INP-WealthPk

Ayesha Mudassar

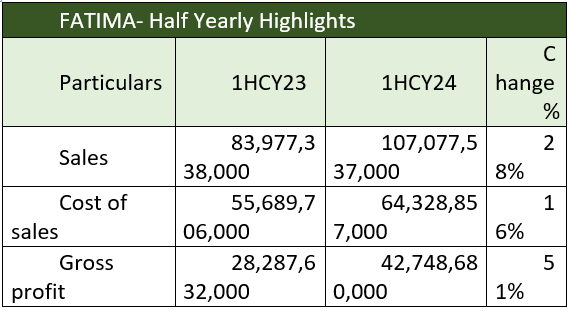

Fatima Fertilizer Company Limited (FATIMA) reported a remarkable increase of 158% in profitability for the first half of the ongoing calendar year 2024, earning a net profit of Rs13.2 billion compared to Rs5.1 billion recorded in the corresponding period of last calendar, according to WealthPK.

As per the company's unconsolidated results, the net sales increased by 28% year-on-year (YoY) to Rs107.07 billion from Rs83.9 billion in the first half of CY23. Although the cost of sales rose by 16% YoY, this increase was outpaced by sales growth, leading to a 51% improvement in gross profit in 1HCY24.

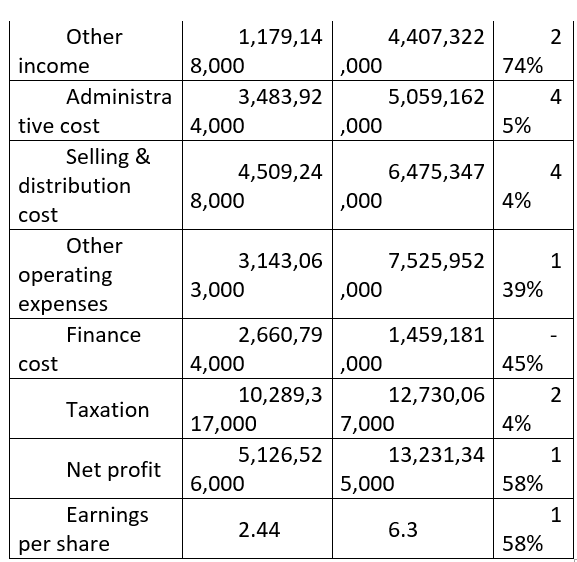

Furthermore, other income surged by an impressive 274% YoY to Rs4.4 billion in 1HCY24 from Rs1.1 billion in 1HCY23. On the expense side, administrative and distribution costs rose by 45% and 44%, respectively, during the period. Additionally, other operating expenses skyrocketed 139% YoY. In contrast, the company’s finance cost declined 45% YoY to Rs1.4 billion from Rs2.6 billion in 1HCY23. On the tax front, FATIMA paid a higher tax worth Rs12.7 billion against Rs10.2 billion paid in the corresponding period last year, depicting an increase of 24%.

Sectoral financials- quarterly review

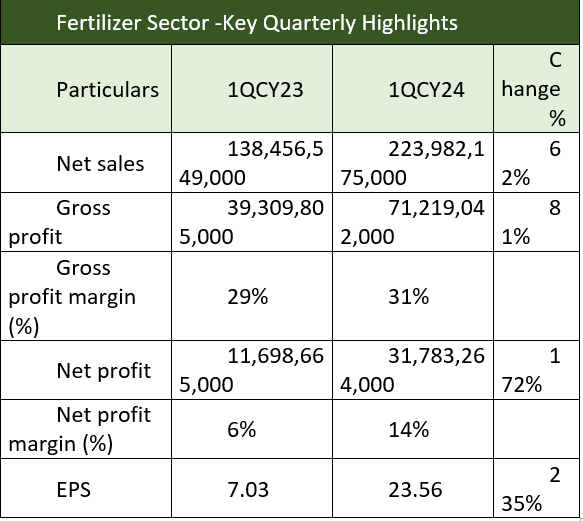

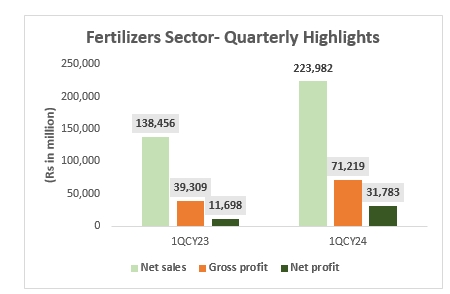

Pakistan's fertilizer sector reported an impressive 81% increase in gross profit and a 172% growth in net profit during the first quarter of the calendar year 2024 compared to the corresponding period of 2023. In 1QCY24, the listed fertilizer firms collectively earned a gross profit of Rs71.2 billion and a net profit of Rs31.7 billion, resulting in gross profit and net profit margins of 31% and 14%, respectively.

This significant growth can primarily be attributed to increased production and sales volume of urea and diammonium phosphate (DAP) fertilizers. According to results available with WealthPK, the fertilizer sector’s net sales rose to Rs223.9 billion in 1QCY24, up from Rs138.4 billion in the same period of 2023, representing an increase of 62%. The fertilizer sector encompasses key players, including Engro Fertilizers Limited (EFERT), Fauji Fertilizers Company Limited (FFC), FATIMA, and Fauji Fertilizer Bin Qasim Limited (FFBL).

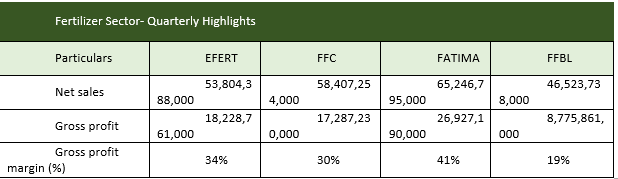

Fertilizer companies- quarterly review-1QCY24

In 1QCY24, FATIMA outperformed its competitors by achieving the highest sales and declaring the highest gross profit in the sector. The company reported a gross profit of Rs26.9 billion on net sales of Rs65.2 billion, resulting in a gross profit margin of 41% for the quarter.

The impressive performance was supported by enhanced operational efficiencies and consistent plant operations, contributing to the company’s overall success during the period.

About the company

FATIMA was incorporated in Pakistan on December 24, 2003, as a public company under the Companies Ordinance, 1984 (now Companies Act, 2017). The company’s primary activities include the manufacturing, production, purchase, sale, import, and export of fertilizers and chemicals.

Future outlook

The fertilizer industry plays a crucial role in the nation's sustainable agricultural development. FATIMA actively collaborates with both the industry and the government to ensure uninterrupted production of urea. In response to declining gas pressure, FATIMA and other fertilizer producers have agreed with Mari Petroleum Company Limited (MPCL) to invest in pressure enhancement facilities at MPCL’s delivery node. This project is expected to require a significant capital investment and will ensure sustained gas supplies to fertilizer manufacturers.

Credit: INP-WealthPk