period. The profit before tax contracted by 32.80% to Rs12.08 billion in 9MFY24. Likewise, the company reported a decline of 45.8% in the net profit to Rs7.93 billion. The company attributed this decline to the one-time gain of Rs9.84 billion on the divestment of NutriCo Morinaga (Private) Limited (NMPL) shares added to net profit last year. Thus, the net profit margin and earnings per share plunged to 8.69% and Rs85.89 in 9MFY24.

Chemical sector

![]()

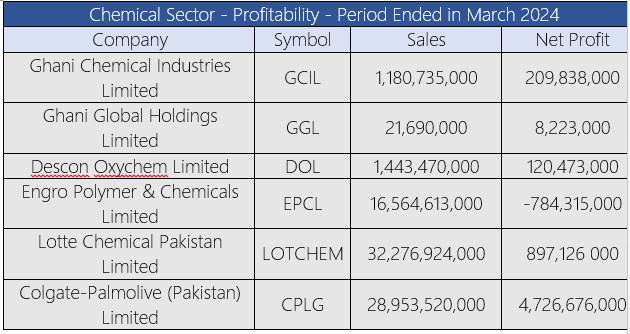

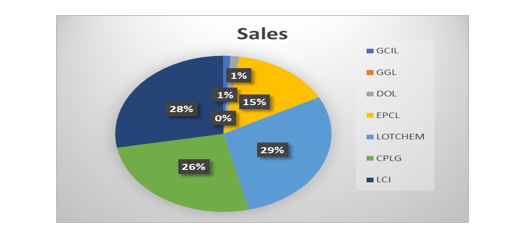

A thorough comparison of the companies in the chemical segment was made for the period ending on March 2024. According to the sales for 1QFY24, Lotte Chemical Pakistan Limited led the sector, accounting for 29% of total sales and followed by Lucky Core Industries Limited with 28% of sales and 26% by Colgate-Palmolive (Pakistan) Limited. The chemical sector posted total sales of Rs111.49 billion at the end of the review period.

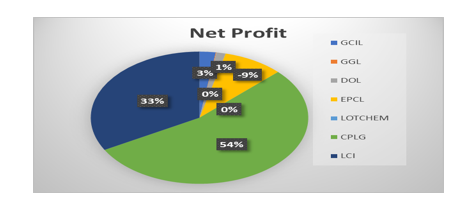

However, Colgate-Palmolive (Pakistan) Limited posted the highest net profit of Rs4.7 billion in 1QFY24, accounting for 54% of net profit generation in the chemical sector. Lucky Core Industries Limited secured the second position, with 33% of the total net profit generation. However, Engro Polymer & Chemicals Limited suffered a loss of Rs784.3 million in the chemical sector. At the end of the quarter, the chemical sector's total net profit stood at Rs7.17 billion.

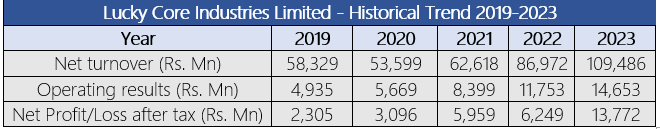

Historical trend

Lucky Core Industries Limited's net turnover rose from Rs58.3 billion in 2019 to Rs109.48 billion in 2023. The company ascribed this increase to the performance of all divisions due to the ongoing investments in product line expansion and cost-push price changes. Covid-19 caused a single fall in 2020, the polyester factory closure, and a decrease in the price of petrochemicals along the value chain. The operating results increased over the years, up from Rs4.9 billion in 2019 to Rs14.6 billion in 2023 as a consequence of ongoing business expansion, new product introductions, and effective cost-control measures. A one-time gain of 9.84 billion from the sale of NMPL shares and growth in the polyester coupled with growth in soda ash, animal health, chemicals, and agri sciences businesses contributed to the net profit's steady increase from Rs2.3 billion in 2019 to Rs6.2 billion in 2022 and then a sharp rise to Rs13.7 billion in 2023.

Future outlook

The global growth outlook for 2024 is projected at 3.1%, with economies demonstrating resilience through tight monetary policies. Government spending supports global activity, while geopolitical tensions and US interest rate cuts are expected. Pakistan's GDP growth is expected to increase to 2.4% in 2025. The Special Investment Facilitation Council's reforms, privatization of government entities, and IMF program will impact industrial activity and consumer demand. The company remains committed to leveraging its diverse product portfolio and monitoring costs.

Credit: INP-WealthPk