INP-WealthPk

Ayesha Mudassar

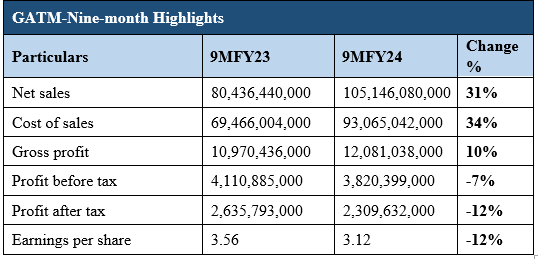

Gul Ahmed Textile Mills Limited (GATM), a manufacturer of textile products, recorded a decline of 7% and 12% in before- and after-tax profits, respectively, during the nine months of the ongoing fiscal year, compared to the corresponding period of the previous fiscal, according to WealthPK.

According to the unconsolidated income statement, the company posted a pre-tax profit of Rs 3.8 billion and a post-tax profit of Rs 2.3 billion in 9MFY24. The lower profit was mainly due to challenging and adverse economic conditions, including higher raw materials costs, depreciation of local currency, a rapid increase in the interest rate, and high inflation.

GATM posted earnings per share of Rs 3.12 during the period under review. Furthermore, the company's sales stood at Rs 105.1 billion in 9MFY24 as compared to Rs 80.4 billion in 9MFY23, representing 31% growth. This prominent increase is attributed to the favorable impact of currency fluctuations and an increase in exports. The cost of sales has experienced a significant upswing of 34%, primarily driven by increased material costs, higher energy costs, and an increase in minimum wages.

Pattern of Shareholding

As of June 30, 2023, the GATM had a total of 740 million shares outstanding which are held by 7394 shareholders. Around 69% of the shares are held by associated parties, undertakings, and related parties. Within this category, Gul Ahmed Holdings (Private) Limited leads with a stake of 80% percent in GATM’s outstanding share volume. In addition, the individuals and directors own 11.5% and 7.4% of the entire share shareholding.

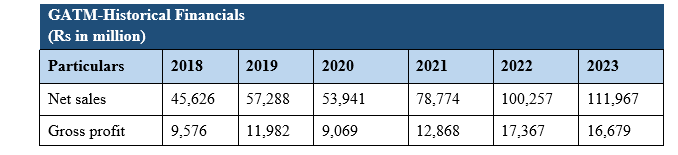

Financial Performance (2018-23)

GATM’s topline showed a growth trend over all the years except 2020. Conversely, its bottom line slid twice during the period, i.e. 2020 and 2023. In 2019, the company's topline grew by 26% year-on-year (YoY) on account of satisfactory demand in the local and export markets. The company closed the year with a 25% and 74% rise in gross and net profit, which clocked in at Rs 11.9 billion and 3.6 billion, respectively. The company’s profit-before-tax also progressed from Rs 2.3 billion in 2018 to Rs 4 billion in 2019. Owing to COVID-19, the company registered a drop in its sales by around 6% YoY in 2020. The weak demand and pandemic-related restrictions have resulted in a 24% decline in GATM's gross profit. In addition, the company registered a net loss of Rs 479 million during the year. 2021 was a recovery year as the company's sales posted a YoY growth of 46%. The growth came on the heels of a rebound in both local and export sales. The gross profit and net profit also grew to Rs 12.8 and Rs 4.4 billion, respectively.

![]()

The year 2022 was characterized by grave macroeconomic challenges and persistent political uncertainty. However, the massive rupee devaluation enabled the company to boost its export sales, which resulted in a topline growth of 27% in 2022. Furthermore, the company registered a 100% enhancement in its net profit, which clocked in at Rs 8.8 billion. In 2023, GATM’s topline registered a nominal 10% surge. The hike in the prices of raw materials, local currency depreciation, and higher utility charges have resulted in a 4% decline in GATM's gross profit. In addition, the net profit slipped by 55% to Rs 3.9 billion.

Company Profile

Gul Ahmed Textile Mills Limited was incorporated on April 01, 1953, in Pakistan as a private limited company, subsequently converted into a public limited company on January 07, 1955. The company is a composite textile mill engaged in the manufacture and sale of textile products.

Credit: INP-WealthPk