INP-WealthPk

Shams ul Nisa

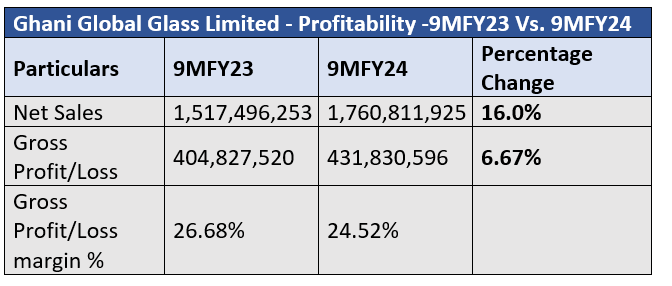

Net sales of Ghani Global Glass Limited increased by 16% in the first nine months of the financial year 2023-24 compared to the same period of FY23, suggesting improved market demand and effective sales policies, reports WealthPK.

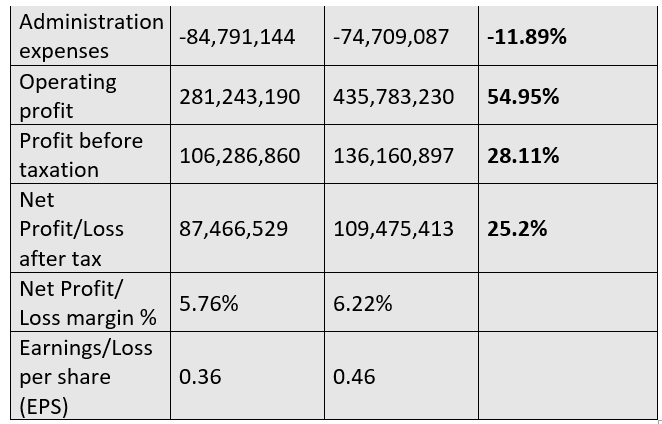

Despite a moderate growth of 6.67% in gross profit, the gross profit margin decreased marginally to 24.52% in 9MFY24 from 26.68% in 9MFY23, highlighting increased production and raw material costs. The administrative expenses contracted by 11.89% in 9MFY24. However, operating profit expanded by 54.95%, suggesting operational effectiveness.

Furthermore, the company posted a jump of 28.11% in profit-before-tax in 9MFY24. Additionally, the net profit increased by 25.2%, pushing the net profit margin to 6.22% from 5.76% in 9MFY23. The company's improved profitability translated into the earnings per share rising from Rs0.36 in 9MFY23 to Rs0.46 in 9MFY24.

Historical trend

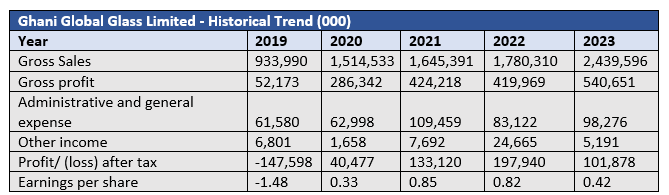

The company demonstrated a consistent rise in gross sales, gross profit, administrative and general expenses, and other income from 2019 to 2023. The company's gross sales expanded gradually from Rs933.9 million in 2019 to Rs2.43 billion in 2023, suggesting a growing market presence and successful policies. Gross profit increased from Rs52.17 million in 2019 to Rs540.6 million in 2023, with a single dip of Rs419.9 million in 2022. The overall improvement in gross profit shows better cost control and favourable price policies.

There was a notable surge in administrative and general expenses in 2021 to Rs109.4 million, followed by a notable decrease in 2022 to Rs83.12 million, but a slight rise in 2023 to Rs98.27 million. Other income demonstrated fluctuation, with a peak of Rs24.6 million in 2022 and a precipitous decline in 2023 to Rs5.19 million. The company recorded a net loss of Rs147.59 million in 2019, but rebounded in the following years with the highest net profit of Rs197.9 million in 2022. Similarly, the company reported a loss per share of Rs1.48 in 2019 and an earnings per share in the subsequent years.

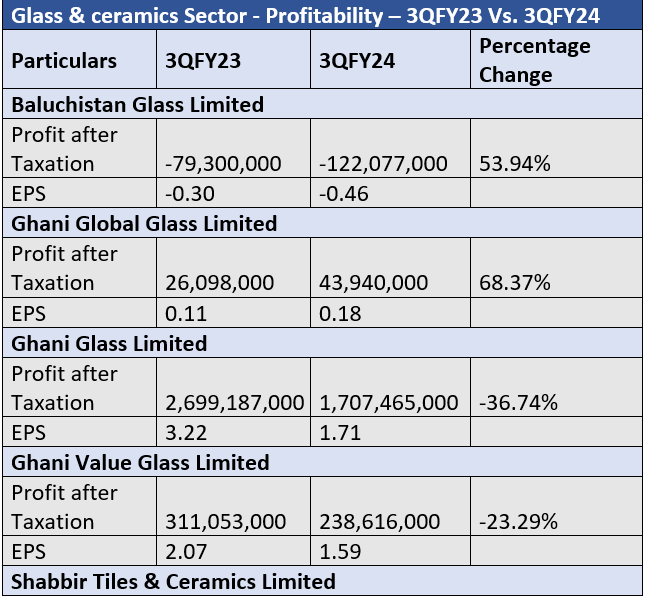

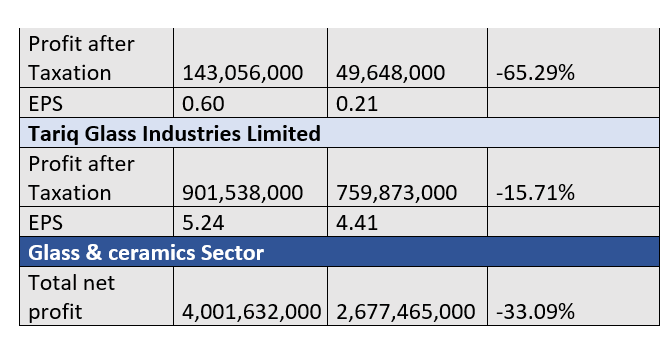

Glass & ceramics sector

The profitability analysis of the glass and ceramics sector for 3QFY24 reveals a notable decrease in profitability, with net profit plunging by 33.09% compared to the same quarter of FY23. Balochistan Glass Limited's net losses expanded by 53.94% in 3QFY24. Similarly, it posted a loss per share of Rs0.46 in 3QFY24, indicating a negative financial position. However, Ghani Global Glass Limited demonstrated a strong improvement with a 68.37% increase in net profit.

Ghani Glass Limited, Ghani Value Glass Limited, Tariq Glass Industries Limited and Shabbir Tiles & Ceramics Limited saw a sharp downturn in both net profit and EPS. The biggest fall was recorded by Shabbir Tiles & Ceramics, with a 65.29% decrease.

Future prospects

Ghani Global Glass plans to increase its glass ampoules and vials production capacity by acquiring six high-tech, fully automatic ampoules lines. This will enable the production of over 50 million ampoules per month. The company is also working with Latin American companies to supply glass ampoules and vials, with Colombian companies approving their products, allowing for value-added exports beyond glass tube exports.

Company profile

Ghani Global Glass Limited, which was incorporated in Pakistan in 2007, primarily manufactures and sells glass tubes, glassware, vials, ampoules, and chemicals.

Credit: INP-WealthPk