INP-WealthPk

Shams ul Nisa

Jahangir Siddiqui

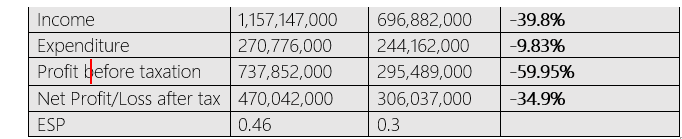

& Company Limited witnessed a substantial decrease in income, dropping by 39.8% to Rs696.88 million in the first half of calendar year 2024, reports WealthPK. The company attributed this dramatic decline to the lower dividend income and unrealized losses on equity securities classified at fair value through P&L compared to the corresponding period last year. Despite the decline in income, expenditures decreased by 9.83%, from Rs270.78 million to Rs244.16 million in 1HCY24. This shows that the company has made efforts to control costs despite declining revenues, but is insufficient to offset the substantial income decline.

![]()

The profit before taxation plummeted to Rs295.49 million in 1HCY24, down by 59.95% from Rs737.85 million in 1HCY23. The company's profitability has significantly declined due to the reduced income, indicating a struggle to maintain operational efficiency amidst the challenging conditions. Thus, the net profit decreased significantly by 34.9% to Rs306.04 million. Furthermore, the earnings per share dropped from Rs0.46 to Rs0.30, indicating a decrease in shareholder value and a potential impact on investor confidence.

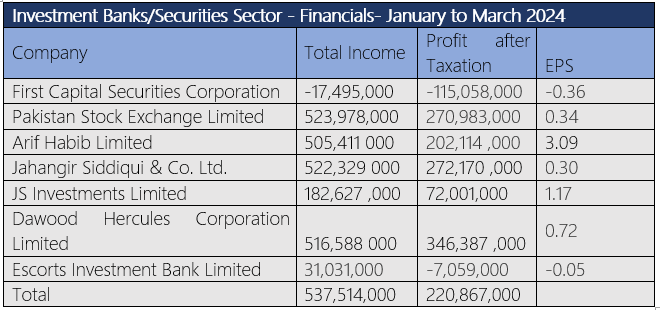

Investment Banks/Securities Sector

The financial performance of companies in the sector has been mixed, with some reporting losses and others generating substantial profits. From January to March 2024, the sector reported a total income of Rs537.5 million and a net profit of Rs220.8 million. First Capital Securities Corporation reported a total income loss of Rs17.50 million, reflecting significant operational challenges. However, Pakistan Stock Exchange Limited posted a total income of Rs523.98 million, demonstrating a robust operational performance and efficient trading management during the review period.

Arif Habib Limited displayed a strong financial performance, with a total income of Rs505.41 million and a profit after tax of Rs202.11 million, reflecting successful business strategies and client engagement. Similarly, Jahangir Siddiqui & Co. Ltd. reported a total income of Rs522.33 million and a profit after tax of Rs272.17 million. JS Investments Limited generated a total income of Rs182.63 million, achieving a profit after tax of Rs72 million, and an EPS of Rs1.17. Dawood Hercules Corporation Limited posted a total income of Rs516.59 million, with a profit after tax of Rs346.39 million and an EPS of Rs0.72, highlighting strong profitability. However, Escorts Investment Bank Limited encountered difficulties, recording a total income of Rs31.03 million but a loss after tax of Rs7.06 million, resulting in an EPS of Rs0.05 during the period under review.

Ratios Analysis

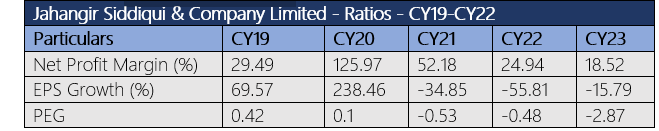

Jahangir Siddiqui & Company Limited's net profit margin has shown significant volatility over the years, reaching an impressive 125.97% in CY20. However, this trend declined to 52.18% in CY21, 24.94% in CY22, and 18.52% in CY23, indicating the company is struggling to maintain profitability.

The company's earnings per share saw a negative growth of 34.85% in CY21, 55.81% in CY22, and 15.79% in CY23. Additionally, its price-to-earnings-growth ratio worsened, hitting -2.87 by CY23.

Future Outlook

In the short to medium term, monetary easing will likely be driven by receding inflation, demand growth, improved sentiment, and the IMF Extended Fund Facility. However, factors like exchange rate instability, volatile food, energy, commodity prices, and regional conflicts could hinder this process and GDP growth.

The company's diversified investments in sectors like banking, insurance, technology, textiles, and chemicals are well-positioned to endure economic adjustments, contributing positively to both Pakistan's economy and shareholder value.

Company profile

Jahangir Siddiqui & Co. Ltd. was established on May 4, 1991. The principal activities of the company are managing strategic investments, trading securities, consulting services, etc.

Credit: INP-WealthPk