INP-WealthPk

Ayesha Mudassar

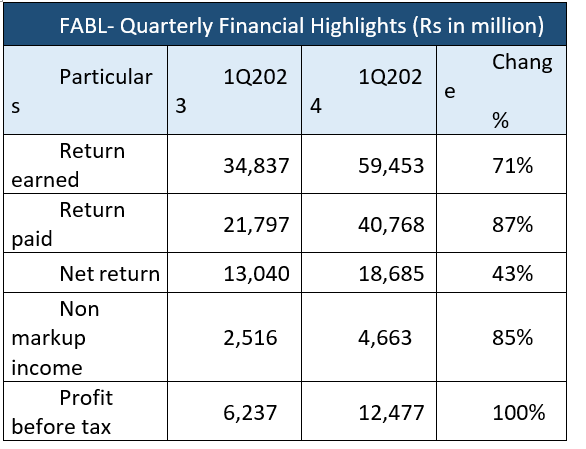

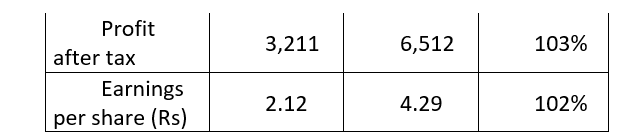

Faysal Bank Limited (FABL), the country's fastest-growing Islamic bank, continued with its growth stride during the first quarter of the calendar year 2024, whereby its net profit doubled to Rs6.5 billion from Rs3.2 billion in 1QCY23, reports WealthPK. FABL achieved an impressive profit-before-tax (PBT) of Rs12.4 billion, which was 100% higher than Rs6.2 billion in the same period last year. Furthermore, the earnings per share (EPS) exhibited an admirable rise, soaring from Rs2.12 to Rs4.29 in 1QCY24.

The bank's net return, the difference between return earned and return paid, jumped 43% to Rs18.6 billion in 1QCY24, largely boosted by higher interest rates. In addition, the total non-markup income, which includes fees, commission, foreign exchange, and dividend income, also increased 85% to Rs4.6 billion in 1QCY24. The sound financial performance reflects the bank's customer-centric approach coupled with prudent risk management practices.

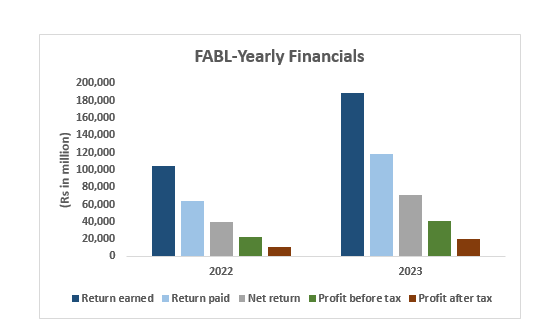

2023 vs 2022 – operational performance

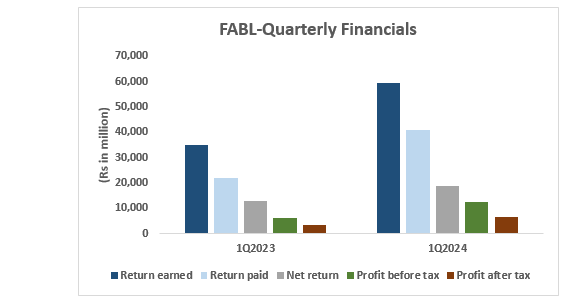

The bank experienced an increase of 85% and 78% in before and after-tax profits, respectively, in 2023 compared with earlier calendar year. This was primarily driven by higher returns on Islamic financing and related assets, investments, and placements. Furthermore, the FABL's net return increased 78% to Rs71.05 billion on account of growth in interest-earning assets over the previous year.

During 2023, the bank continued its growth trajectory, substantially increasing total revenue by 70% over 2022. The robust growth in the balance sheet, coupled with an increase in spreads, led to a year-on-year growth of 78% in net spread earned, taking it to Rs71.1 billion. Healthy growth in current deposits of Rs49 billion (18%) and an increase in the average benchmark rate helped improve overall spreads. However, as a result of prevailing circumstances of double-digit inflation, a depreciating currency, and an expanding branch network, the bank's total non-markup expenses rose 48% to Rs40.8 billion.

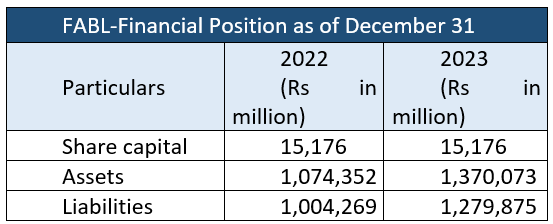

Financial position as of December 31, 2023

The bank's total assets witnessed a 27.5% increase, reaching Rs1.3 trillion in December 2023 compared to December 2022. The expansion is a testament to the company's strong foundation and its commitment to playing its role in the economic development of the country while maintaining a prudent approach to risk management. FABL's strong and diversified business model, along with proactive credit policies, has been pivotal in driving growth.

In addition, the analysis of the bank's financial position shows that total liabilities also increased due to the payment of increased dues to financial institutions and an enormous rise in deferred tax liabilities.

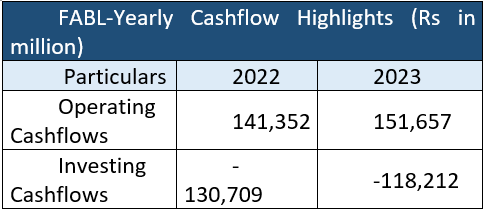

Cashflow summary

The bank's operating cash flow portrays higher cash inflow generated from core activities, i.e., deposit mobilisation and loan and advance disbursements. In 2023, total cash inflows generated from operating activities were Rs151.6 billion as compared to cash inflow of Rs141.3 billion recorded in 2022.

![]()

The investing activities posted a net cash outflow, indicating a significant divestment of assets or reduction in long-term investments. Moreover, the decline in financing cash outflows is due to the lower dividend payout in 2023, compared to the earlier calendar year.

Bank description

Faysal Bank was incorporated in Pakistan on October 3, 1994, as a public limited company, and its shares are listed on the Pakistan Stock Exchange. FABL offers a wide range of Islamic banking services to all customer segments, including retail, small and medium enterprises, commercial, agri-based and corporate. The bank surrendered its conventional banking licence on December 31, 2022, and started operations under an Islamic banking licence issued by the State Bank of Pakistan. Its footprint spreads over 270 cities across the country, with 722 branches offering only Sharia-complaint banking services.

Future outlook

The bank remains steadfast in delivering exceptional results and creating sustainable value for stakeholders. With a strong foundation and a strategic focus on growth, the management is confident in its ability to achieve new heights in the future.

Credit: INP-WealthPk