INP-WealthPk

Fakiha Tariq

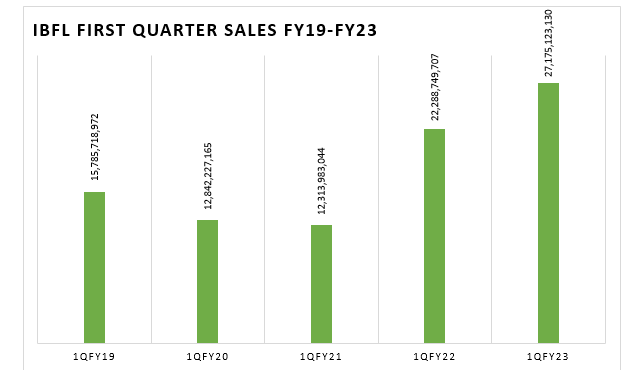

Ibrahim Fabrics Limited (IBFL) started off the fiscal year 2022-23 by reporting the gross sales of Rs27 billion in the first quarter, the highest turnover achieved by the company in the corresponding quarters of last four years, WealthPK reports. Ibrahim Fabrics Limited being traded under the symbol of IBFL on Pakistan Stock Exchange is the largest company on the basis of market capitalisation operating in the synthetic and rayon sector.

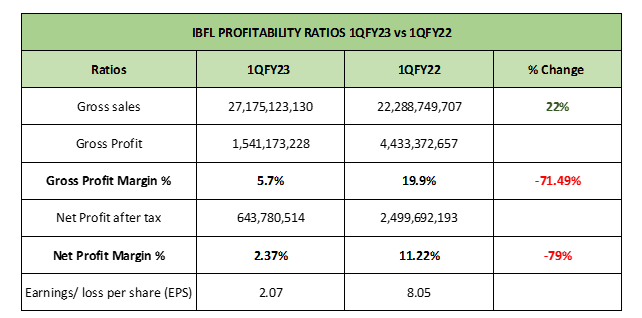

Incorporated as a public entity in 1986, IBFL market cap is worth Rs62.1 billion, and it’s a leading manufacturer and seller of polyester and yarn in Pakistan and abroad. Compared to the first quarter of FY22, IBFL’s revenues increased by 22% in 1QFY23, opening the FY23 with the most successful turnover.

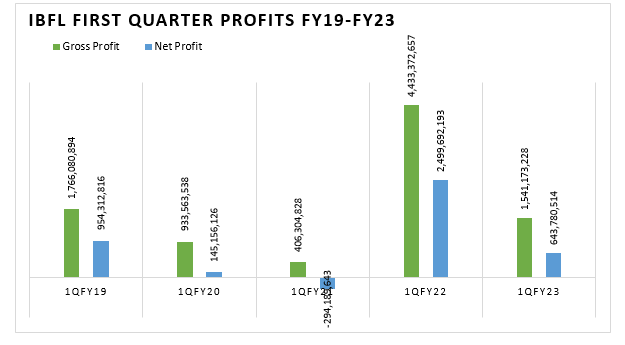

However, despite showing increasing trend in revenues, the gross and net profit margins of the company reported a decline of 71% and 79%, respectively, in 1QFY23. Increase in the cost of production pushed down the gross profit margins in 1QFY23. The responsible factors for high cost of production included economic and political unrest domestically. The IBFL management also cited global inflation and oil price hike as major contributors to the increased cost of production. Despite suffering a huge decrease in the gross profit in 1QFY23 compared to the same quarter of last year, the first quarter of FY23 enjoyed the third-best first quarter gross profit in the last four years.

IBFL earned a gross profit of Rs1.5 billion and a net profit of Rs643 million in 1QFY23. The first quarter of FY23 ended with earnings per share of Rs2.07 for its investors.

IBFL performance in calendar year 2022

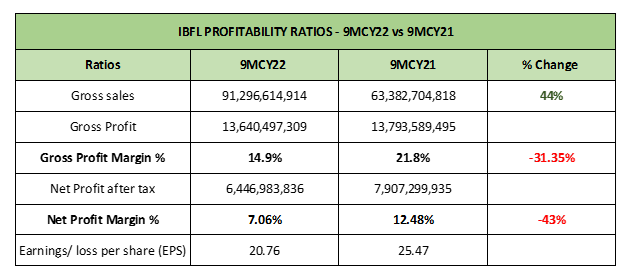

The WealthPK study also observed Ibrahim Fabrics increased its revenue by 44% in the first nine months of calendar year 2022 compared to the same period of 2021. However, in 9MCY22, the gross profit and net profit ratios decreased by 31% and 43%, respectively, compared to the 9MCY21.

Earnings per share (EPS) value reported by IBFL by the end of September 2022 also declined to Rs20.76 from the EPS value of Rs25.47 earned in the nine months through Sept 2021. In the future outlook, the senior management of IBFL foresee material impact of economic crisis on the company’s revenue and profits.

Credit : Independent News Pakistan-WealthPk