INP-WealthPk

Ayesha Mudassar

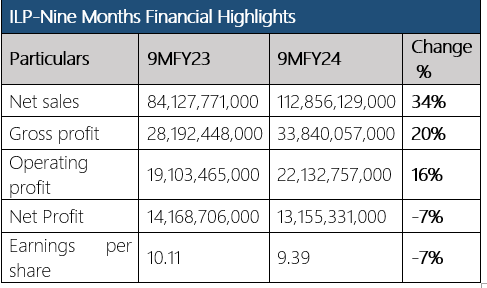

Interloop Limited (ILP)'s net sales surged by 34% to Rs112.8 billion in the nine months of the current fiscal year (9MFY24), compared to Rs84.1 billion during 9MFY23, reports WealthPK. The textile giant earned a gross and operating profit of Rs33.8 billion and Rs22.1 billion, respectively, during the nine months under review. The management successfully maintained operational efficiency, contributing to a 16% growth in profit from operations.

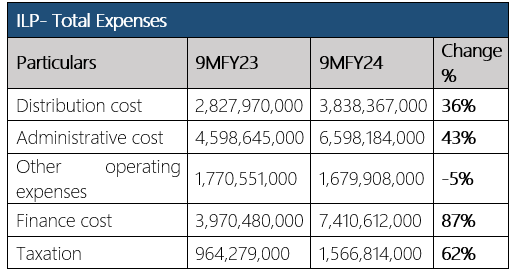

However, the net profit stood at Rs13.1 billion compared to Rs14.1 billion in the corresponding period last year, resulting in an earnings per share (EPS) of Rs9.39 versus Rs10.11 in the same period last year. The declined profit was due to exchange loss, increased working capital requirements, and capitalization of the apparel master project. The operating expenses, encompassing administrative, selling, and distribution expenses, increased by 32% from Rs9.1 billion to Rs12.1 billion.

Going by the income statement, the 87% increase in finance cost was mainly due to new borrowings at normal rates and repayment of subsidized loans. On the tax front, the company paid a higher tax worth Rs1.5 billion against Rs964.2 million paid in the corresponding period of last year, depicting a rise of 62%.

Four years performance (2020-2023)

Historical Financials

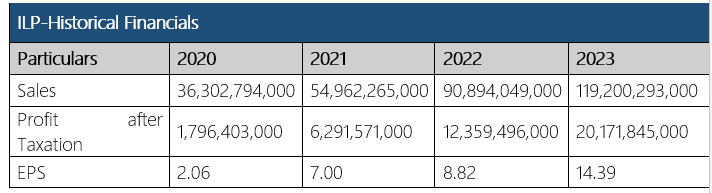

The sales and net profit of ILP have been growing remarkably over the years. Nonetheless, the company performed remarkably well during the fiscal year 2023 and delivered exceptional results by achieving the highest-ever sales revenue of Rs119.2 billion, compared to Rs90.8 billion during FY22.

Moreover, the company achieved a profit-after-tax of Rs20.1 billion for the fiscal year 2023, reflecting an increase of 63% compared to Rs12.3 billion last year. This notable improvement in profitability was primarily due to the cost-saving initiatives and better pricing management. The greater profit resulted in an EPS of Rs14.39 in fiscal year 2023, compared to Rs8.82 in fiscal year 2022. The analysis of the company's EPS shows that in the last four years, its EPS kept increasing. The company posted its highest four-year EPS in 2023 at Rs14.39.

Historical ratios

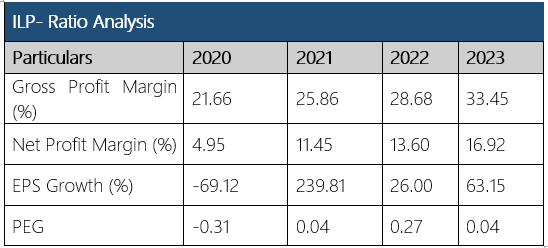

The historical ratios of Interloop Limited provide valuable insights into its financial performance and growth patterns over the years. The company has showcased a consistent improvement in its gross profit margin, reaching 33.45% in FY23, up from 28.68% in FY22, 25.86% in FY21, and 21.66% in FY22. This steady upward trend reflects the company's effective cost management and pricing strategies, contributing to a healthier bottom line. The net profit margin also experienced a positive growth, rising to 16.92% in FY23 compared to 13.60% in FY22, 11.45% in FY21, and 4.95% in FY20. The upward trajectory in the net profit margin is a positive signal for investors, demonstrating Interloop’s success in managing expenses and maximizing profits.

Concerning EPS, Interloop Limited reported a significant growth of 63.15% in FY23. This follows 26% growth in FY22 and an outstanding 239.81% surge in FY21. The consistent rise in EPS highlights the company’s capacity to generate value for its shareholders, reflecting a strong financial performance. During the years under consideration, the price/earnings to growth (PEG) ratio for the company was notably low at 0.04 in FY23. The PEG ratio assesses the relationship between a company's price/ earnings (P/E) ratio and its earnings growth rate. A PEG ratio below 1 suggests that the stock may be undervalued relative to its earnings growth potential.

About the company

Established in 1992, Interloop was listed on the Pakistan Stock Exchange in 2019. It is a vertically integrated, multi-category company that manufactures hosiery, denim, knitted apparel, and activewear. In addition, it produces yarn for textile customers.

Future outlook

Pak rupee depreciation along with high demand from the US and Euro-based apparel and fashion industry will continue to drive the sales up. However, the high cost of sales, operating expenses, and finance costs will be the major areas of concern.

Credit: INP-WealthPk