INP-WealthPk

Kanwal Naseer

The small and medium enterprises (SMEs) have demonstrated their role as a driving force in many successful economies, including China and India. However, this vital sector remains largely ignored in Pakistan despite its great potential.

Nadeem Ahmed Khan, Head of the Credit Division, told WealthPK, “Certain rules and regulations make it challenging for the banks to lend to the unregistered companies, lacking collateral or financial statements. However, the SMEs often struggle to supply adequate and reliable information to the financial institutions. Sometimes, they are unable to provide the audited financial statements to the banks, resulting in information asymmetry. This asymmetry in information between the SMEs and financial institutions creates significant barriers for the SMEs seeking credit from the formal financial institutions. Many SMEs fail due to the lack of understanding of financial services, banking procedures, and risk-return management concepts. In Pakistan, credit mismanagement is a significant factor contributing to the failure of these enterprises. “Specialized financing schemes such as the Assaan Finance scheme are being operated by the banks specifically to support the growth of SMEs. Unfortunately, these schemes are not being fully utilized, primarily due to the lack of awareness among the general public about their existence and benefits. This gap in understanding hinders the SMEs from accessing the vital financial resources that can help them thrive, he elaborated.

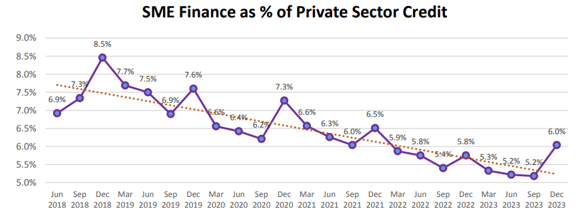

According to the SBP data, SME financing has been on a steady decline as a percentage of overall private sector financing. However, it saw an increase in the last quarter from 5.2% to 6% as of December. Despite this uptick, the overall trend remains downward due to the challenging economic conditions affecting the SMEs’ ability to secure funding. In addition, power shortage is also a major issue that the SMEs encounter on a regular basis. Frequent power outages have long-term consequences for the small enterprises’ productivity. Furthermore, the cost of electricity for the SMEs is roughly four times that of larger businesses that benefit from the captive power plants and preferential government treatment. This inequitable advantage fosters a hostile climate for the SMEs, severely limiting their growth potential and market competitiveness. The combination of high energy costs and intermittent power supply not only increases operating costs but also reduces investment and innovation in the industry.

Credit: INP-WealthPk