INP-WealthPk

Amir Khan

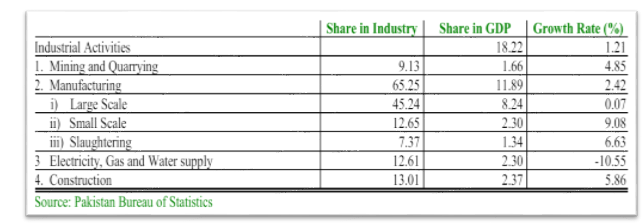

The industrial sector has staged a remarkable comeback in the Fiscal Year 2024, posting a growth of 1.21%. This recovery was largely driven by the manufacturing segment, constituting 65.3% of the industry, which rebounded from the previous setbacks. In an interview with WealthPK, Joint Secretary of Industries and Production Syed Sibt-e-Abbas Zaidi highlighted the varied recovery across different sub-sectors of the industry in FY2024. Although the mining and manufacturing industries have recovered quite well, problems still exist in the gas, electricity, and water supply sectors. He highlighted that the construction sector, buoyed by private investments, has emerged as a significant contributor to the sector's positive growth trajectory. As the economy navigates through evolving challenges and opportunities, the industrial sector's performance remains pivotal in shaping broader economic outcomes in the upcoming fiscal years. The manufacturing sector, encompassing large-scale manufacturing (LSM), and small-scale manufacturing, had struggled in FY2023, primarily due to the

prolonged downturns in LSM as measured by the Quick Estimates Index of Manufacturing (QIM). However, the sector saw a slight turnaround with an estimated growth of 0.07% in FY2024, compared to a steep decline of -9.87% in the preceding year. This recovery, albeit modest, varied significantly across different groups within LSM: food (1.69%), beverages (-3.43%), textile (-8.27%), tobacco (-33.59%), wearing apparel (5.41%), non-metallic mineral products (-3.89%), wood (12.09%), coke & petroleum (4.85%), and pharmaceuticals (23.19%). Moreover, contributing 9.1% to the industrial sector, the mining and quarrying segment exhibited a vigorous growth of 4.85% in FY2024, a sharp contrast to its decline in the previous year. Talking to WealthPK, Joint Secretary Industries and Production Ms. Saira Imdad Ali said the industrial sector growth was driven by increased production of crude oil, coal, marble, limestone, and laterite.

In addition, the Gross Fixed Capital Formation (GFCF) in the private sector for mining and quarrying expanded significantly by 10.5% during FY 2024, further bolstering the sector's positive trajectory. However, not all sectors saw growth. The electricity, gas, and water supply industry experienced a downturn of -10.55% in FY2024, following a robust growth of 9.95% in FY2023. This decline was attributed to reduced subsidies and an increased deflator, indicating challenges in maintaining the growth momentum in this essential sector. The construction industry showed resilience with a growth of 5.86% in FY2024, a marked improvement from the -9.25% contraction observed in the previous year. This growth was driven by a low base effect and increased private sector investments in the construction activities.

Credit: INP-WealthPk