INP-WealthPk

Shams ul Nisa

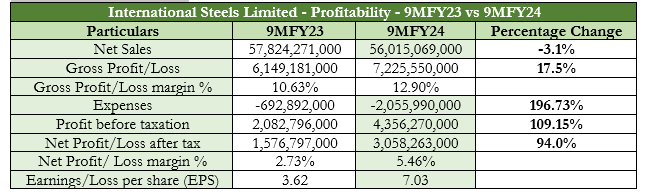

The net profit of International Steels Limited skyrocketed by 94.0% to Rs3.05 billion in nine months of FY 2024, compared to Rs1.57 billion in 9MFY23, according to WealthPK. The cost base of domestic production increased significantly in February by a 10% increase in gas and electricity rates and affected large-scale manufacturing. Thus, the net sales decreased by 3.1% to Rs56.01 billion in 9MFY24.

Thus, the gross profit grew by 17.5% to 7.22 billion, translating into a gross margin of 12.90% for the period in review. Likewise, selling and distribution expenses and administrative expenses jumped significantly, pushing expenses to grow by around 196.73% to Rs2.05 billion in 9MFY24. The company’s profit before tax rose massively by 109.15% from Rs2.08 billion in 9MFY23 to Rs4.35 billion in 9MFY24. Hence, the net profit margin improved from 2.73% to 5.46% in 9MFY24. The company reported earnings per share of Rs7.03 in 9MFY24 as opposed to Rs3.62 per share in 9MFY23.

Quarterly Analysis

The third quarter showed challenging results, with the net sales shrinking by 31.9%, the gross profit by 39.8%, and the net profit by 53.4%. The company’s gross margin slipped to 11.75% in 3QFY24 from 13.28% in 2QFY23. An increase in the cost of manufacturing because of hikes in gas and electricity tariffs drag expenses to grow by 122.94% at the end of the 3QFY24.

![]()

![]()

The profit before tax collapsed to Rs845.18 million in 3QFY24, 60.03% lower than Rs2.11 billion in the same period last year. The net profit margin and earnings per share slipped to 4.34% and Rs1.62 at the end of the period under review.

Historical trend

From FY18 to FY23, International Steels Limited's net sales historical trend remained volatile. The net sales improved slightly from Rs49.15 billion in FY18 to Rs57.48 billion in FY19, showing a positive trend. However, the company's net sales in FY20 decline to Rs48.08 billion, reversing the upward trend. The net sales showed a noticeable increase, picking up steam and reaching Rs69.79 billion in FY21 and Rs91.4 billion in FY22. In FY23, the net sales dropped dramatically to Rs76.75 billion.

![]()

International Steels Limited experienced a decline in net profit from Rs4.36 billion in FY18 to Rs3.51 billion in FY23. During the six years, the highest net profit was Rs7.46 billion in FY21, while the lowest was Rs494.8 million in FY20.

Engineering Sector

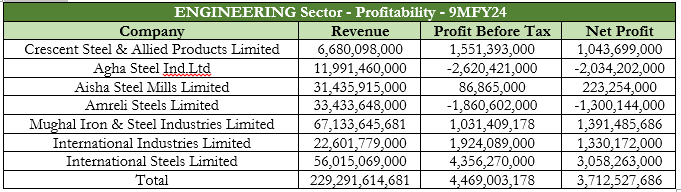

During the first nine months of the current fiscal year, the Engineering Sector revenue came in at Rs229.29 billion. With a revenue of Rs67.133 billion in 9MFY24, Mughal Iron & Steel Industries Limited was the sector's top contributor. Followed by International Steels Limited with a revenue of Rs56.01 billion, due to a rise in export sales to important markets including North America, Europe, and Asia.

However, during the 9MFY24, the Engineering Sector registered a profit before and after tax of Rs4.46 billion and Rs3.71 billion, respectively. The leading company, in terms of net profit, is International Steels Limited, with a profit before tax of Rs4.35 billion and a net profit of Rs3.05 billion in 9MFY23. However, Agha Steel Ind.Ltd and Amreli Steels Limited experienced losses both before and after taxes during the study period. During the review period, the hike in energy costs, high inflation, and unstable economies hindered economic growth.

Company Profile

International Steels Limited is Pakistan's biggest producer of flat steel, founded in 2007. The Company is a subsidiary of International Industries Limited. The core activities include the manufacturing of cold-rolled, galvanized, and color-coated steel coils and sheets.

Credit: INP-WealthPk