INP-WealthPk

Shams ul Nisa

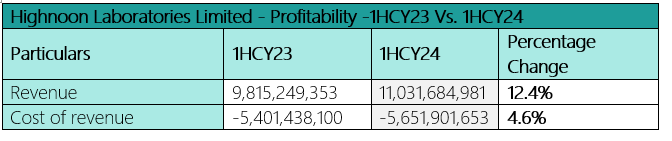

Highnoon

Laboratories announced a 12.4% increase in revenue, reaching Rs11.03 billion in the first half of the calendar year 2024. This growth was fueled by a strong performance from the established brands, the introduction of new brands into the Billion League, and the launch of additional new brands. However, the cost of revenue also increased by 4.6% and gross profit by 21.89%, to Rs5.38 billion, indicating effective pricing strategies, reports WealthPK.

The operating expenses increased by 25.47% to Rs3.34 billion, surpassing the growth in revenue. Despite the higher costs, the company saw a 16.42% increase in the operating profit. Similarly, the other income surged to Rs203.22 million, rising by 143.79%, which positively impacted the overall profitability and showcased the company’s effective diversification of income sources. The profit before taxation increased by 17.38%, while the net profit rose by 24.9% to Rs1.50 billion in the first half of the calendar year 2024. This boost in net profitability is due to the improved working capital management, streamlined processes, and income from investments. Additionally, the earnings per share saw a substantial increase to Rs28.33, indicating greater value for shareholders.

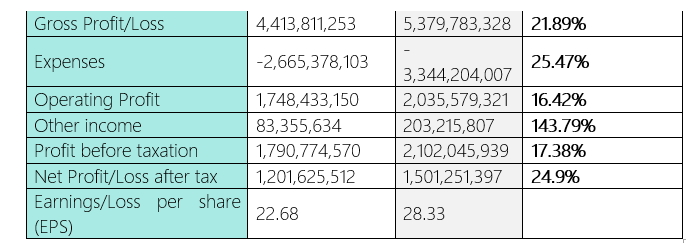

Assets and Liabilities Analysis

Highnoon Laboratories’ non-current assets rose by 2.23% from December 2023 to June 2024, indicating a commitment to investing in long-term assets for future operations and growth. However, the current assets saw a slight decrease of 0.99%, raising concerns about the company’s short-term liquidity. Additionally, the non-current liabilities dropped significantly by 8.05%, suggesting that the company had reduced long-term and enhanced long-term financial stability and decreased interest payments. However, the current liabilities increased by 6.86% to Rs3.07 billion in June 2024.

Overall, the total equity and liabilities showed a negligible decrease of 0.11%, from Rs14.03 billion to Rs14.01 billion, indicating stability in the company’s financial structure.

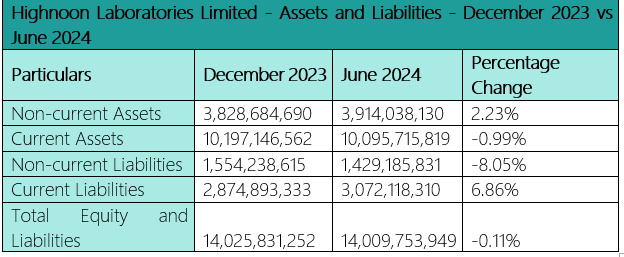

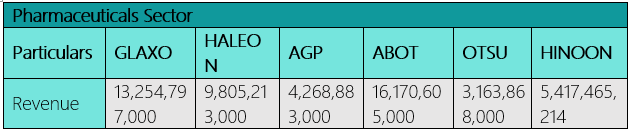

Pharmaceuticals Sector Analysis

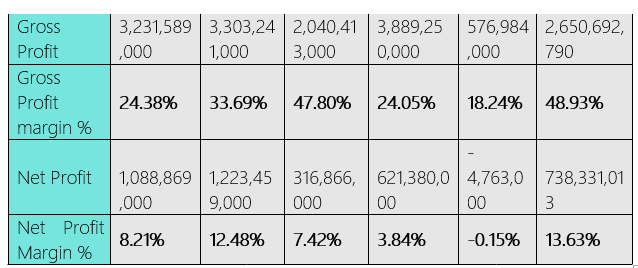

The pharmaceutical sector displays a diverse performance among the key players, with significant disparities in revenue generation, gross profitability, and net profitability metrics. Companies such as AGP and Highnoon demonstrate robust gross profit margins, reflecting their effective cost management strategies. However, Otsuka is encountering substantial challenges in enhancing its financial health and competitive standing. Abbott leads the sector with revenues of Rs16.17 billion, followed by GLAXO at Rs13.25 billion and HALEON at Rs9.81 billion. HINOON and AGP follow with revenues of Rs5.42 billion and Rs4.27 billion, and OTSU trails with Rs3.16 billion. The AGP’s gross profit margin of 47.80% indicates a highly efficient cost structure relative to sales. Highnoon’s gross profit margin of 48.93% suggests effective pricing strategies and cost management, enabling it to retain a significant portion of its revenue as profit. However, GLAXO and ABOT report lower gross profit margins, which may reflect higher production costs or competitive pricing pressures. HALEON has the highest net profit at Rs1.22 billion, with a net profit margin of 12.48%, indicating strong revenue generation and expense management. ABOT and AGP report a net profit margin of 3.84% and 7.42%. However, OTSU registered a net loss of Rs4.76 million, highlighting significant challenges in cost management and revenue generation during the review period.

Future Outlook

In the first half of the year, Pakistan’s pharmaceutical industry experienced positive advancements due to the government’s adoption of global pharmaceutical practices. This facilitated price adjustments for non-essential medicines, leading to enhanced quality, efficacy, and increased market competition. However, the industry still needs supportive policies to encourage local production of essential raw materials and boost exports, which would enable a greater contribution to the national economy. The company is dedicated to sustaining sales growth and optimizing costs, confident in meeting corporate objectives and continuing the company’s growth trajectory.

Company Profile

Highnoon Laboratories Limited was listed on the Pakistan Stock Exchange in November 1994. The company focuses on the manufacture, import, sale, and marketing of pharmaceuticals and related consumer products. Its registered office is situated on Multan Road, Lahore.

Credit: INP-WealthPk