INP-WealthPk

Fakiha Tariq

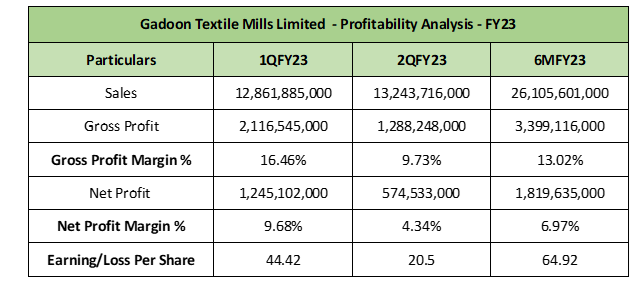

Gadoon Textile Mills Limited posted a sales revenue of Rs26 billion in the first half (July-Dec) of the ongoing fiscal year 2022-23. The company made a gross profit of Rs3.3 billion and net profit of Rs1.8 billion on its sales in 1HFY23. The textile firm is listed on the Pakistan Stock Exchange with the symbol of GADT under the textile spinning sector. With a market capitalisation of Rs6.2 billion, GADT is currently the third largest firm in Pakistan’s textile spinning sector. Incorporated as a public limited company in 1988, the primary function of GADT is production and selling of bedding products and yarn.

In the 1HFY23, GADT reported gross profit and net profit ratios of 13.02% and 6.97%, respectively. Its earnings per share (EPS) stood at Rs64.92 during the period under review.

Quarterly Review

In the first quarter (July-Sept) of FY23, GADT posted a revenue of Rs12 billion and gross profit of Rs2.1 billion on its sales value. The company reported a net profit of Rs1.2 billion and EPS value of Rs44.42. The company reported gross profit and net profit ratios of 16.46% and 9.68%, respectively, during this quarter.

However, in the second quarter (Oct-Dec) of FY23, the company’s gross profit and net profit dropped to Rs1.2 billion and Rs574 million, respectively, on total sales of Rs13 billion. The gross profit and net profit ratios came out to be 9.73% and 4.34%, respectively. The EPS value in 2QFY23 stood at Rs20.5.

Market value in 1HFY23

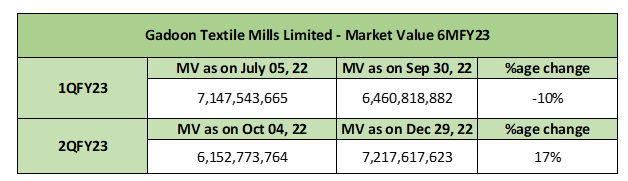

Gadoon Textiles Mills Limited raised Rs70 million in market value over the first half of fiscal year 23. However, in the first quarter of this fiscal, the company’s market value dropped 10%. The firm started the quarterly trade on market value of Rs7.1 billion and ended the quarter on Rs6.4 billion.

However, in the second quarter of FY23, GADT’s market value witnessed an upsurge of 17%. It started the quarter on a market value of Rs6.1 billion and ended the period with Rs7.2 billion.

Credit: Independent News Pakistan-WealthPk