INP-WealthPk

Ayesha Mudassar

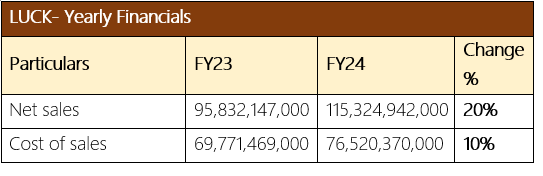

Lucky Cement Limited (LUCK) reported a remarkable 105% increase in net profit for the fiscal year 2024, reaching

Rs28.1 billion compared to a profit of Rs13.7 billion in the earlier fiscal, reports WealthPK.

The substantial profit growth can be attributed to the company's strong focus on cost optimization, effective risk management, and innovative practices to deliver sustainable value to its stakeholders.

According to the income statement, the company's net sales increased by 20% year-on-year (YoY) to Rs115.3 billion compared to Rs95.8 billion in FY23. This revenue growth was primarily driven by increased domestic sales and higher pricing. The cost of sales also rose by 10% YoY but was lesser than proportionate to sales rise, which improved the gross profit by 49% YoY to Rs38.8 billion in FY24. Additionally, the gross margins improved to 34%, up from 27% in FY23. The company's commitment to cost management, operational efficiency, and significant investments in renewable energy initiatives over the years has contributed to this margin increase.

Pattern of shareholding

As of June 30, 2024, LUCK had a total of 293 million shares outstanding, which are held by 9,640 shareholders. Directors, CEOs, and their spouses and minor children hold the majority stake of 44.7% in the company's shares, followed by the associated companies, undertakings, and related parties owing 25.3% shares. The general public accounts for 21.6% of the shares, while the mutual fund holds 3.5% shares. Around 1.6% of shares are held by banks, development financial institutions, and non-banking financial institutions. The remaining shares are held by the other categories of shareholders, each possessing less than 1% of the company's equity.

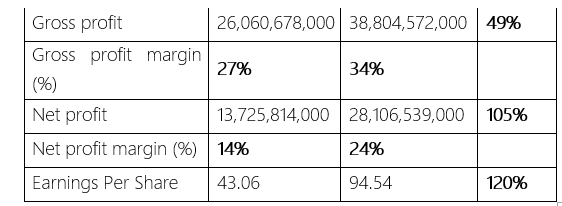

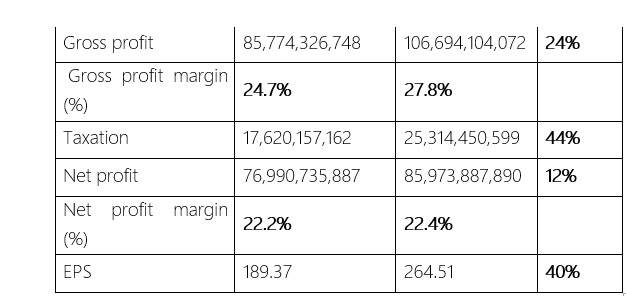

Sectoral Financials - 9MFY23 Vs 9MFY24

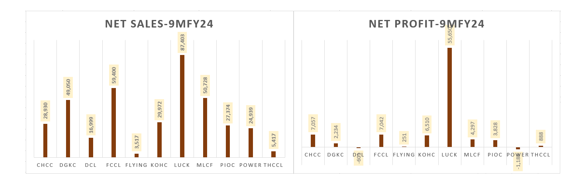

The cement sector experienced a 12% YoY growth in net profits, reaching Rs85.9 billion in 9MFY24 against Rs76.9 billion in the same period of the last fiscal year. Similarly, the sector's gross profit grew by 24% over the nine months. According to the results compiled by WealthPK from the income statements of the 11 PSX-listed cement companies, the sector saw an increase of 10% in its net sales to Rs383.7 billion as compared to Rs347.3 billion in 9MFY23.

The compiled sector includes Cherat Cement Company Limited (CHCC), D.G. Khan Cement Company Limited (DGKC), Dewan Cement Limited (DCL), Fauji Cement Company Limited (FCCL), Flying Cement Company Limited (FLYING), Kohat Cement Company Limited (KOHC), Lucky Cement Limited (LUCK), Maple Leaf Cement Factory Limited (MLCF), Pioneer Cement Limited (PIOC), Power Cement Limited (POWER), and Thatta Cement Company Limited (THCCL). According to the Monthly Economic Update and Outlook for April 2024, the total cement dispatches, including both domestic and export volumes, reached Rs34.5 million tonnes (MT), representing 2.6% higher than the 33.6 MT dispatched during the corresponding period of last year. The improved dispatches were mainly due to the enhanced exports within the sector. On the cost front, the cost of sales rose by 6% YoY, which stood at Rs 277 billion in 9MFY24 compared to Rs261.5 billion in 9MFY23. Moreover, the sector paid a higher tax worth Rs25.3 billion against Rs17.6 billion in the corresponding period of the last year, depicting a rise of 44% YoY. During 9MFY24, LUCK beat its peers by making the highest sales and declaring the highest net profit. The robust performance is mainly attributable to the

company's strong focus on cost optimization, risk management, and innovation to deliver sustainable value to our stakeholders.

Company Profile

Lucky Cement Limited was incorporated in Pakistan on September 18, 1993, under the Companies Ordinance, 1984 (now the Companies Act, 2017). The principal activity of the company is the manufacturing and marketing of cement.

Future Outlook

Lucky Cement Limited remains committed to leveraging its diverse portfolio to sustain strong earnings. The company's robust financial position reflects the management's efforts to operational efficiency, prudent investment strategies, and enhance shareholder value.

Credit: INP-WealthPk