INP-WealthPk

Shams ul Nisa

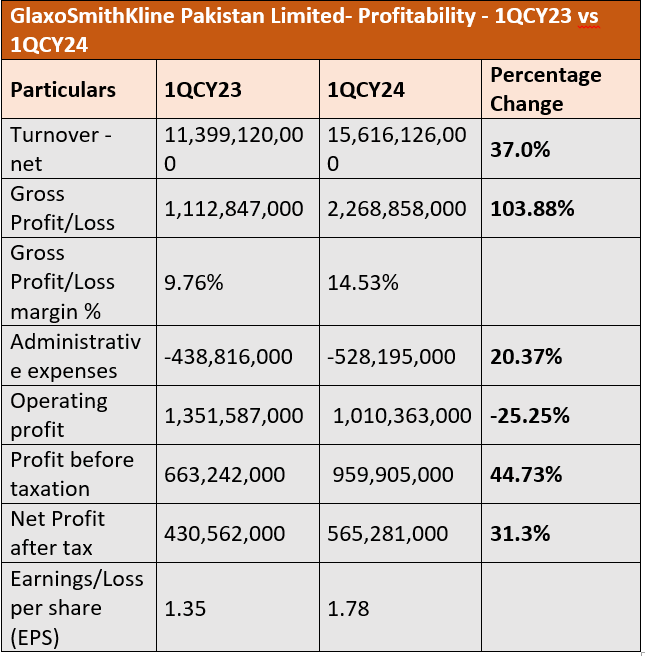

The net turnover of GlaxoSmithKline Pakistan Limited increased by 37% to Rs15.61 billion in the first quarter of 2024 compared to the same period in 2023, reports WealthPK. The company attributed this growth to the utilization of digital channels, strong involvement of healthcare personnel (HCP), improved execution, and higher prices. Additionally, gross profit grew by a remarkable 103.88% during the period, raising the gross profit margin to 14.53% in 1QCY24 from 9.76% in 1QCY23. This increase was driven by higher prices, which offset the cost increases brought on by inflation and currency depreciation. Administrative expenses stood at Rs528.19 million in 1QCY24, up by 20.37% from the corresponding quarter of CY23. Consequently, the operating profit decreased by 25.25%. However, the company posted a 44.73% increase in profit-before-tax during the period, demonstrating efficient control over non-operating costs.

In addition, the net profit rose by 31.3%, from Rs430.6 million in 1QCY23 to Rs565.3 million in 1QCY24. The increased profit pushed the earnings per share from Rs1.35 in 1QCY23 to Rs1.78 in 1QCY24.

Financial highlights

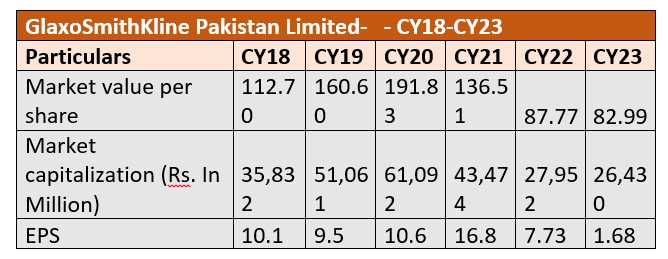

GlaxoSmithKline Pakistan Limited saw notable swings in its market capitalisation, earnings per share and market value per share between CY18 and CY23. Market value per share increased from Rs112.70 in CY18 to Rs191.83 in CY20, indicating strong financial performance and high investor confidence. But by CY23, it dropped precipitously to Rs82.99, a sign of declining investor confidence. Additionally, the market capitalisation increased from Rs35.83 billion in CY18 to Rs61.09 billion in CY20. However, by CY23, it dropped to Rs26.43 billion. The company’s earnings per share peaked at Rs16.8 in CY21, but dropped massively to Rs1.68 in CY23.

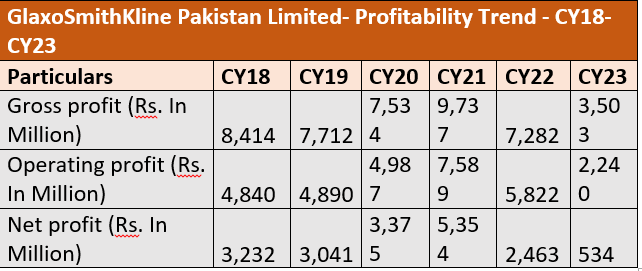

Profitability trend

The profitability trajectory of GlaxoSmithKline Pakistan remained unstable from 2018 and 2023. The company's gross profit peaked at Rs9.73 billion in 2021 and fell precipitously to Rs3.503 billion in 2023. Similarly, the operating profit declined from Rs4.84 billion in 2018 to Rs2.24 billion in 2023, indicating problems with expense control or dwindling revenue sources. Additionally, the net profit varied over the period, and plunged to Rs534 million in 2023.

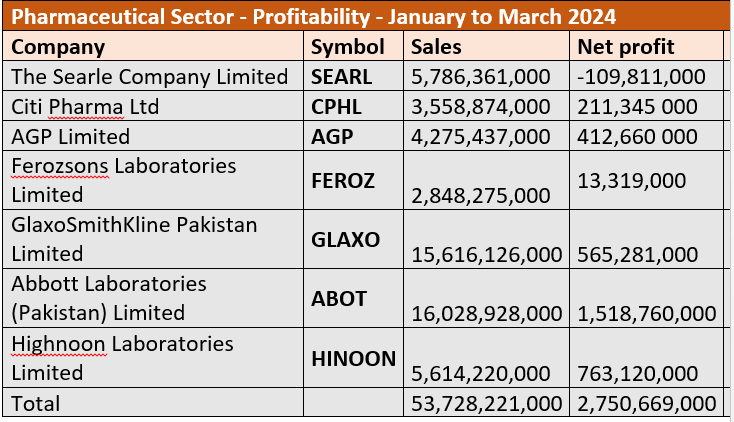

Pharmaceutical sector’s performance

Pakistan's pharmaceutical industry saw varied profitability results from January to March 2024. With sales of Rs15.6 billion and Rs16.0 billion, GlaxoSmithKline Pakistan Limited and Abbott Laboratories (Pakistan) Limited were on top. With a net profit of Rs1.5 billion, Abbott Laboratories was the most profitable company, demonstrating excellent cost control. Furthermore, Highnoon Laboratories Limited recorded a remarkable performance with a net profit of Rs763.1 million and an EPS of Rs14.4. AGP Limited and Citi Pharma Ltd both had good results. While SEARL revealed a net loss of Rs109.81 million, and FEROZ posted a minor profit of Rs13.31 million.

Future outlook

GlaxoSmithKline maintains high standards of quality and safety in its products. The company links tackling health challenges and promoting safe and effective medications to cooperation between governmental agencies, regulatory bodies and industry stakeholders. The company strives to promote creativity and innovation in its operations and focuses on strengthening human capital.

Company profile

GlaxoSmithKline Pakistan is incorporated as a limited liability company. It is engaged in the manufacturing and marketing of research-based ethical specialties and pharmaceutical products.

Credit: INP-WealthPk