INP-WealthPk

Shams ul Nisa

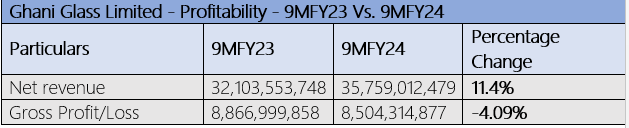

Ghani Glass Limited's profitability declined notably by 23.9% during the nine months of the Fiscal Year 2024 despite an increase of around 11.4% in net revenue, reports WealthPK. According to the company's financial report, the net revenue climbed from Rs32.10 billion in 9MFY23 to Rs35.76 billion in 9MFY24, demonstrating a strong sales growth. During the period, the company earned a total net profit of Rs4.92 billion, mainly due to the total rise in operating expenses, primarily from increased taxes and energy costs.

The gross profit contracted by 4.09% to Rs8.50 billion in 9MFY24, causing the gross margin to fall to 23.78% because of the higher production and energy costs. The company posted a notable decrease of around 15.10% to Rs5.31 billion in the operating profit in 9MFY24. This was partially attributed to a 9.32% increase in general and administrative expenses and a substantial drop of 43.91% in other income during the review period. Additionally, profit before tax slipped to Rs5.95 billion, down by 8.83% from Rs6.53 billion in 9MFY23. At the end of the period, the net margin and earnings per share shrank to 13.77% and Rs4.93, respectively, compared to the net margin of 20.17% and EPS of Rs6.48 in 9MFY23.

Profitability ratios

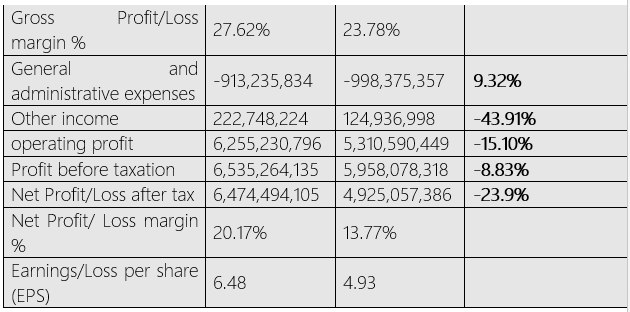

The profitability ratios from 2018 to 2023 demonstrate an uneven but generally upward trend. From 28% in 2018 to 15% in 2020, the gross profit ratio declined gradually; however, it increased to 29% in 2022. This rebound in gross profit is attributed to efficient cost control and improved pricing tactics. However, in 2023 gross profit ratio again decreased to 28%. The net profitability ratio decreased from 22% in 2018 to 9% in 2020. But in the following years, it increased to 21% in 2023, showing the company's capacity to improve profit margins. The inventory turnover ratio ranged from the lowest of 2.83 in 2020 to the highest of 10.97 in 2018. Overall, it followed a declining trend to 3.01 in 2023, indicating slower inventory movement.

The total assets turnover ratio stayed comparatively stable, increasing marginally from 0.79 in 2018 to 1.00 in 2022 and then slightly declining to 0.94 in 2023. The earnings per share rose significantly from Rs4.53 in 2018 to Rs8.10 in 2023, indicating a notable increase in profitability per share.

Glass and ceramics sector analysis

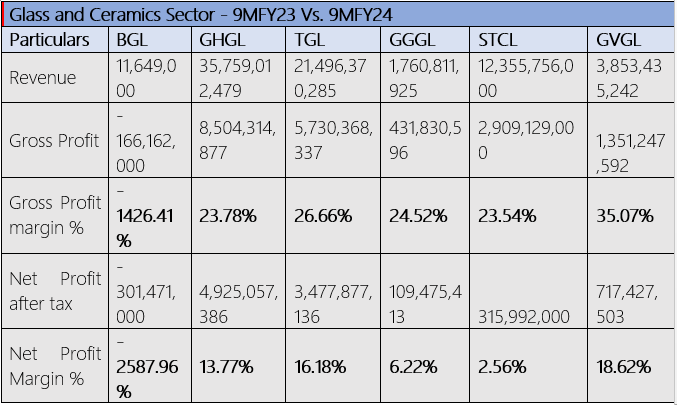

The first nine months of Fiscal Year 2024 financial performance for the glass and ceramics sector compared to 9MFY23 shows notable differences in profitability and efficiency. According to the revenue generation and net profit, Ghani Glass Limited (GHGL) leads the sector with Rs35.76 billion in revenue, but its gross profit margin is marginally lower than that of its rival companies, suggesting higher costs than revenue. The company's net profit after tax is Rs4.93 billion, which is a strong indication of overall profitability. Tariq Glass Limited (TGL) has demonstrated strong financial performance, exhibiting a gross profit margin of 26.66% and a net profit margin of 16.18%. Both Shabbir Tiles & Ceramics Limited (STCL) and Ghani Global Group Limited (GGGL) have modest gross profit margins of 26.66% and 24.52% respectively, but the net profit margins of 16.18% and 6.22% indicate lower total profitability.

However, Balochistan Glass Limited (BGL) and Ghani Value Glass Limited (GVGL) exhibit weak financial results. BGL posted a negative gross profit margin of 1426.41% and a loss net profit margin of -2587.96%, both indicating significant losses and ineffective cost control.

Future outlook

Economic issues such as skyrocketing inflation, unparalleled climate change, budgetary imbalances, high debt payments, payment gaps, continuous budget deficit, rising energy and input prices, and a general industrial slowdown are hindering the growth. However, the management is totally dedicated to handling these difficulties and producing profitable growth.

Company profile

Ghani Glass Limited was incorporated in Pakistan in 1992 as a limited liability company under the Companies Ordinance, 1984 (now Companies Act, 2017). The company is engaged in the business of manufacturing and sale of glass containers and float glass.

Credit: INP-WealthPk