INP-WealthPk

Qudsia Bano

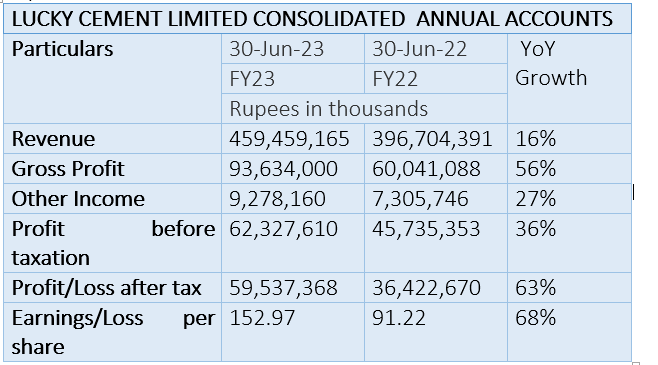

Lucky Cement Limited, a stalwart in the Pakistani cement industry, has released its consolidated annual financial results for the fiscal year ending on June 30, 2023, showcasing a remarkable year of growth and profitability and affirming the company's steadfast position in the market. The company's consolidated revenue for FY23 reached a substantial Rs459.46 billion, marking a notable 16% surge from the preceding fiscal year. This commendable growth is attributed to various strategic initiatives and a strong demand for construction materials in the domestic market. Lucky Cement's gross profit, a crucial indicator of operational efficiency, amounted to Rs93.63 billion – a substantial 56% increase compared to FY22.

This surge in gross profit underscores the company's adeptness at cost management and its ability to navigate challenges in the competitive landscape. Beyond core operations, the company's other income registered a healthy increase of 27%, reaching Rs9.28 billion. This diverse income stream signifies the company's ability to leverage opportunities beyond its primary business activities. The profit-before-taxation for FY23 stood at Rs62.33 billion, reflecting a commendable 36% growth from the previous fiscal year. This robust performance speaks to the company's ability to effectively manage its tax liabilities while maintaining a strong bottom line. The most striking aspect of Lucky Cement's annual performance is its profit-after-tax, which surged to Rs59.54 billion – an impressive 63% increase from FY22.

This substantial growth in profitability is a testament to the company's prudent financial management and its ability to capitalise on favourable market conditions. Earnings per share (EPS) for FY23 stood at Rs152.97, showcasing a remarkable 68% growth compared to the previous fiscal year. This substantial increase in EPS signifies that Lucky Cement's earnings available to shareholders have surged substantially on a per-share basis.

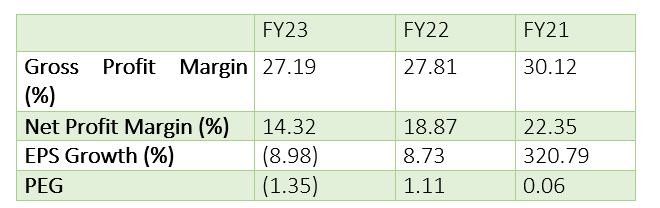

The ratio analysis of Lucky Cement Limited's financial performance over the past three fiscal years offers valuable insights into the company's operational efficiency, profitability, and growth. The gross profit margin, a key indicator of how effectively the company manages its cost of production, has exhibited a downward trend. In FY23, the gross profit margin stood at 27.19%, showing a slight decline from 27.81% in FY22 and a more notable decrease from 30.12% in FY21. This decline is indicative of various factors, such as changes in input costs, pricing strategies, or shifts in product mix. The net profit margin, indicating the proportion of revenue retained as net profit after all costs, has also shown a declining pattern.

In FY23, the net profit margin was 14.32%, down from 18.87% in FY22 and significantly lower than 22.35% in FY21. This decline in net profit margin could be attributed to a combination of factors, including changes in costs, operating efficiency and external economic conditions. The EPS growth, which assesses the percentage change in EPS from one fiscal year to another, has exhibited variations. In FY23, the EPS growth was -8.98%, indicating a decrease in earnings on a per-share basis. In FY22, the EPS growth was positive at 8.73%, reflecting a growth in earnings per share. Notably, in FY21, the EPS growth was a remarkable 320.79%, indicating an exceptional surge in earnings available to shareholders.

The PEG (Price/Earnings to Growth) ratio, which evaluates a company's valuation relative to its EPS growth rate, has shown fluctuations. In FY23, Lucky Cement Limited's PEG ratio was -1.35, suggesting a potentially undervalued status when considering the negative EPS growth. In FY22, the PEG ratio was 1.11, indicating a balanced valuation in relation to its EPS growth. Meanwhile, in FY21, the PEG ratio was 0.06, reflecting an attractively valued status considering the substantial EPS growth.

About the company

Lucky Cement Limited was incorporated in Pakistan on September 18, 1993, under the Companies Ordinance, 1984 (now the Companies Act, 2017). The principal activity of the company is manufacturing and marketing of cement.

Credit: INP-WealthPk